- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My employer is in the city of Detroit, but since COVID, I work from home 4 days a week. I can't find the option to allocate the days work in Detroit, how do I find that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer is in the city of Detroit, but since COVID, I work from home 4 days a week. I can't find the option to allocate the days work in Detroit, how do I find that?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer is in the city of Detroit, but since COVID, I work from home 4 days a week. I can't find the option to allocate the days work in Detroit, how do I find that?

Yes, you have the option to allocate Detroit wages by working days. Return to your MI state interview and "Edit" the "Other Situations" topic.

- Revisit the Michigan City Tax Return

- Verify Detroit

- Select your Detroit Resident status

- Edit the employer line

- Select Working Days Allocation

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer is in the city of Detroit, but since COVID, I work from home 4 days a week. I can't find the option to allocate the days work in Detroit, how do I find that?

It doesn't give me the option if I select Detroit Non Resident. Would I select Detroit Part-Year Resident?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer is in the city of Detroit, but since COVID, I work from home 4 days a week. I can't find the option to allocate the days work in Detroit, how do I find that?

No, you should not select the part-year Detroit resident option; nonresident is correct and should provide the correct interview questions.

Once you select the "I file as Detroit nonresident" radial on the page titled "Your Detroit Return" the next page should be titled "Detroit Wages" and show your employer name from your W2. See Screenshot #1 below.

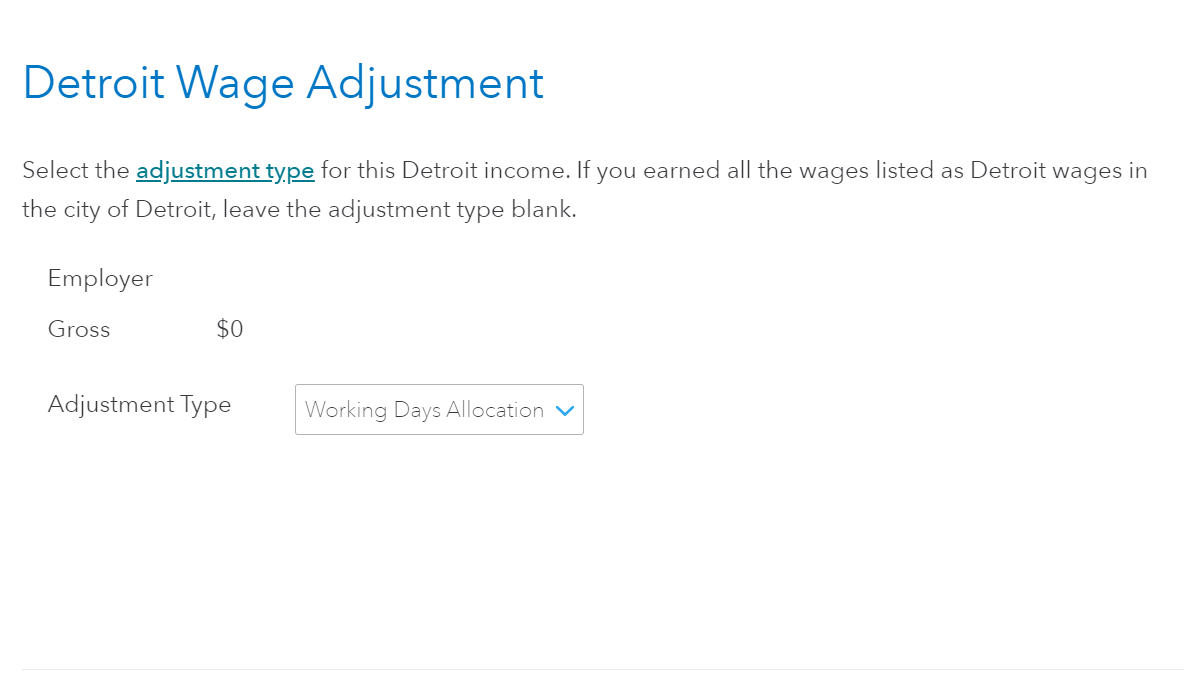

You should then select "Edit" next to the employer line. The next page should be "Detroit Wage Adjustment" and provide a dropdown menu with an option that reads "Working Days Allocation" (Screenshot #2 below).

Screenshot #1

Screenshot #2

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer is in the city of Detroit, but since COVID, I work from home 4 days a week. I can't find the option to allocate the days work in Detroit, how do I find that?

Hello -- when I select the "I file as a Detroit nonresident" radial it does not take me to "Detroit Wages". It goes straight to "Income Attributable to Detroit" and says "Enter the Detroit amounts, if any, for these items: Gain (Loss) from Sale or Exchange of Property in Detroit" and does not give me the option to allocate working days at any point in the process. Could you please help or point me in the right direction? Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My employer is in the city of Detroit, but since COVID, I work from home 4 days a week. I can't find the option to allocate the days work in Detroit, how do I find that?

Typically when the wages are not showing up on the Detroit return then the W2 entries did not include a local line (Boxes 18-20). First, check your copy of your W2. If your form W2 does not have these lines filled in then no Detroit taxes were withheld. If you believe there should have been withholding, then enter your box 1 wages in box 18 leave 19 blank and enter Detroit in box 20. This will put the wages on a Detroit return and give you the options to allocate in the MI state interview.

If your form W2 does have amounts in boxes 18-20 then Return to the W2 topic in the federal interview and verify there is line in the "Local Taxes" area with Michigan as the associated state and amounts in boxes 18 and 19 with Detroit in box 20.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abicom

Returning Member

Waylon182

New Member

TaxConfused25

New Member

zzz2

Level 3

marisa112

Returning Member