- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- posting sale of an inherited home with multiple heirs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

posting sale of an inherited home with multiple heirs

My uncle passed away and owned 3 homes that were passed on to my 4 siblings and myself. The homes were in disrepair so they were sold under the assessed value at time of death. Each 1099-S has the amount that I was paid for the proceeds, which was 20 percent of the NET PROCEEDS but there doesn't seem to be a place in Turbo Tax to put my portion of the basis value. It is very unclear, and I even paid the tax professional in Turbo Tax to help, but have not been helped with how to enter these numbers. I assume that each transaction will be handled the same, but I can't even get answers for even 1. Any help is appreciated

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

posting sale of an inherited home with multiple heirs

Follow these steps to enter each of your 1099-S forms (note there are differences in the words and pictures between programs):

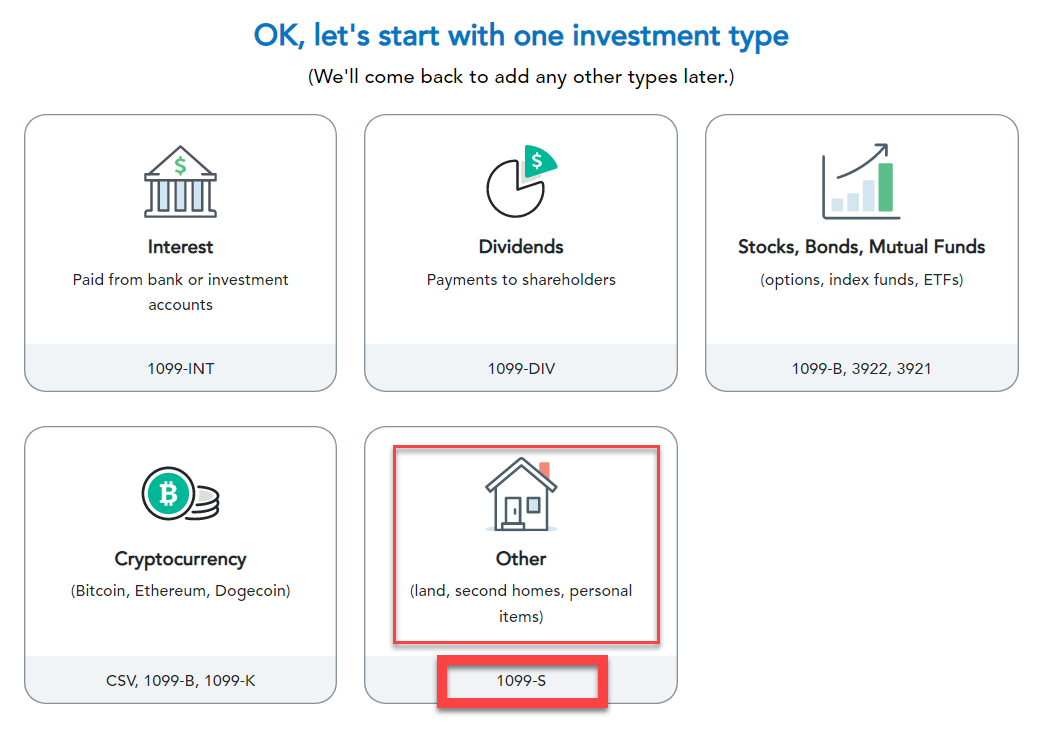

- Locate federal income

- Select investment income for Stocks, Bonds, Other

- Select second home / 1099-S

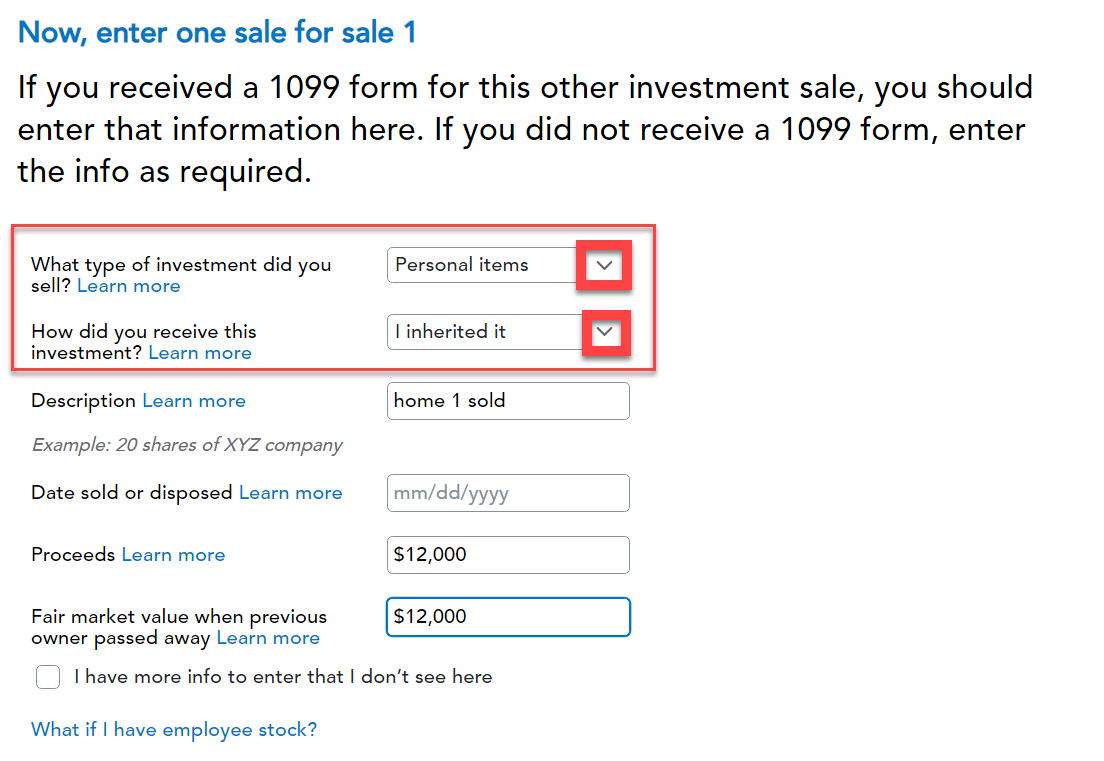

- Enter information

- Select that you inherited the home

- Enter your 1099S for the proceeds.

- Enter the fair market value.

- Another screen asks about sales expenses.

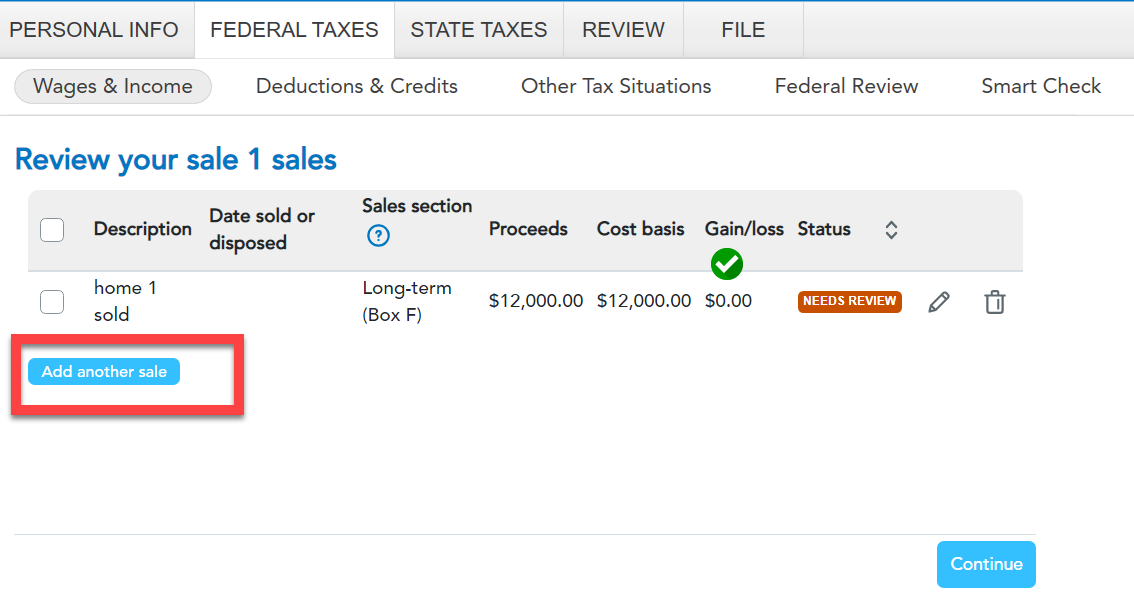

- Add your next form and repeat the steps until done.

See Where do I enter the sale of a second home, an inherited home, or land on my 2024 taxes?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

MamaC1

Level 3

kmc21

Level 1

janwithTT

Returning Member

weazy

New Member

gehrm403

New Member