- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- NEC Being Rejected also and see that others have been having the same problem

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NEC Being Rejected also and see that others have been having the same problem

I submitted the NEC timely this year, however the was "rejected" several days later. I spoke with a TurboTax Rep who didn't know about this issue but I tried to submit again through TurboTax - however about a week later it was rejected yet again --- Another poster mentioned that Turbotax would credit them for paying an accountant to submit the form themselves... but I'm also wondering about any potential government fees... Also would love to be able to get it to finally accept the form as April 15 is coming fast.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NEC Being Rejected also and see that others have been having the same problem

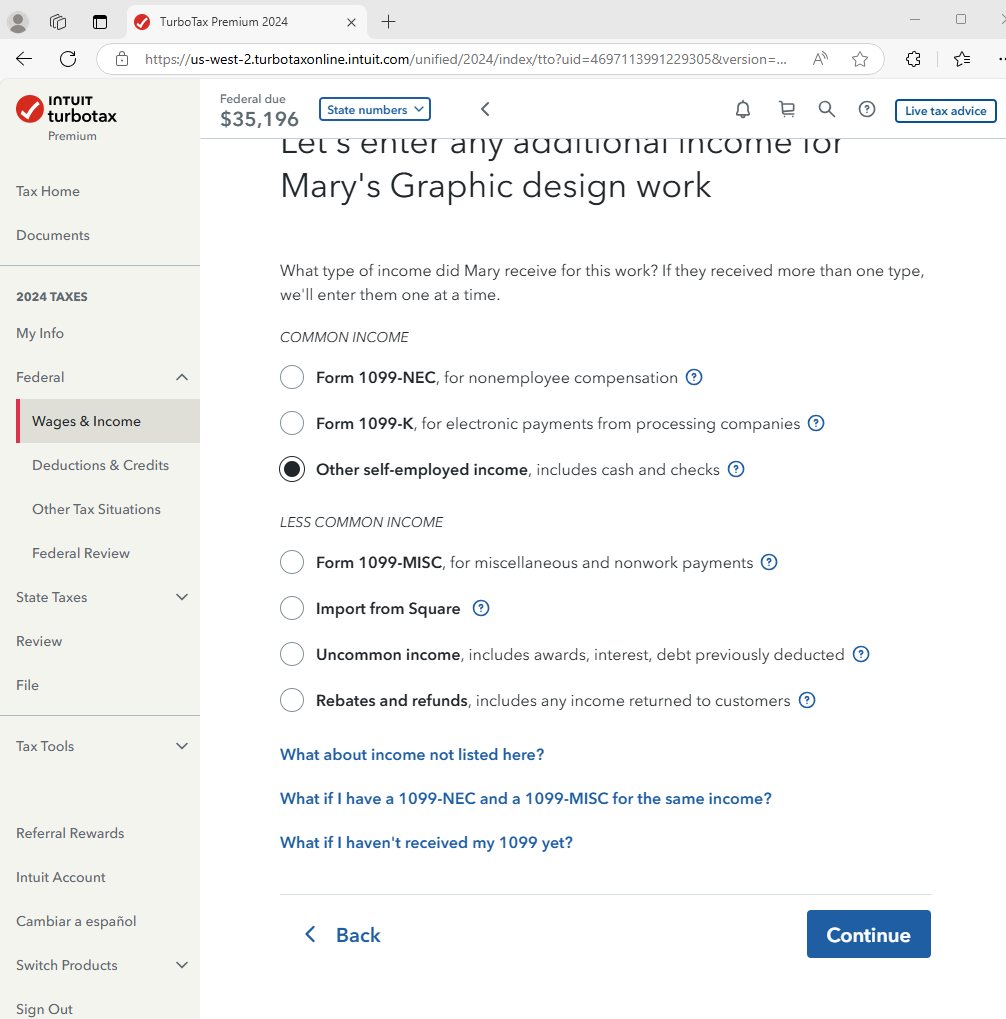

Where are you entering your 1099-NEC in the program? If it's a payment for self-employment (which is usually the case), EDIT your Business in the Income section. After entering some business info, TurboTax asks you about Business Income, and you can enter your 1099-NEC here.

If you're using TurboTax Online, you could delete your 1099-NEC and re-enter it in this section. After deleting the form, clear your Cache and Cookies first.

If you can give more info, we'll try to help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NEC Being Rejected also and see that others have been having the same problem

Whelp - I've deleted and resubmitted multiple times. It's beyond frustrating. Today I got a call back from TurboTax and the call dropped after I explained the issue. I called the 800 number back and got someone who didn't seem knowledgeable at all. I'm at a loss here-

I created the NEC where it reads "create employer forms." I've been doing this since Jan 2025 - and now taxes are due in 3 days. I tried to file an extension and now it says that I have to mail the form. I shouldn't have to do that and should be able to file for an extension electronically as well - but the person on the phone seemed to think sometimes you have to depending on your tax situation - however, the tax situation was the same last year and I filed both for me and my aunt's extension electronically.

This may be the last year I contend with TurboTax and at this point believe I'm owed a refund, in addition to any potential irs fees for a late filed NEC. Please call me to discuss -- it seems it's the luck of the draw when it comes to knowledgeable reps-- thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NEC Being Rejected also and see that others have been having the same problem

also now... the NEC is "processing" which may kick back again by tomorrow or whenever -- but shouldn't this be easier? It's done this many times and at this point I may have to find a cpa to even do this part --- (someone else's similar issue said they did that and it was accepted instantly) --- it seems there's something glitchy with Turbo this year... I've had no issues like this and have done the same tax situations for 2 people since 2019. thanks for any help-

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NEC Being Rejected also and see that others have been having the same problem

Your rejection should come with a 'rejection error' code. What is the code that you are receiving for the 1099-NEC rejection?

If you are filing the extension on the same account that created the rejected 1099s the system may be trying to make you file the extensions by mail because of the rejection. If you need to you can create a separate account in TurboTax just to file the extension so that it can be submitted today.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TEAMBERA

New Member

BoulderLEA

Returning Member

Benafulwilerjr

New Member

jesse_garone

New Member

vfluaitt001

Level 1