- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My income is considered "Difficulty of Care Income" and is nontaxable yet i am considered to be self employed. How would i report the income and claim deductions?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is considered "Difficulty of Care Income" and is nontaxable yet i am considered to be self employed. How would i report the income and claim deductions?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is considered "Difficulty of Care Income" and is nontaxable yet i am considered to be self employed. How would i report the income and claim deductions?

Per the IRS 1040 schedule I instructions

quote

Medicaid waiver payments to care

provider. Certain Medicaid waiver

payments you received for caring for

someone living in your home with you

may be nontaxable. If these payments

were reported to you in box 1 of Form(s)

W-2, include the amount on Form 1040

or 1040-SR, line 1. Also, include on

line 1 any Medicaid waiver payments

you received that you choose to include

in earned income for purposes of claiming

a credit or other tax benefit, even if

you did not receive a Form W-2 reporting

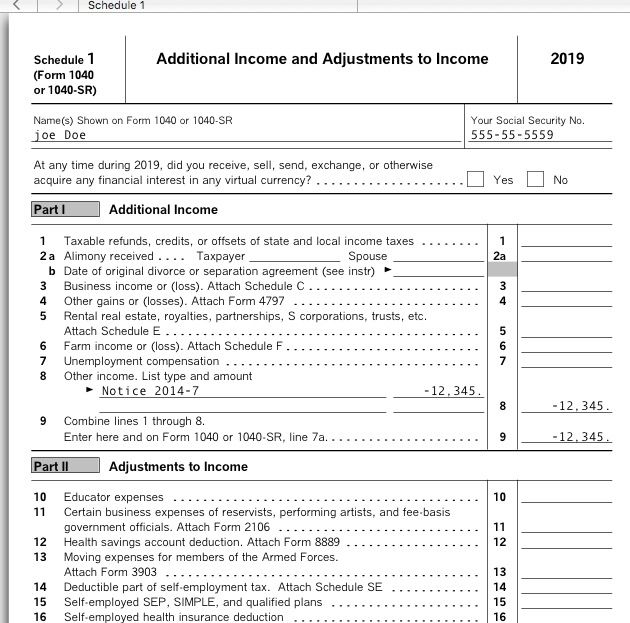

these payments. On line 8, subtract

the nontaxable amount of the payments

from any income on line 8 and enter the

result. If the result is less than zero, enter

it in parentheses. Enter “Notice

2014-7” and the nontaxable amount on

the dotted line next to line 8. For more

information about these payments, see

Pub. 525.

That is reported on the 1040 schedule 1 line 8 as follows:

Federal Taxes,

Wages and Income,

Choose Jump to Full List -or I'll choose what I work on

Scroll way down to the end - Less Common Income

Click start or update next to the last one "miscellaneous income"

Then the last one for Other Reportable Income

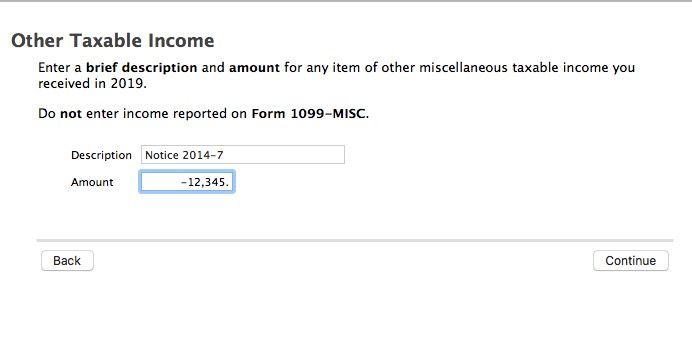

For description enter “Notice 2014-7” . Enter the amount with a minus sign (-) in front of it.

The Schedule 1 line 9 will go on the 1040 line 7a.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is considered "Difficulty of Care Income" and is nontaxable yet i am considered to be self employed. How would i report the income and claim deductions?

You cannot include Difficulty of Care Income on your tax return, as it is excluded from income taxation and is not reported on your tax return at all.

If you have other self-employment income to report you will enter this, along with the corresponding expenses, under self-employment income and expenses in Wages & Income (or Income & Expenses in some versions of the program.)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My income is considered "Difficulty of Care Income" and is nontaxable yet i am considered to be self employed. How would i report the income and claim deductions?

Per the IRS 1040 schedule I instructions

quote

Medicaid waiver payments to care

provider. Certain Medicaid waiver

payments you received for caring for

someone living in your home with you

may be nontaxable. If these payments

were reported to you in box 1 of Form(s)

W-2, include the amount on Form 1040

or 1040-SR, line 1. Also, include on

line 1 any Medicaid waiver payments

you received that you choose to include

in earned income for purposes of claiming

a credit or other tax benefit, even if

you did not receive a Form W-2 reporting

these payments. On line 8, subtract

the nontaxable amount of the payments

from any income on line 8 and enter the

result. If the result is less than zero, enter

it in parentheses. Enter “Notice

2014-7” and the nontaxable amount on

the dotted line next to line 8. For more

information about these payments, see

Pub. 525.

That is reported on the 1040 schedule 1 line 8 as follows:

Federal Taxes,

Wages and Income,

Choose Jump to Full List -or I'll choose what I work on

Scroll way down to the end - Less Common Income

Click start or update next to the last one "miscellaneous income"

Then the last one for Other Reportable Income

For description enter “Notice 2014-7” . Enter the amount with a minus sign (-) in front of it.

The Schedule 1 line 9 will go on the 1040 line 7a.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shikhiss13

New Member

dgjensen

New Member

lizmckanna88

New Member

alex1907

Level 2

brandonhawley

New Member