- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My information is not being uploaded from Fidelity for 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My information is not being uploaded from Fidelity for 2020?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My information is not being uploaded from Fidelity for 2020?

After any import...some forms definitely need to be "edited" to enter missing information that does not come with the import. Just "edit" any one that needs Review and go thru the Q&A that follows.

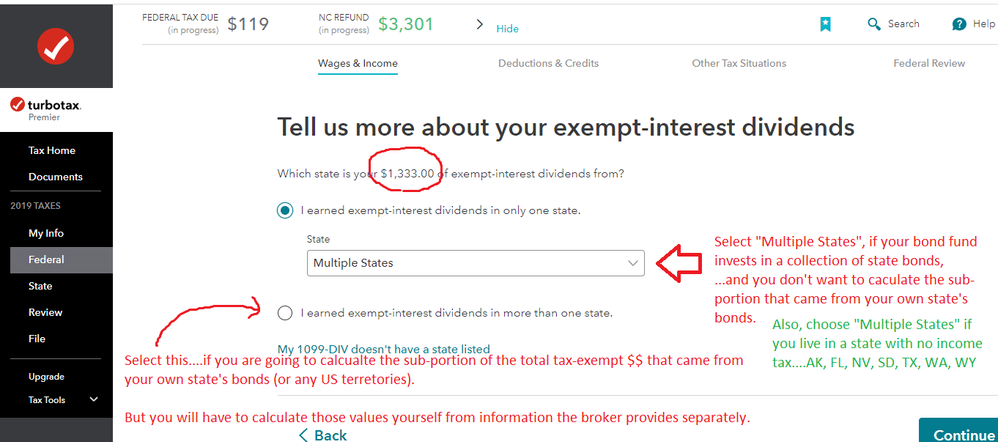

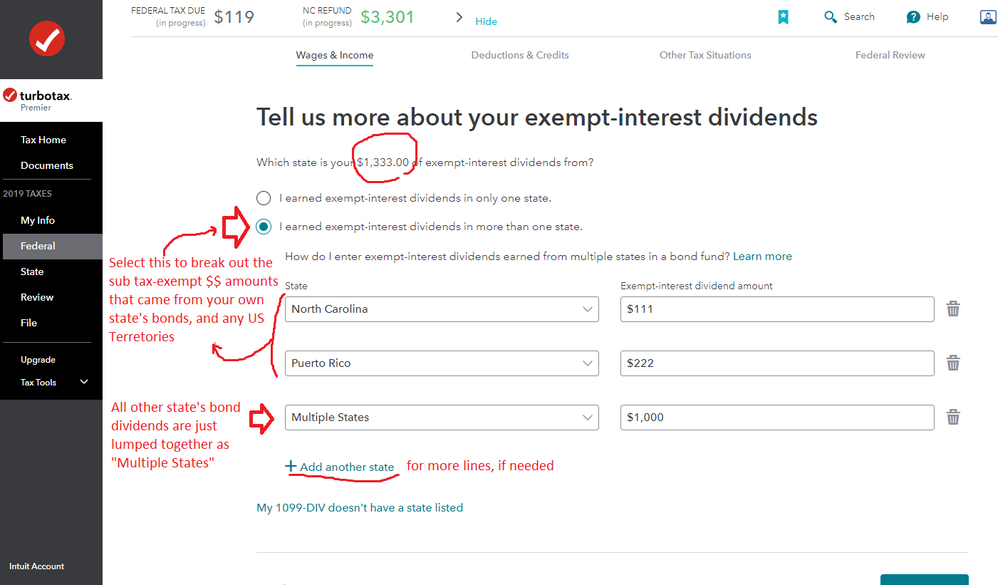

1) Any 1099-INT with box 8 $$ in it must be edited to answer the question about what state the $$ in box 8 came from. (Selecting "Multiple States" from the end of the list in the top screen is easiest......but sometimes a state reduction in taxes is possible if your break out your state's $$)

2) Any 1099-DIV with box 11 $$ in it must be edited to answer the question about what state the $$ in box 11 came from. (Selecting "Multiple States" from the end of the list in the top screen is easiest......but sometimes a state reduction in taxes is possible if your break out your state's $$)

3) IF you had some sales of any stocks, bonds or mutual funds on a 1099-B/8949.....sometimes the Cost basis for those shares did not come along with the data import...because Fidelity may not have that information (usually it would have to be be for something held for more than ~10 years...called "Non-covered")

4) maybe others types too if you had any imported

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My information is not being uploaded from Fidelity for 2020?

IF you did have any 1099-INT with box 8 $$ , or any 1099-DIV with any box 11 $$.......teh following shows how you could deal with them

____________________________________________

____________________________________

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jkosse83

New Member

NancyRVN

New Member

lavancedavis

New Member

jjwildernessguy

New Member

hdudleywm

New Member