- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Overtime

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overtime

My W2 does not have overtime on it. My payroll department broke it down on the last paycheck in December. They also gave me a code for double overtime which I understand is not deductible, but my time and 1/2 is a different code . Where and how do I deduct this amount on my W2 form in TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overtime

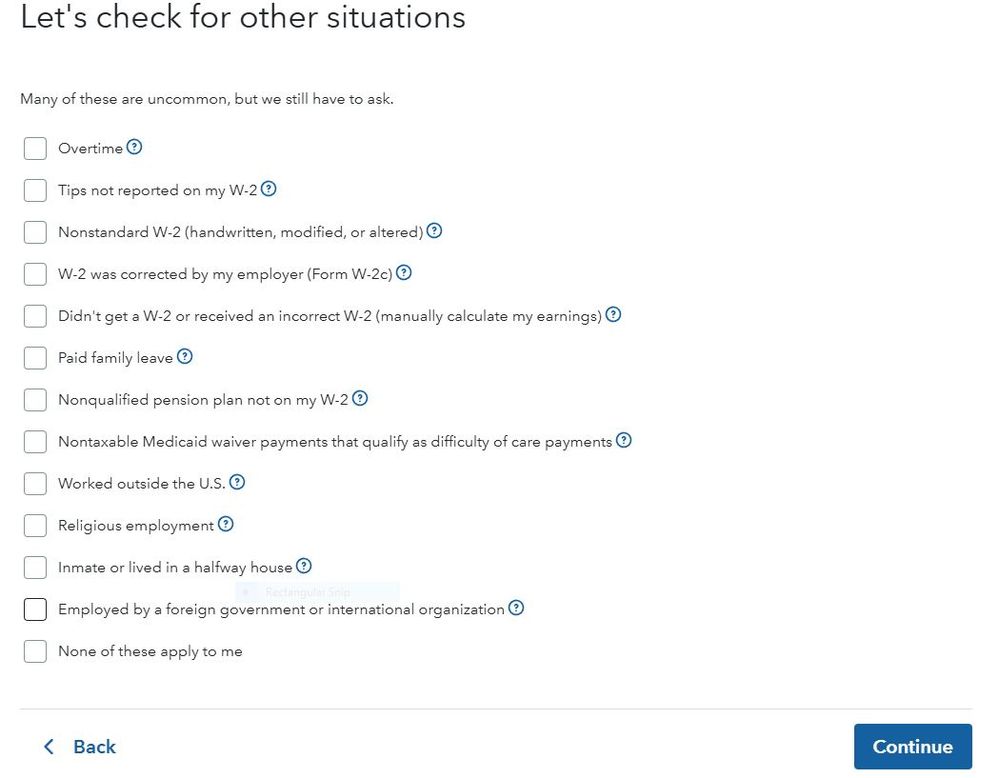

You enter the W-2 as received. After entering the W-2, on the following screen check the box Overtime and continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Overtime

After you select that you enter your W-2, check the box that that you have the uncommon situation of overtime in the interview that follows. Then, a series of questions will be generated.

Only the overtime (the extra "half" in time-and-a-half) is deductible. How to compute this depends on how the overtime was reported. I understand that the time-and-a-half and double time are separate, but the computation will depend on if they reporting the total overtime or the premium only. If you have the total time-and-a-half, you'd divide by 3 to compute the premium, and for double time, you'd divide by 4 to get the premium. If on your paystub, the time-and-a-half premium only is listed, that is the deductible amount, and the double time premium would need to be divided by 2.

After you indicate that you earned overtime, here are the steps to ensure the wages are properly treated on your tax return:

- On the screen "Let's see if your overtime qualifies as tax-free," select "No help needed—I know what to enter."

- The next screen will ask if you were or were not an exempt employee. Note that you must be non-exempt in order to be eligible for the overtime deduction.

- Next, you will be asked to enter your deductible overtime from your employer, you can continue on, and TurboTax will compute the deduction, if you are eligible.

Here is an article you may find helpful: No Tax on Overtime Explained: Qualified Overtime Deduction Rules for 2025

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bmab33

New Member

kibas2009

New Member

elcewiczb

New Member

davekrause

Level 2

woodywvhome

New Member