in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My husband has a reject code S2-F1040-429. However, he sold his home for no gain and does not need to repay the credit. How do I get ride of this error?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband has a reject code S2-F1040-429. However, he sold his home for no gain and does not need to repay the credit. How do I get ride of this error?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My husband has a reject code S2-F1040-429. However, he sold his home for no gain and does not need to repay the credit. How do I get ride of this error?

If you're using TurboTax Online, first thing to do is to clear your Cache and Cookies.

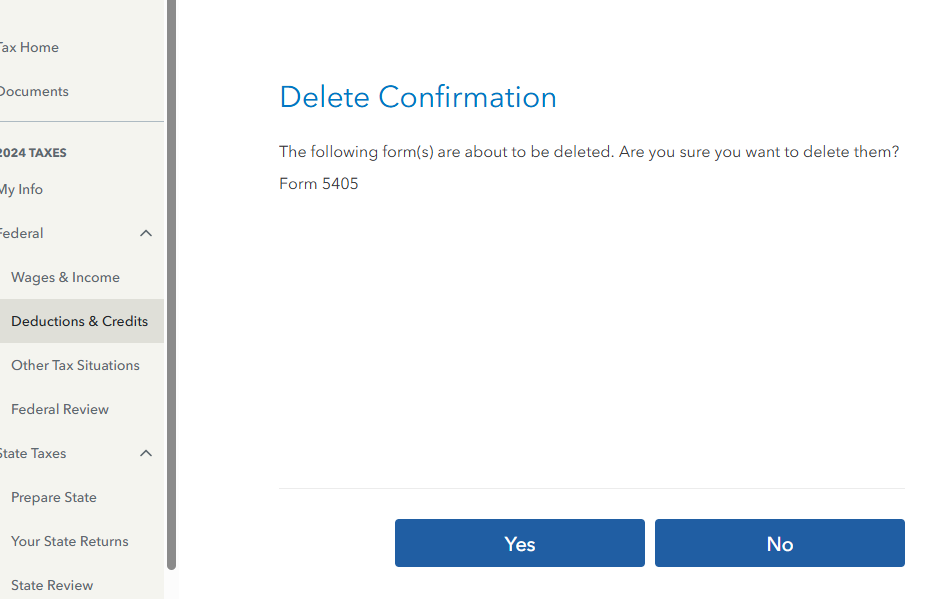

Then return to the First Time Homebuyer Credit section. When you choose the second option 'Yes, but the home we received the credit for stopped being our main home on or before December 31, 2023' on the next page you should get a 'Delete Confirmation' page, where you choose YES.

If you return to the section after this, you may see the third option NO checked, but don't change it. Your Efile should not get rejected again.

If it does, it could be the IRS is showing a payment is still outstanding, and you would need to contact them at (844) 545-5640.

If you're using TurboTax Desktop, in FORMS, 'Open Form' 5405 and click Delete at the bottom of the form when it's displayed.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joeylawell1234

New Member

donnapb75

New Member

benzaquenbills

New Member

mburback8

New Member

linda11mom

New Member