- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No, the situation is a bit different for two relatives.

First, the person whose Social Security number is listed on the 1099-INT form will need to report the full amount on their tax return. Then, they will need to make an adjustment to back out the portion of the interest income allocable to the relative. Finally, the person who received the 1099-INT would also need to complete forms 1096 and 1099-INT to report the interest income allocable to the relative in accordance with the instructions for Schedule B.

To make the entries on the tax return for the person who's Social Security number is listed on the tax form, please see where do I enter Form 1099-INT.

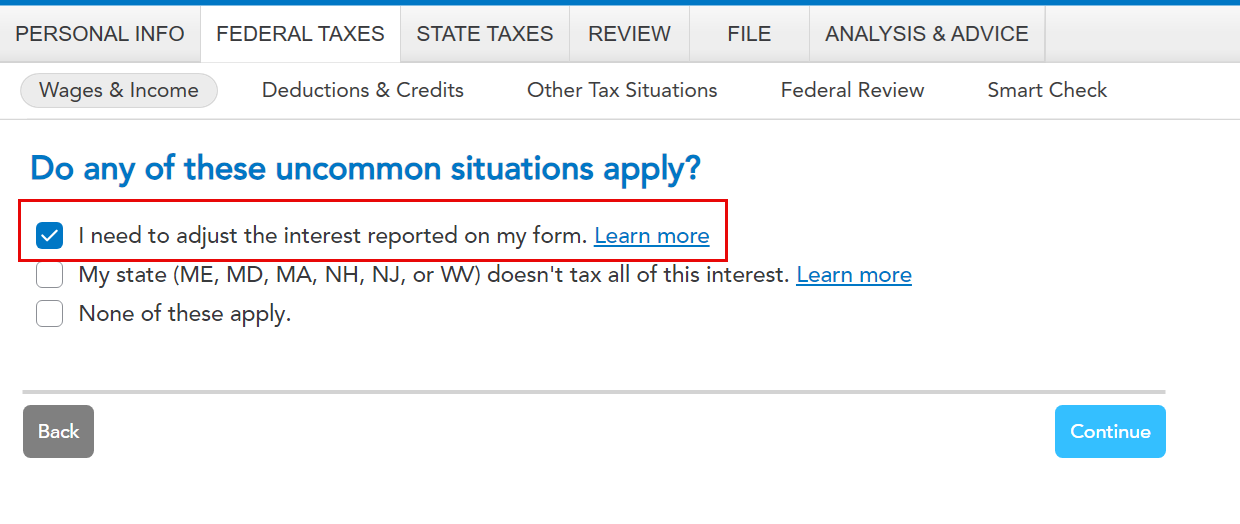

Proceed to enter the information from the 1099-INT form. Continue on the interview screens until you see "Do any of these uncommon situations apply?". Select the box to the left of I need to adjust the interest reported on my form. Select continue.

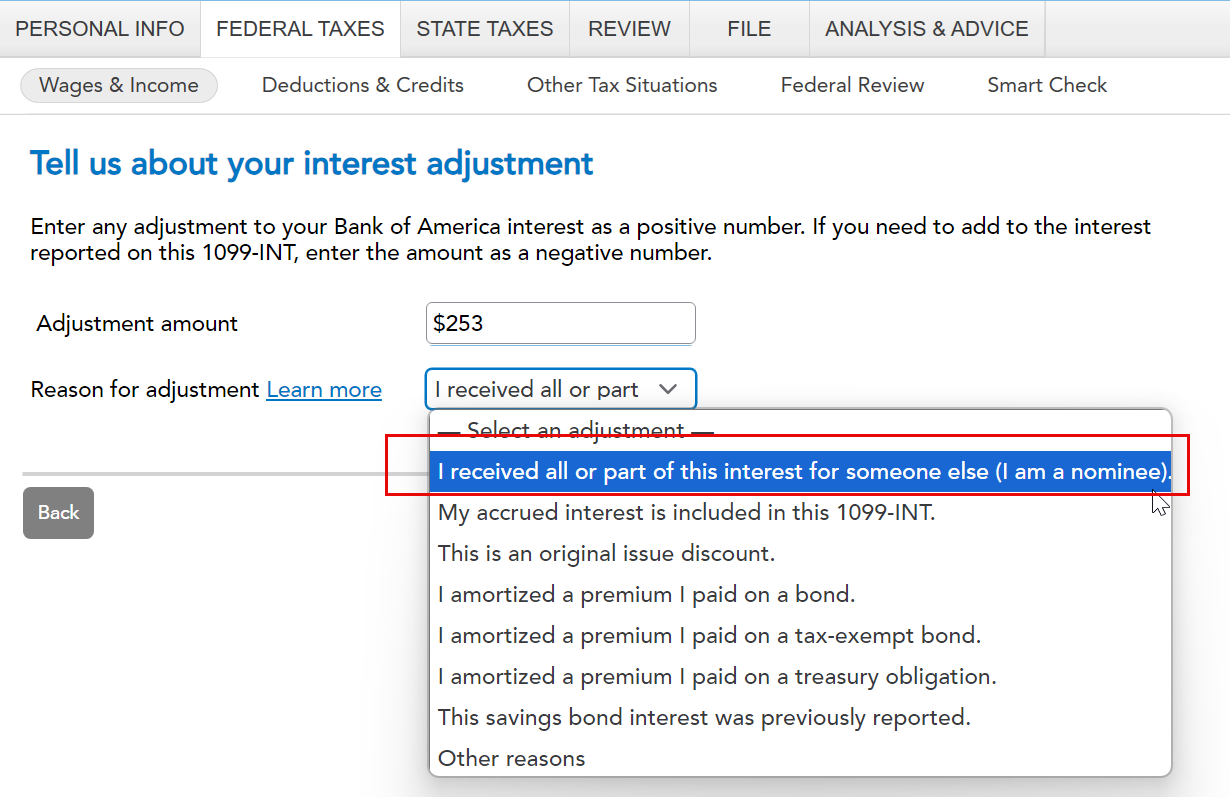

The next screen will allow you to enter your interest adjustment and provide a reason for the adjustment. Enter the amount of the interest income that is allocable to your relative and using the pull down arrow, select "I received all of part of this interest for someone else (I am a nominee). Select continue.

Your entries here will adjust the interest income reported on your Schedule B. You should see the amount of interest allocable to your relative on Schedule B, Part I, line 1.

@kinamasi

**Mark the post that answers your question by clicking on "Mark as Best Answer"