in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- My Dependent College student received 1099-NEC for $2,450. Do they need to file a tax return? If so, Can I still claim them as a dependent on the parents return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Dependent College student received 1099-NEC for $2,450. Do they need to file a tax return? If so, Can I still claim them as a dependent on the parents return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Dependent College student received 1099-NEC for $2,450. Do they need to file a tax return? If so, Can I still claim them as a dependent on the parents return?

Yes, they need to file a return. If your dependent student received Form 1099-NEC, they are being treated as an independent contractor. Workers are required to file a return when they receive $400 or more of income through self-employment / independent contractor work. The filing threshold is higher if the income is from wages.

If they also have business expenses to deduct, they would need a self-employed version of TurboTax to report income and expenses on Schedule C. If they have no expenses, they can just enter Form 1099-NEC and TurboTax will calculate the self-employment tax as well as the income tax.

You can still claim them as a dependent if you meet the criteria. Claiming a child as a dependent generally requires that they live with you for more than half the year, they don't provide more than half of their own financial support, and they are under the age of 19, or under 24 if a full-time student.

A full-time student is a student who is enrolled for the number of hours or courses that the school considers to be full-time attendance.

To qualify as a student, the person must be, during some part of each of any five calendar months of the year:

- A full-time student at a school that has a regular teaching staff, course of study, and a regularly enrolled student body at the school, or

- A student taking a full-time, on-farm training course given by a school described in (1), or by a state, county, or local government agency.

This information is found in the Personal Exemptions and Dependents chapter of Publication 17.

Please also see this tax tips article for more information from TurboTax on claiming dependents.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Dependent College student received 1099-NEC for $2,450. Do they need to file a tax return? If so, Can I still claim them as a dependent on the parents return?

Yes, they need to file a return. If your dependent student received Form 1099-NEC, they are being treated as an independent contractor. Workers are required to file a return when they receive $400 or more of income through self-employment / independent contractor work. The filing threshold is higher if the income is from wages.

If they also have business expenses to deduct, they would need a self-employed version of TurboTax to report income and expenses on Schedule C. If they have no expenses, they can just enter Form 1099-NEC and TurboTax will calculate the self-employment tax as well as the income tax.

You can still claim them as a dependent if you meet the criteria. Claiming a child as a dependent generally requires that they live with you for more than half the year, they don't provide more than half of their own financial support, and they are under the age of 19, or under 24 if a full-time student.

A full-time student is a student who is enrolled for the number of hours or courses that the school considers to be full-time attendance.

To qualify as a student, the person must be, during some part of each of any five calendar months of the year:

- A full-time student at a school that has a regular teaching staff, course of study, and a regularly enrolled student body at the school, or

- A student taking a full-time, on-farm training course given by a school described in (1), or by a state, county, or local government agency.

This information is found in the Personal Exemptions and Dependents chapter of Publication 17.

Please also see this tax tips article for more information from TurboTax on claiming dependents.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Dependent College student received 1099-NEC for $2,450. Do they need to file a tax return? If so, Can I still claim them as a dependent on the parents return?

My college student collects sneakers. He sold some, and he was issued the 1099-NEC for $2,450. Is this considered a hobby or does it has to be considered self-employed income for tax return purpose? He does the sneaker thing when he has time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My Dependent College student received 1099-NEC for $2,450. Do they need to file a tax return? If so, Can I still claim them as a dependent on the parents return?

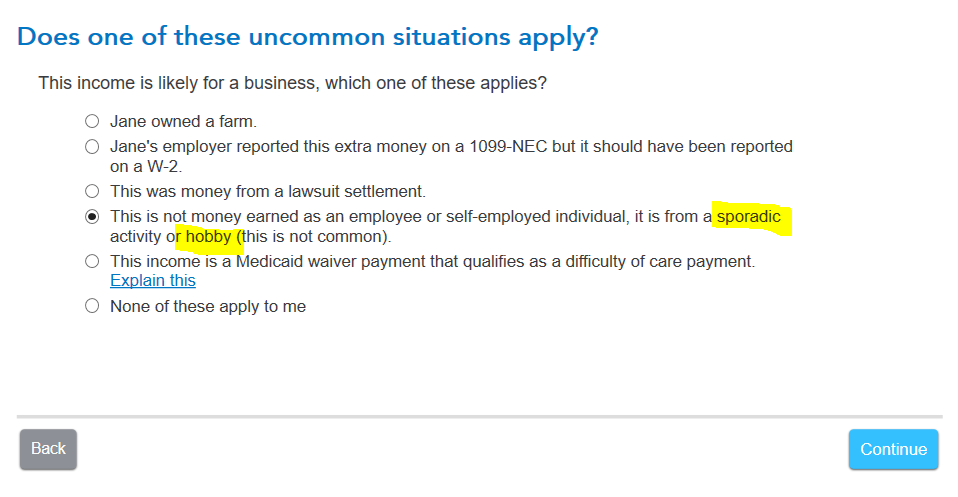

It sounds like a hobby. Follow these steps:

Open return

Select federal income

Select the 1099-NEC to enter information

Enter the requested information, continue

Describe the reason, something like selling sneakers, continue

Does one of these apply? Select hobby, select sporadic activity/ hobby

Continue, Done

Reference: Earning side income: Is it a hobby or a business?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anonymouse1

Level 5

rgrahovec55

New Member

Stitha2

New Member

bgoodreau01

Returning Member

bgoodreau01

Returning Member