- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Part 1' Estimated Tax Required for the Year 4. Enter 2019 tax. Subtract the sum of MI-1040 lines 25, 26, 27b, and 28 from line 21 (see instructions). Q: Where to find ??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part 1' Estimated Tax Required for the Year 4. Enter 2019 tax. Subtract the sum of MI-1040 lines 25, 26, 27b, and 28 from line 21 (see instructions). Q: Where to find ??

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Part 1' Estimated Tax Required for the Year 4. Enter 2019 tax. Subtract the sum of MI-1040 lines 25, 26, 27b, and 28 from line 21 (see instructions). Q: Where to find ??

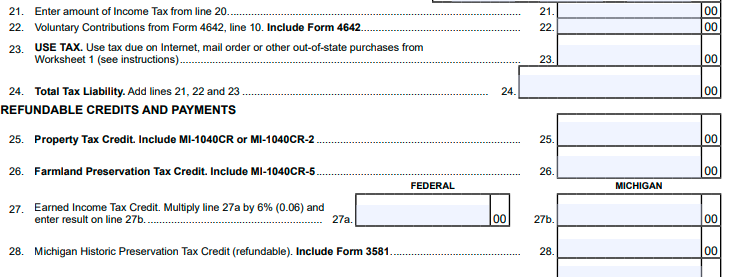

If you look at your 2019 MI-1040 tax return, you will take your total Michigan tax which is shown on Line 21. From that number, you would subtract any refundable credits on your 2019 return, which are shown on Lines 25, 26, 27b and 28. I have attached a picture below for additional guidance. Your total is the amount you would enter into TurboTax to calculate whether you should be assessed an underpayment penalty for 2020.

If you filed your 2019 taxes with TurboTax, sign in and go down to Your tax returns & documents and you should be able to view your prior year Michigan tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vmuralid

New Member

BobTT

Level 2

dmcrory

Returning Member

buteo35

Level 2

Frank nKansas

Level 3