- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Lump Sum Social Security

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lump Sum Social Security

When entering information from SSA-1099 I have lump sum distributions list for tax year 2020-2023, this is also an amount for 'Other Tax Year'. How do I enter that amount without a year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lump Sum Social Security

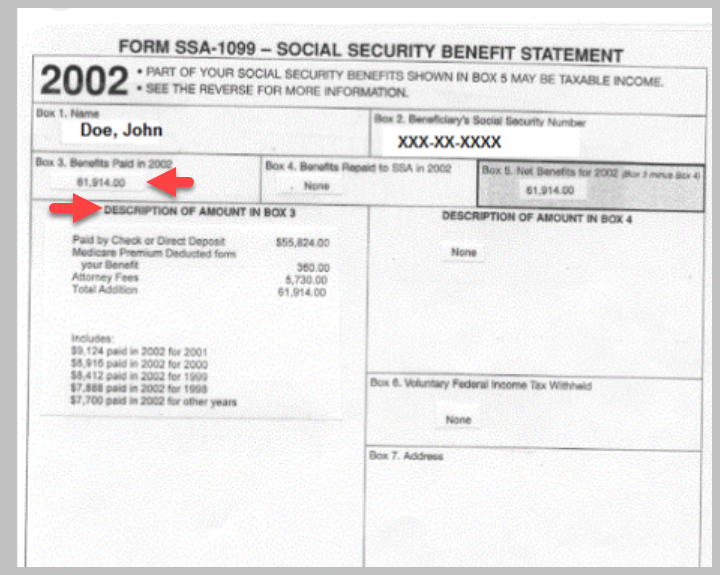

Generally, if you have received a lump-sum payment from Social Security there will be an amount in box 3 of your SSA-1099 Form. The years for which the lump-sum payment is for should also be reported on your SSA-1099 Form, in the box that states "Description of Amount in Box 3".

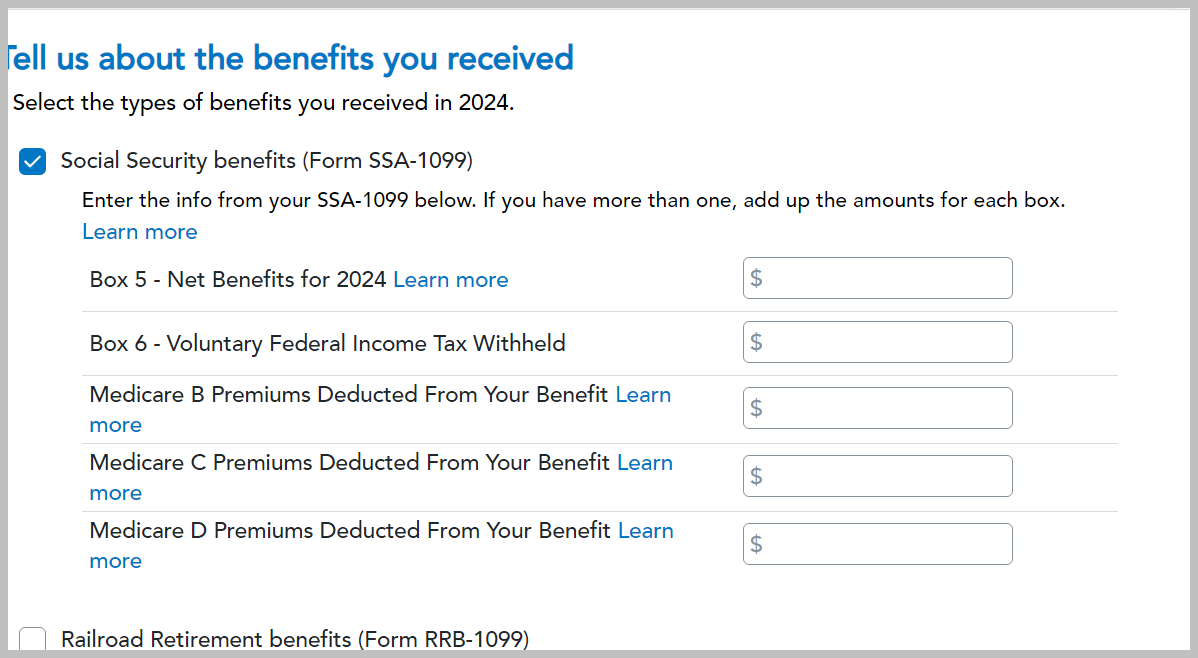

The amount in box 5 shows your net benefits for 2024 (box 3 minus box 4). Box 5 is used to figure out whether any of your benefits are taxable. You will only have to enter Box 5 & 6 in TurboTax along with Medicare premiums reported in the description box for Box 3.

To enter your Form SSA-1099 in TurboTax you can do the following:

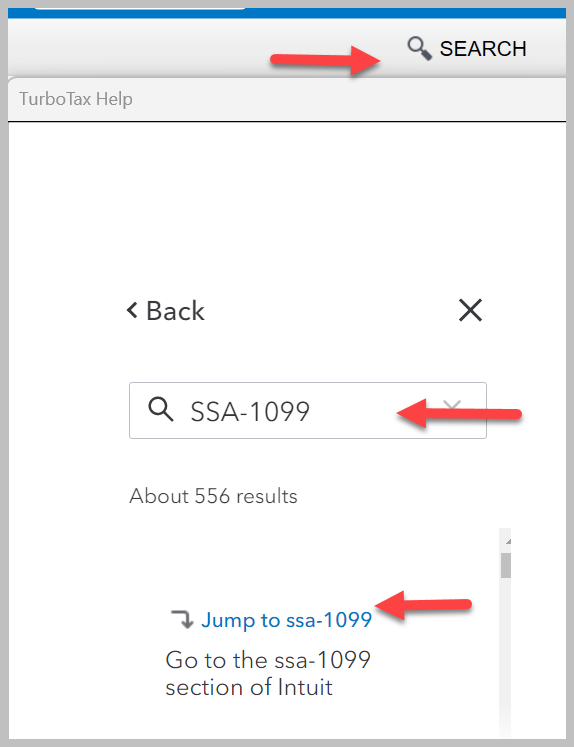

- Click on the search icon in the upper right of your TurboTax screen.

- Type "SSA-1099" in the search box

- Click on the link "Jump to SSA-1099"

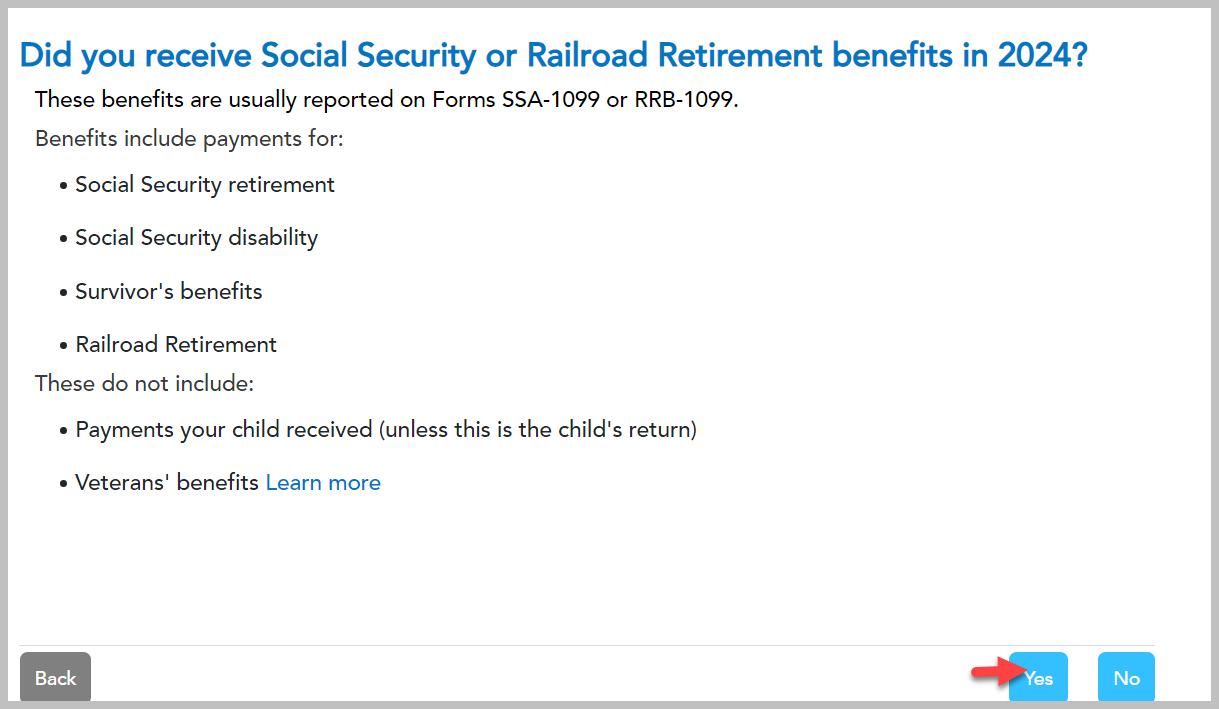

- Follow your TurboTax screens and answer all follow-up questions

Your TurboTax screens will look something like this:

Check box "Description of Amount in Box 3" for the years:

Click here for "Where do I enter an SSA-1099, SSA-1099-SM, or SSA-1099-R-OP1?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Sgoddard14

New Member

rodiy2k21

Returning Member

michelle_duarte

New Member

pnberkowtaxes201

New Member

Kimrnmadison

Returning Member