- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Lost my tax files and now I can't e-file my amended return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lost my tax files and now I can't e-file my amended return?

I am using desktop version of Turbotax and e-filed my 2023 returns 2 weeks ago. I've already received my federal refund.

I just received a late 1099-DIV form and now I need to file an amended return.

Unfortunately, my PC crashed and I lost my Turbotax files. Therefore, I had to re-do my 2023 return before being able to amend it.

Now I'm trying to e-file my amended return but Turbotax is telling me I can't because I didn't e-file the original 2023 return (even though I did). I'm guessing because I don't have the original 2023 Turbotax files, the program doesn't know I e-filed it.

I'd rather e-file than print whole bunch of pages and mail it in for obvious reasons. Is there a way I can "trick" Turbotax to think I e-filed my return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lost my tax files and now I can't e-file my amended return?

Can anyone please help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lost my tax files and now I can't e-file my amended return?

I just talked to Turbotax support and they said it may be a delay between their system and IRS. They recommended I wait couple of weeks before trying to e-file my amended return again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lost my tax files and now I can't e-file my amended return?

I don't think that will work. You needed to amend the actual efiled return .tax2023 file. Maybe you can see if this file will update as filed. For the Desktop program you have to check the filing status inside the program. Open your return and go up to menu item

File > Electronic Filing > Check Electronic Filing Status

Then save your return with the status. Go to File-Save.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lost my tax files and now I can't e-file my amended return?

Checked the e-file status and it properly shows they were filed and accepted. Yet, it won't let me e-file the amended return!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lost my tax files and now I can't e-file my amended return?

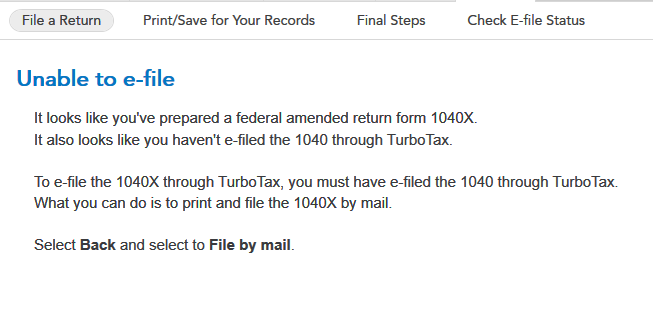

If I try to e-file the amended return, I get this message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Lost my tax files and now I can't e-file my amended return?

Oh good. I haven't heard of anyone efiling an amended return yet. Maybe you do have to wait. The amended return just became available 2/15. Boy I'm really surprised it said it was efiled and accepted from the new redo return. Maybe it checks from your ssn.

Did you do what I said and Save your return after checking the efile status? Then close Turbo Tax and reopen it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

reynadevin28

New Member

ahkhan99

New Member

20tprtax

New Member

berniek1

Returning Member

berniek1

Returning Member