- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My return keeps getting Reject it this is the code the send me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return keeps getting Reject it this is the code the send me

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return keeps getting Reject it this is the code the send me

Rejection Code INJ-031-04 means that your 2018 AGI amount entered into your 2019 Tax return is incorrect, or there is a data mismatch at the government level.

First you want to make sure that you used the correct AGI for 2018. If you used TurboTax last year you can view your 2018 AGI by selecting Documents on the left hand side of your screen. Select View Documents from: Select 2018 on the drop down menu.

OR

You can obtain a copy of last year's tax transcript online using IRS link: Transcript

OR

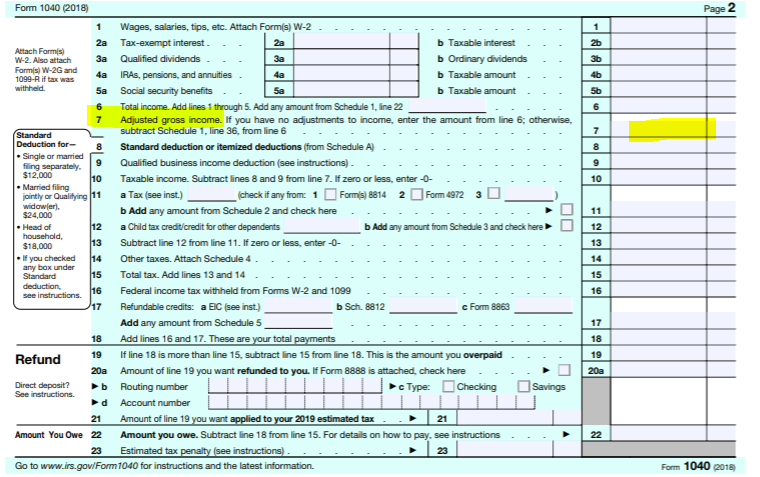

If you have a copy of your 2018 tax return, your AGI is located on line 7.

To double check your 2018 AGI is correct fin TurboTax, follow these steps:

- Select File from the left hand side of your screen,

- Complete Step 1 and 2 if you haven’t already done so, then go to Step 3.

- When getting to the Let’s get ready to e-file screen after selecting Step 3, select I want to e-file before you continue.

- Follow the online instructions. When prompted, put in your exact 2018 AGI.

- Continue through the screens until you’ve re-transmitted your return.

If your 2018 AGI is correct, then you will have no choice but to file a paper return. Select File, and follow the on-screen prompts, selecting to file a paper return. When you print your return, instructions will be printed with where and how to file your returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return keeps getting Reject it this is the code the send me

I did not file withTurbo tax last year. The AGI I have from my 2019 tax form is $478.00. What can I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return keeps getting Reject it this is the code the send me

@cooldude123 You can enter your 2019 AGI into your 2020 tax return, to e-file. The place to enter it, will show up, once you choose step 3 to e-file.

Please see this TurboTax FAQ, for more information, Where do I correct my 2019 AGI in TurboTax Online?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

coachantoniobrown

New Member

AndrewA87

Level 4

yorkjoseph

New Member

mattbarta

New Member

scornedtorrent

New Member