- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Mail old returns originally rejected for E-filing

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mail old returns originally rejected for E-filing

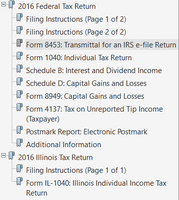

I am trying to print old returns ('16, '17, and '18) to mail in that were originally rejected for E-filing under IND-031-03, a problem with personal AGI. I've been told that as long as I have the correct personal information, I can mail in these returns without having an accurate AGI for that year. When I print 'All Official Forms Required For Filing' using the downloaded 2016 TurboTax software, it gives me the electronic filing instructions for that year, saying for a federal tax return I should mail form 8453 with an 8949 after my return is accepted. Are these filing instructions correct? Is there a way to receive filing instructions for mail-in only?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mail old returns originally rejected for E-filing

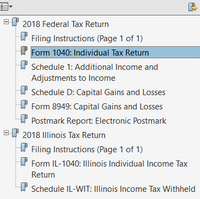

In each program ... complete the interview and complete the FILE tab ... choose to MAIL in the return then the correct mail in forms and instructions will be presented.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mail old returns originally rejected for E-filing

see the 1040 Instructions at www.irs.gov for where to mail your tax returns.

mail each return separately.

if you elected the mail in option in 2016, then a paper return should include the required transaction detail report.

As critter would say, I doubt the IRS will make an issue of it if you leave out the detail report.

Are you expecting a refund ? You are coming up on the deadline to file 2016 return for a refund. So work on that one first.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mail old returns originally rejected for E-filing

Thank you for getting back to me. When I finish going through the amendment software, it tells me that I am done and the only option is to exit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mail old returns originally rejected for E-filing

Yes.

You do not need to send the Form 8453 forms as those are for e-filed returns.

Please see the following link for additional information on printing your amended return.

Printing/downloading an amended return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Lapetty

New Member

bsilcott

New Member

aihualiaoca

New Member

GingerE

New Member

rachelwaine35

New Member