- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Paying California SMLLC fee online - confused about which Payment Type to pick

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paying California SMLLC fee online - confused about which Payment Type to pick

I e-filed my Taxes (Fed, State including LLC) - filed this morning, all accepted this morning.

Now, I am trying to pay the LLC $800 fee at ftb.ca.gov.

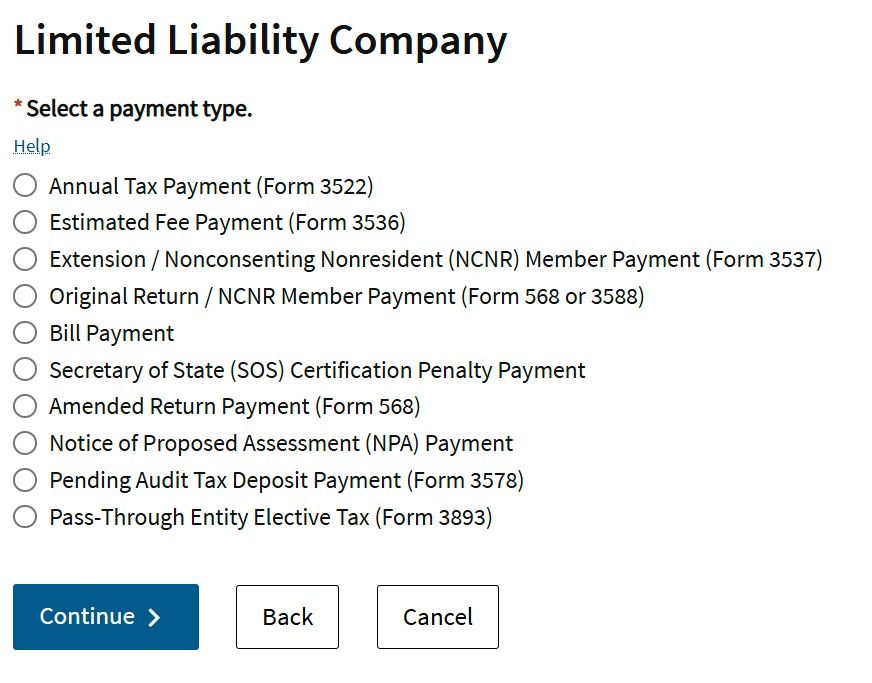

I am confused about which Payment Type to choose. I e-filed, so I assumed Form 3588 (e-file) should be correct since it says e-file on the voucher so I originally chose Original Return / NCNR Member Payment (Form 568 or 3588) from the Payment type list. (screenshot below)

But this page https://www.ftb.ca.gov/file/business/types/limited-liability-company/index.html doesn't say anything about form 3588 and almost everything suggests I should use form 3522 - except it says: Use FTB 3522 when paying by mail. (!) Confused! 😕

I'm presuming I should select Annual Tax Payment (Form 3522) as the Payment Type. Am I right?

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Paying California SMLLC fee online - confused about which Payment Type to pick

Nevermind - after reading the language on each form and comparing, I understand now.

Form 3588 is only for paying when there are taxes due over and above your annual payment, whereas form 3522 is strictly for paying the annual fee for the LLC.

Odd that I should misunderstand tax language.... 😒 🙄

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rgibson

New Member

mahdiismael20

New Member

ahulani989

New Member

RNU

New Member

LidiaTapia

New Member