- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My return was rejected because the IRS doesn't recognized the EIN of my employers. But the numbers entered match my w-2's. I don't know why?

Announcements

Attend our Ask the Experts event about Tax Law Changes - One Big Beautiful Bill on Aug 6! >> RSVP NOW!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

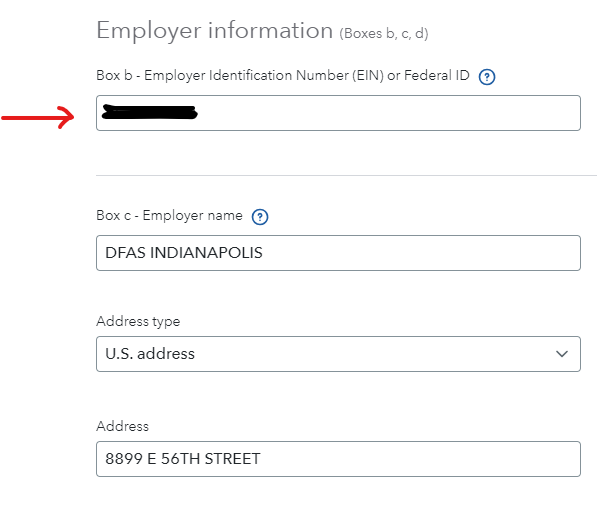

My return was rejected because the IRS doesn't recognized the EIN of my employers. But the numbers entered match my w-2's. I don't know why?

If the EIN numbers I entered match my W-2's, why is my return being rejected?

Topics:

posted

February 21, 2024

12:34 PM

last updated

February 21, 2024

12:34 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return was rejected because the IRS doesn't recognized the EIN of my employers. But the numbers entered match my w-2's. I don't know why?

If the EIN has been correctly entered into the software, either

- Contact your employer to see whether the W-2 was prepared correctly, or

- Check one of your 2023 paystubs which may have the EIN number included on them.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 21, 2024

1:53 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return was rejected because the IRS doesn't recognized the EIN of my employers. But the numbers entered match my w-2's. I don't know why?

Is the employer a startup company?

Maybe they only recently applied for their FEIN and it isn't in the IRS e-file computers yet.

Ask the employer to confirm those FEIN numbers(s) with what's on your W-2...could have been mistyped on their end...unless they've been reported the same way for years now.

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

February 21, 2024

1:54 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

AllanPierce93111

Returning Member

dgudgell

New Member

dana-cotton

New Member

jian10

New Member

johzar1

New Member