- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Problem while filing taxes due to 1099MISC from Downpayment Grant and 1095-A

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem while filing taxes due to 1099MISC from Downpayment Grant and 1095-A

Hello everyone! I really need some help regarding taxes. Here’s the story:

Last year in AugustI bought my first home. Bank of America gave me a downpayment grant of $6750. I received a 1099-MISC a couple of days ago, and since BoA is a for-profit organization, I have to pay taxes on it. Only way I could’ve work around that was if I had received the money from a non-profit organization. I already saw other posts talking about that. I have no problems with paying taxes on it, as BoA had already mentioned it to me, besides I’m grateful for their help during this process and getting me those grants. Now, my really BIG issue is my 1095-A from the Healthcare Marketplace. In 2023 I told them I was expecting to make X amount of money in 2024, which turned out to be close to it. So when I put the information from that form into my taxes, it counts my downpayment grant as extra income, so now they’re askin me to pay back almost $4000. Which to me that’s just outrageous. I don't have that money. I put away money from my 1099 as independent contractor every month, but not for this, I had no idea this was going to happen or that I was going to purchase a home. Is there a way to work this out? I will reach out to the Healthcare Marketplace people and tell them my story and see what they say, but I still wanted to get your help. That grant was a help, not actual income from my work. Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Problem while filing taxes due to 1099MISC from Downpayment Grant and 1095-A

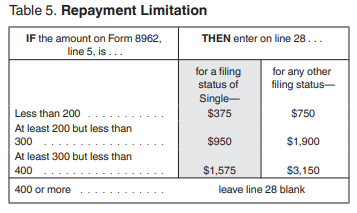

The US taxes all worldwide income, stocks, bonds, sale of apartment buildings, grants, etc- not just work. You have a taxable grant and it pushed your income a little bit. The premium tax credit for the 1095-A is limited except for families at 400% or more of the poverty level.

The IRS does accept payment plans. See Apply Online for a Payment Plan

Reference: About Form 8962, Premium Tax Credit

The federal poverty level (FPL) for 2024 is $15,060 for a single person in the continental United States. For each additional person in the household, the FPL increases by $5,380.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Daniel123456

Returning Member

GAHannon

New Member

Wamoreno90

New Member

mcstel

Level 1

tblawley

Level 1