- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Need help on filing Form 3520

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Dear TurboTax Community,

2022 is coming very soon and I hope you will have a great holiday season and Happy New Year!

I would need some help or better understanding about Form 3520.

Instructions for Form 3520 (2021) | Internal Revenue Service (irs.gov)

4. You are a U.S. person who, during the current tax year, received either:

a. More than $100,000 from a nonresident alien individual or a foreign estate (including foreign persons related to that nonresident alien individual or foreign estate) that you treated as gifts or bequests; or

According to the instruction, it seems like my wife needs to file this form, please correct me if I am wrong and here is what happened in 2021.

We have been using married filing jointly for our ordinary income. During 2021, my wife received few gifts in the cash form from 3 non-resident alien individuals as show below:

Non-resident alien individual (name A) sent an international wire of $50,000 in January 2021.

Non-resident alien individual (name B) sent an international wire of $50,000 in June 2021.

Non-resident alien individual (name C) sent an international wire of $50,000 in November 2021.

In total, my wife received $150,000 in 2021. Name A and B are married couples, and C is their son. They are my wife’s relatives.

Question 1:

Does my wife need to file Form 3520? My understanding is that per instruction 4.a, if the foreign persons are related to each other, my wife should file Form 3520 since the total is over $100,000.

Question 2:

Since my wife was the only person to receive the gifts (wires), even we are filing married jointly, we do NOT need to include my name on Form 3520. Is this statement correct?

Question 3:

If we need to file Form 3520, since it will be the first time, would you please kindly walk us through how to fill in the information out based on our situation?

We greatly appreciate your help and look forward to hearing back from you,

Thank you,

Leo and Emily

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

I think you already know the answers.

Form 3520 is required if the total gifts are more than $100,000, it does not matter that the gift was split into 3 smaller parts. (And don't play games here. If this is a legitimate gift from that family to your spouse, just report it as it happened. Playing word games is what gets you into trouble.)

The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is also required.

Since this is a gift from foreign person(s), your spouse only needs to fill out the identification section and part V.

Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. The deadline is the same (April 15, 2022 for gifts made in 2021).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

@linyi1985 Answering your questions in order -

1. No, just your wife's name.

2. No, only your wife's SSN goes on this form.

3. No, that box says joint return AND joint form 3520. This is not a joint 3520.

4. Yes, @Opus17 meant line 54 in part 4, which is all you need to fill out.

Have your wife sign it and then she can submit it by itself or with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Your wife files the form separately from your joint return. Complete the first section down to line2. Note that your tax ID is requested. Then skip to line 54 where you check “yes” and report the gifts.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

I think you already know the answers.

Form 3520 is required if the total gifts are more than $100,000, it does not matter that the gift was split into 3 smaller parts. (And don't play games here. If this is a legitimate gift from that family to your spouse, just report it as it happened. Playing word games is what gets you into trouble.)

The form is filled out with the name of the gift recipient, but the spouse's taxpayer number is also required.

Since this is a gift from foreign person(s), your spouse only needs to fill out the identification section and part V.

Form 3520 is not included with your tax return, it is mailed separately to the address in the instructions. The deadline is the same (April 15, 2022 for gifts made in 2021).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Hello Opus 17,

Greatly appreciate your response. I have never filled out the form before and I would like to get a bit more clarification from you.

We are filing married jointly on 1040 and my wife was the only person that received the gifts in 2021.

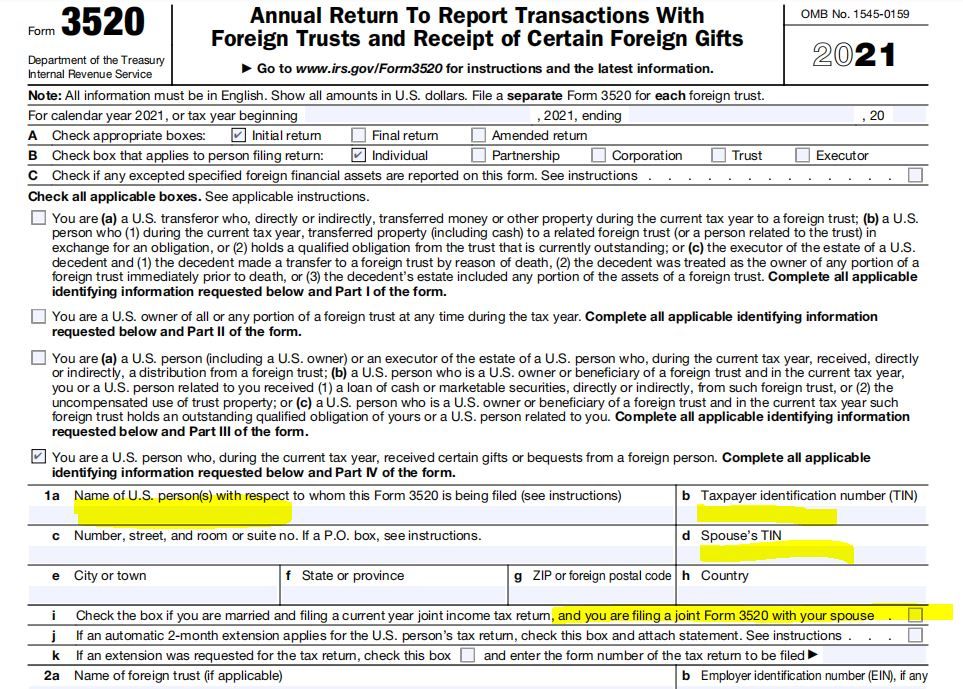

1. Do I need to put both of our names on 1.a?

2. Do I need to put my SSN on 1.d?

3. Do I need to check the box for 1i?

4. Also, I could not find part V as you mentioned in your response. Did you mean part IV, line 54?

Greatly appreciate your time and help,

Thank you,

Leo

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

@linyi1985 Answering your questions in order -

1. No, just your wife's name.

2. No, only your wife's SSN goes on this form.

3. No, that box says joint return AND joint form 3520. This is not a joint 3520.

4. Yes, @Opus17 meant line 54 in part 4, which is all you need to fill out.

Have your wife sign it and then she can submit it by itself or with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

Robert, thank you very much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Need help on filing Form 3520

This is all clear as mud to me. My husband (USA citizen) received an inheritance from his folks (Canadian citizens) during the Covid shutdown. As well as other tax problems and were unable to reach anyone at the IRS to clarify anything. (yes, over 100,000)

So, we need to go back and file this form for 2020. How do we fix this? Any suggestions?

Thank you

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jacklowhorn619

New Member

tstaley922

New Member

monica3000intx

New Member

bobbroske

New Member

Cryptonic_Sonic

New Member