- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Married Filing Jointly with spouse ITIN form W-7

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Jointly with spouse ITIN form W-7

I am trying to file Married-Filing-Jointly but my spouse has to apply for her ITIN (form W-7). I got a few questions to see if Turbotax supports these:

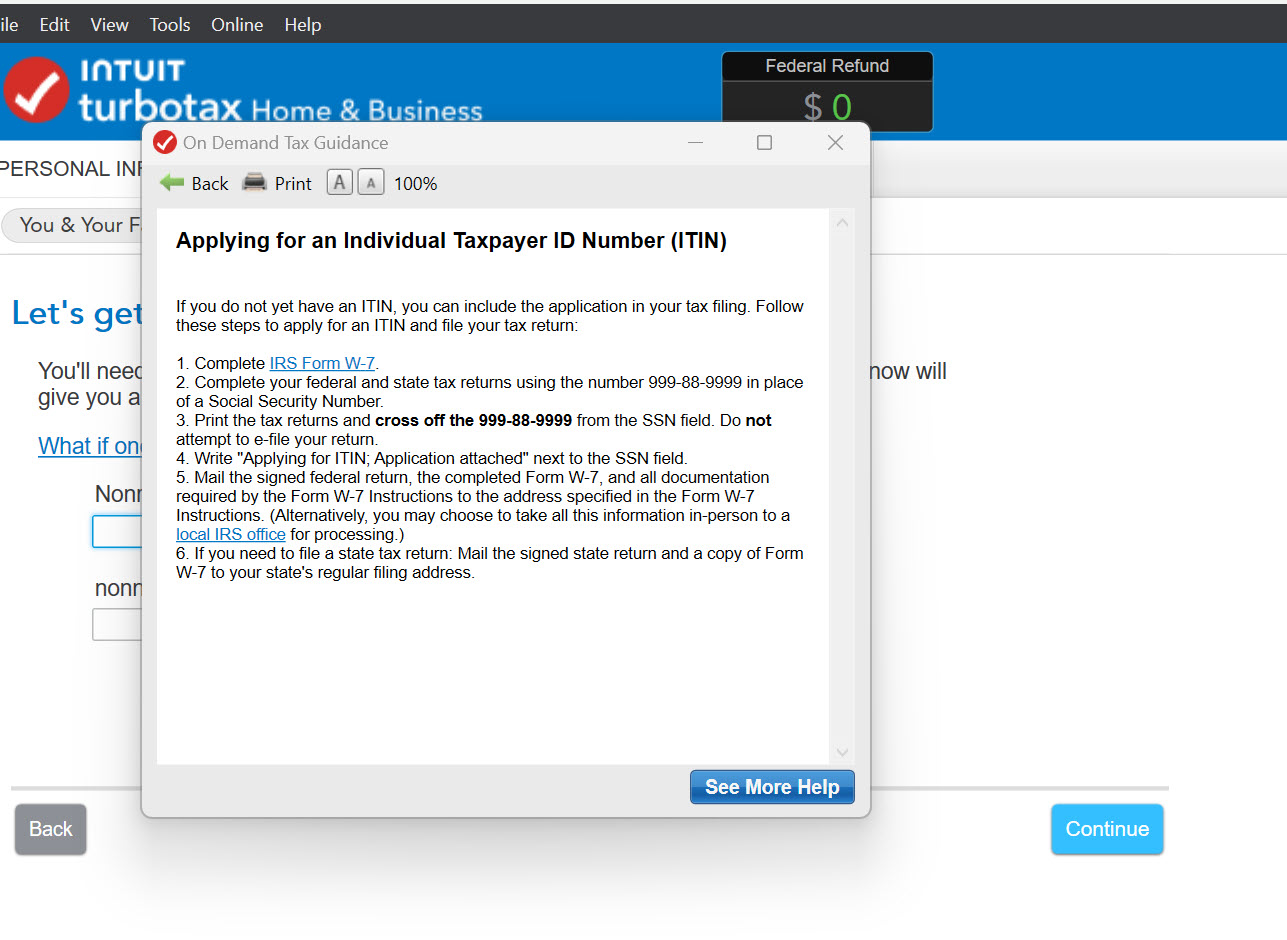

1. In the software, is it possible to put 0s in the SSN/ITIN or leave the box empty for spouse so that I can fill out the rest (that includes my W-2, 1099 DIV, INT etc), and then later print out the return? I need to physically mail the return this time because we need to submit the W-7 along with the return to IRS, Texas. Most other tools I searched don't support this on their software.

2. The same question for California state return, does the software allow putting 0s or empty box for spouse ITIN/SSN and print the return?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Jointly with spouse ITIN form W-7

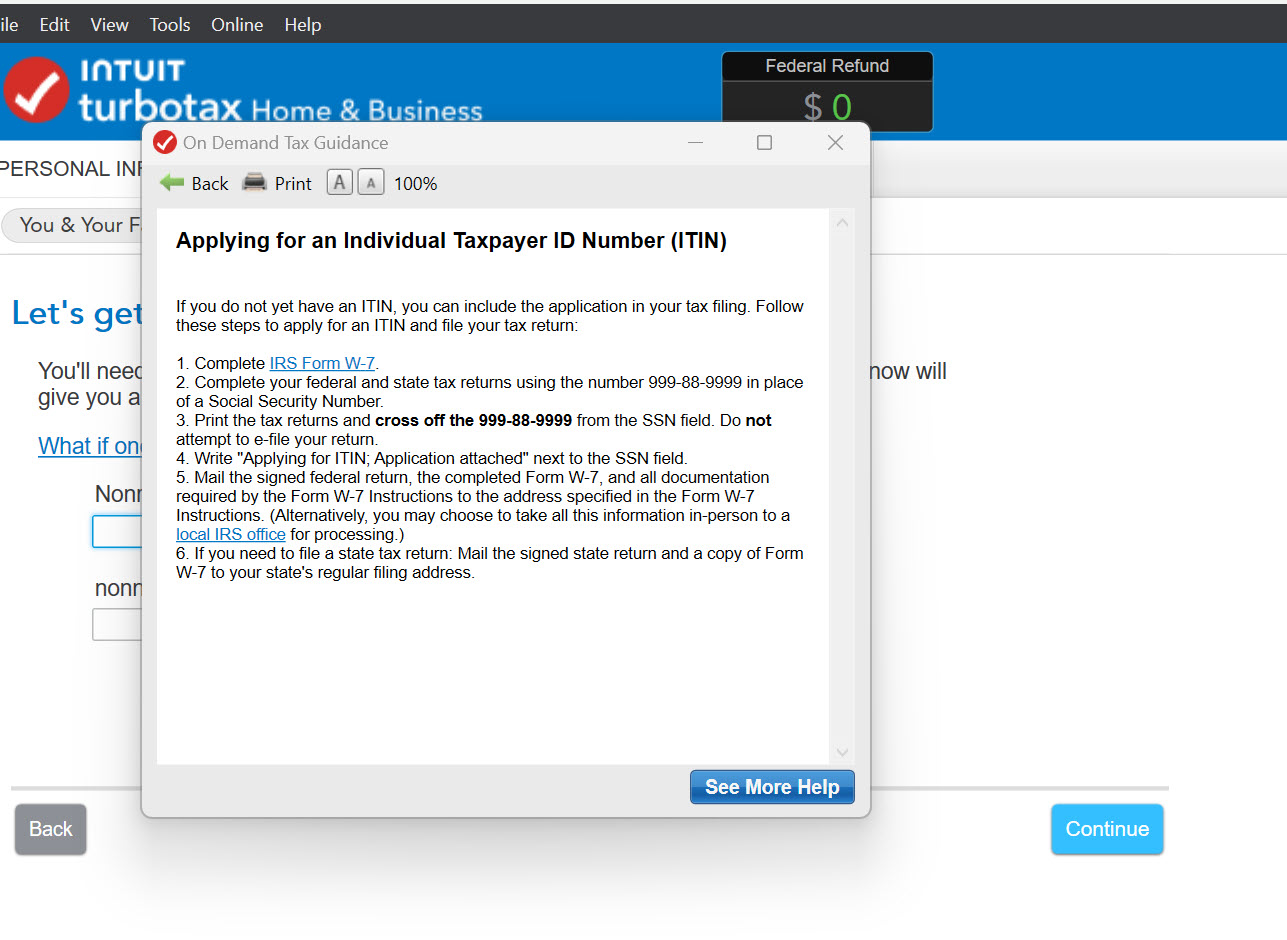

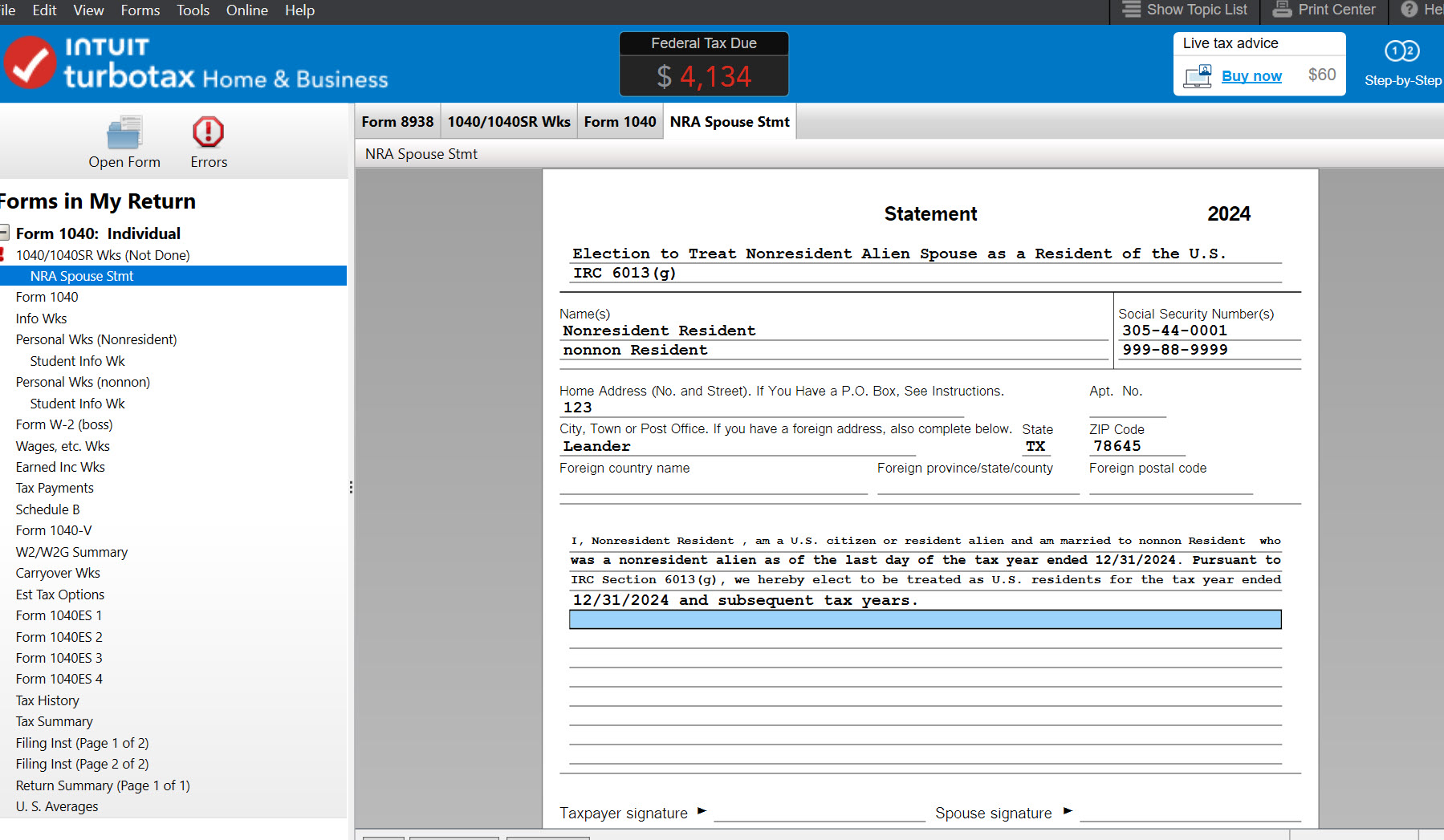

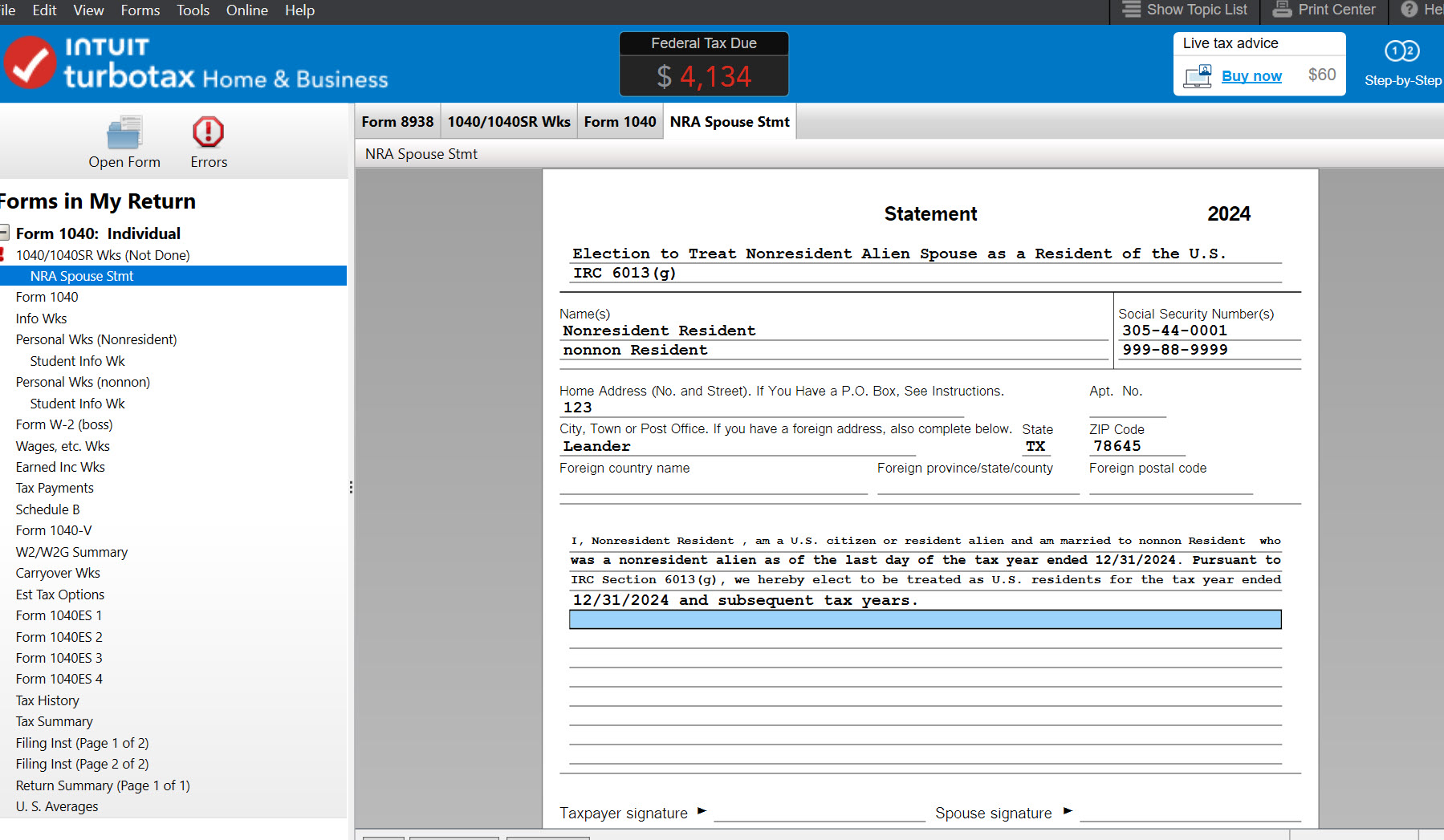

Yes. TurboTax suggests you use 999-88-9999 to use the TurboTax program. This will allow you to calculate a federal and state return. If applying for an ITIN, you should "White-out" the space containing that number on the paper copy. Attach Form W-7 and send to the Austin Texas address or take to a Acceptance Agent or Certifying Acceptance Agent.

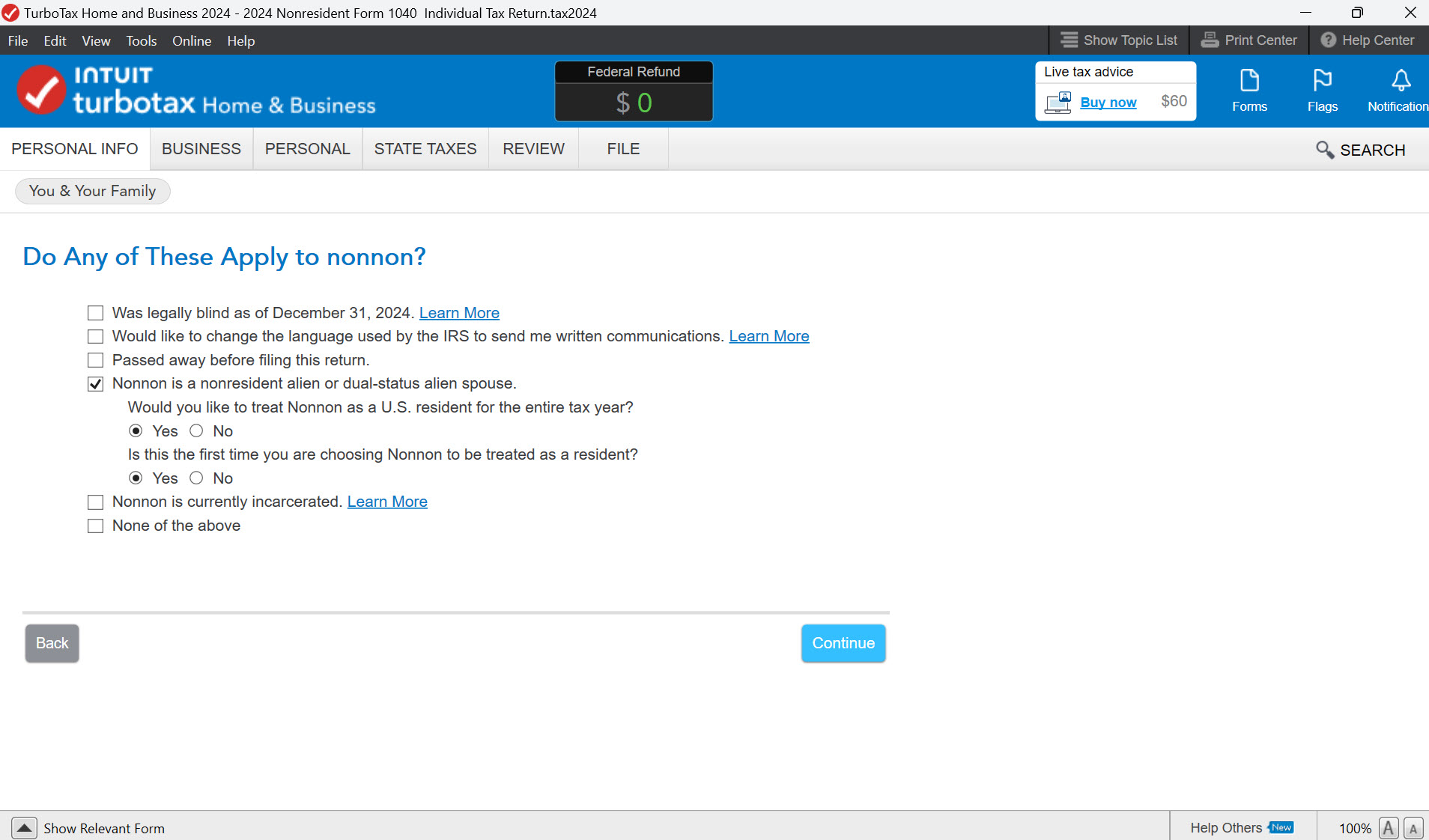

TurboTax also assists if you are making the election to file a joint return. Select the option in the Personal Info section of the return and a statement will be generated with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Married Filing Jointly with spouse ITIN form W-7

Yes. TurboTax suggests you use 999-88-9999 to use the TurboTax program. This will allow you to calculate a federal and state return. If applying for an ITIN, you should "White-out" the space containing that number on the paper copy. Attach Form W-7 and send to the Austin Texas address or take to a Acceptance Agent or Certifying Acceptance Agent.

TurboTax also assists if you are making the election to file a joint return. Select the option in the Personal Info section of the return and a statement will be generated with your return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549282037

New Member

kmarteny

New Member

Agwoods11

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

Agwoods11

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

pv

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill