- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

Hi, I realized while working on my tax return for 2020 that I made an excess contribution for 2019 and was not allowed but still made full contribution for 2020 and 2021. it was too close to deadline for me to completely understand issue and fix it so I got an extension.

Based on discussion here and help articles, I recharacterized my 2020 and 2021 roth contribution as traditional IRA contribution.

My understanding to report this recharacterization,

For year 2021: I will get 1099-R in 2022 which I can use in 2021 return

For year 2020: I will get 1099-R in 2022 which I can use then to amend 2020 tax return or create my own 1099-R now with info from letter I received from Fidelity for 2020 return and ignore 1099-R for 2020 that I will receive in 2022

Is my understanding correct?

My main confusion is about 2019 excess contribution. To correct this I will need to remove excess contribution by requesting fidelity. Does this request also remove earnings? In this thread i-realized-that-i-ve-contributed-to-a-roth-ira-for-the-last-2-years-when-i-am-technically-no it says that I don't have to remove earnings since I am past 2019 deadline but when I talked with fidelity expert, she said that I will have have to remove earnings also because contribution for 2019 was made in year 2020, is this right?

Assuming I have removed excess, how do I report it? Are following steps correct?

1. Amend 2019 tax year return to indicate excess contribution and pay penalty(Ignore 1099-R received in 2022?)

2. in 2020 tax year return indicate excess contribution in prior year and remove before extension deadline. No penalty payment is needed in this case?

3. In 2021 tax year return indicate no excess contribution in prior year

Thanks in advance for your help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

Review IRS Pub 590A and possibly 590B which covers this situation and any other situation you can think of.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

Thanks for your reply. I reviewed Pub 590A and 590B but I am still don't have much clarity about earning an penalty for 2019 excess contribution. Do I have to pay penalty on my 2020 tax return if I remove excess contribution before Oct 15 2021 (2020 Tax extension deadline).

Since I am removing 2019 excess contribution(contribution was made in March 2020 for prior year) after 2019 tax deadline including extension( Oct 15 2020), do I have to remove my earnings? if not will I pay any penalty/taxes in future for this earnings?

some experts here have mentioned that take a regular distribution without telling custodian(fidelity) about excess contribution. I am not sure I understand this approach clearly? Fidelity has form to return excess contribution, Can I not use it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

Since you are dealing with a 2019 contribution, you missed the deadline to fix that without penalty.

You will owe a 6% penalty on your 2019 return, and you have to amend it.

If the excess contribution was made in a previous tax year, the 1099 R form will indicate the year in which the earnings are taxable (most likely 2019). again you may have to amend, so wait for the 1099-R.

Review again Pub 590 A Chapter 1 pages 33-35 and Form 5329 shown there.

In my experience it can take four or five readings (or more) of an IRS Pub to figure what it is really telling you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

I forgot.

Having missed the deadline for 2019 excess removal, there is a loophole.

You don't have to remove the earnings and they can continue to grow tax-free in the Roth.

You will pay 6% penalty for each year you leave excess contribution.

If you are eligible now for Roth contribution, you can use that amount to offset the excess and resolve the issue.

I don't have the details right now for how to properly proceed with this (leaving the earnings in) since if you inform the custodian they will compute the earnings and remove them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

I think the form has a checkbox "I computed the earnings so you, custodian, do not do that."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

Thank you for reply. Can you point me to some reference(irs pub or an article) on this loophole.

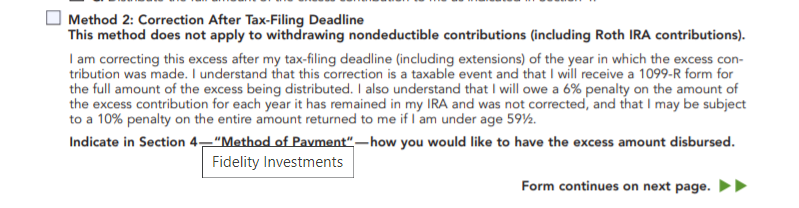

It seems that fidelity provides two method to remove excess, method 2 below is something you are indicating? I am assuming this method will not remove earning but need to confirm with fidelity.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Messed up ROTH IRA contribution & Filing tax return before extension Oct 15

"Can you point me to some reference(irs pub or an article) on this loophole."

See Form 5329 Part IV Additional Tax on Excess Contributions to Roth IRAs.

Particularly, when Line 18 is non-zero.

Note: a distribution at any time of your own contributions to the Roth IRA will not incur a 10% early withdrawal penalty.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teach00001

New Member

bartdolce

New Member

Marivic-2

New Member

x9redhill

Level 2

cheery2

New Member