- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Married filing separately- how to handle 1099-INT for joint account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

My husband and I are filing separately. We have one shared bank account that earned interest and have a 1099-INT form. We are in NYS. Do we both report this form? Only one of us? The form from the bank is only addressed to him.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

Since New York is not a community property state, if the bank account is a joint account you can handle it pretty much any way the two of you agree to, as long as you report all of the interest between the two of you. However, the easiest thing would be for your husband to report it all on his return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

Thank you. This is what I thought but wanted to make sure!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

Thanks for the explanation for NY state.

But it begs the question: what about CA state, which is a community property state?

How should I (and my spouse) report the 1099-INT received for a joint account, with both our names listed on the form? Note that we are filing as "Married Filing Separate" for the first time (i.e. last year's return, and all other previous ones, have been filed as "Married Filing Joint". Hence, I am particularly naive about this situation.

Thanks in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

Split the amount reported 50/50 on each return. What matters is that the entire amount be accounted for between the two returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

Thanks @PaulaM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

If the interest or dividend is a large amount it does not seem fair for one person to have to claim all. It seems more equitable to split it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

Hi Paula,

Would this apply for individuals who are not married, for example two relatives (cousins) have a joint High Savings Account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married filing separately- how to handle 1099-INT for joint account?

No, the situation is a bit different for two relatives.

First, the person whose Social Security number is listed on the 1099-INT form will need to report the full amount on their tax return. Then, they will need to make an adjustment to back out the portion of the interest income allocable to the relative. Finally, the person who received the 1099-INT would also need to complete forms 1096 and 1099-INT to report the interest income allocable to the relative in accordance with the instructions for Schedule B.

To make the entries on the tax return for the person who's Social Security number is listed on the tax form, please see where do I enter Form 1099-INT.

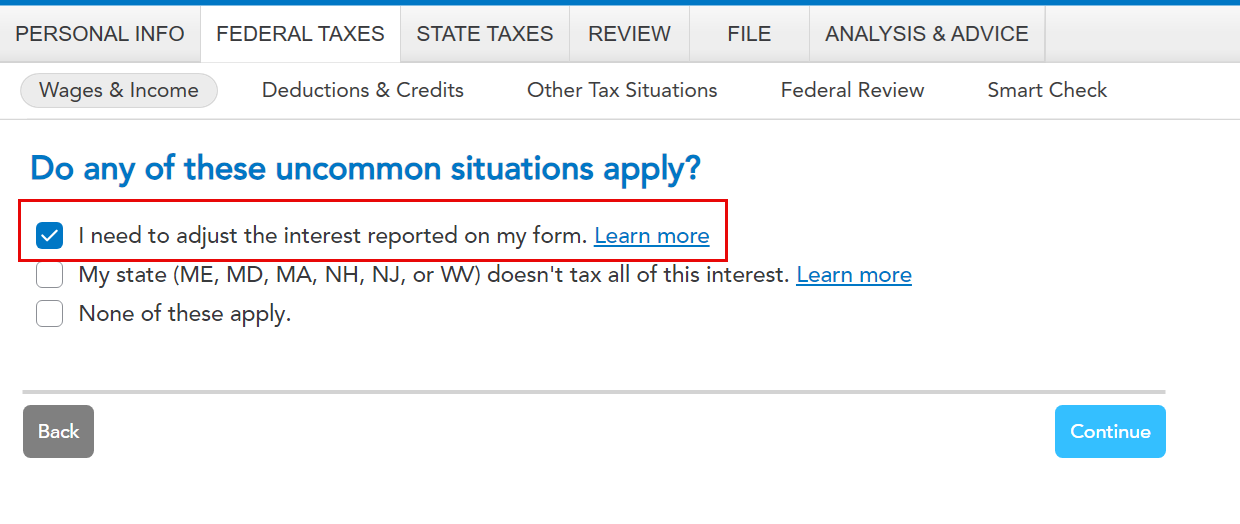

Proceed to enter the information from the 1099-INT form. Continue on the interview screens until you see "Do any of these uncommon situations apply?". Select the box to the left of I need to adjust the interest reported on my form. Select continue.

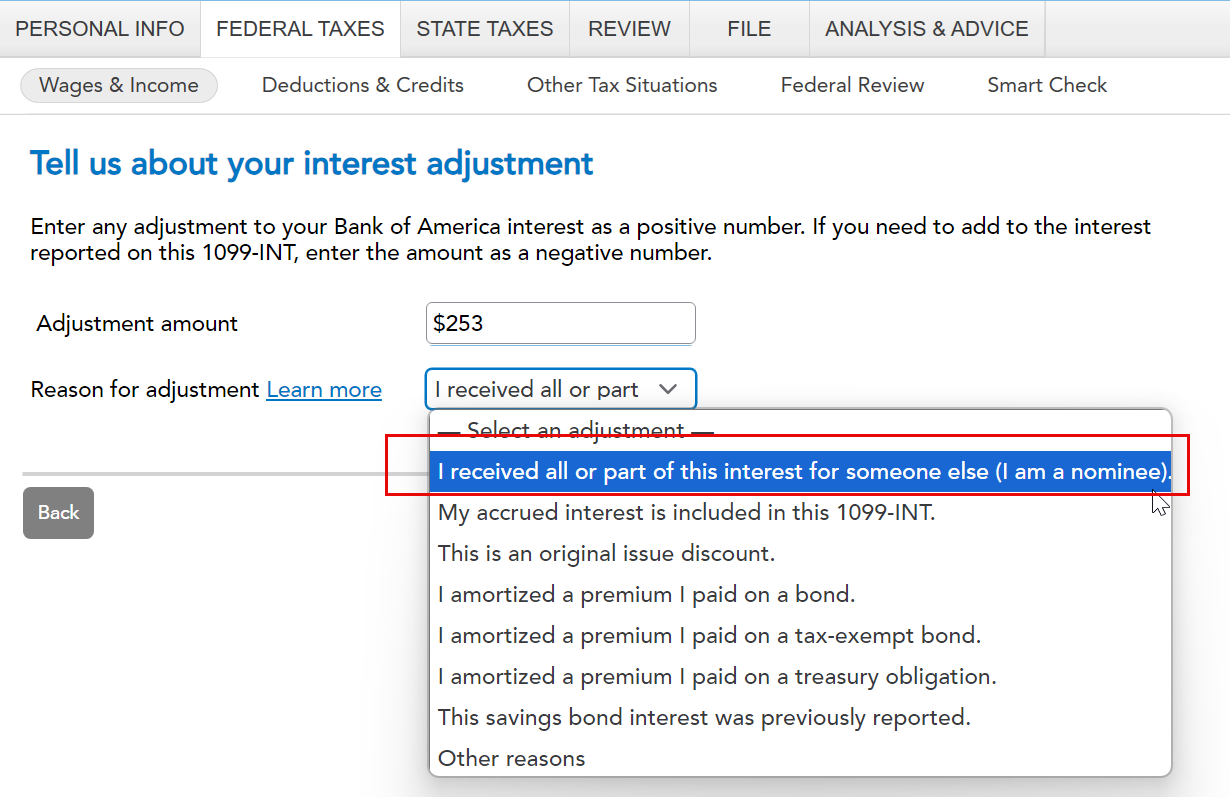

The next screen will allow you to enter your interest adjustment and provide a reason for the adjustment. Enter the amount of the interest income that is allocable to your relative and using the pull down arrow, select "I received all of part of this interest for someone else (I am a nominee). Select continue.

Your entries here will adjust the interest income reported on your Schedule B. You should see the amount of interest allocable to your relative on Schedule B, Part I, line 1.

@kinamasi

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sandy4042

Level 5

samurai226

Level 3

bjoyner

New Member

maxweb69

New Member

maryskaconnolly

New Member