- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

Yes. You can find the most up to date information at IRS Updates on the Second Stimulus and TurboTax Updates on the Second Stimulus.

You can confirm the status of your stimulus payment at Get My Payment.

-

If it shows a direct deposit date and partial account information, then your payment is deposited there.

-

If it shows a date your payment was mailed, it may take up to 3 – 4 weeks for you to receive the payment. Watch your mail carefully for a check or debit card.

-

If it shows "Payment Status #2 – Not Available," then you will not receive a second Economic Impact Payment and instead you need to claim the Recovery Rebate Credit on your 2020 Tax Return.

If you paid for TurboTax with your refund last year, we have given the IRS your correct account information and you can expect the IRS to make a second attempt within the next few days.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

What happens if I file with the 2nd stimulus credit and I receive the funds after? Do I need to file an amended return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

Possibly. If that were to happen, the IRS may catch the error and adjust your return which would make the amendment unnecessary. But yes, if you get a refund for the recovery rebate and receive the payment later, you would need to file an amended return. Amending is necessary when you claimed credits (recovery rebate) that you are not eligible for.

The IRS is not accepting tax returns until Feb 12th. If you have already submitted your return, you will notice that you can't make changes because your return is pending. If you receive a stimulus payment while your return is being processed, wait until your return gets rejected or accepted. If it gets rejected, you can make the change on your return before you re-submit the return. If it gets accepted, wait until your return is fully processed and you have received your refund. If the IRS adjusts your return, you don't have to do anything. But if they don't adjust it and you got the payment and claimed the rebate, it is then that you would need to file an amended return. So, you are not going to know if you need to do the amendment until around the end of February. @johnc

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

No can you help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

If you don't receive your stimulus payment by the time you file your tax return, you can make an adjustment on your 2020 tax return for stimulus payments you qualify for, but have not received.

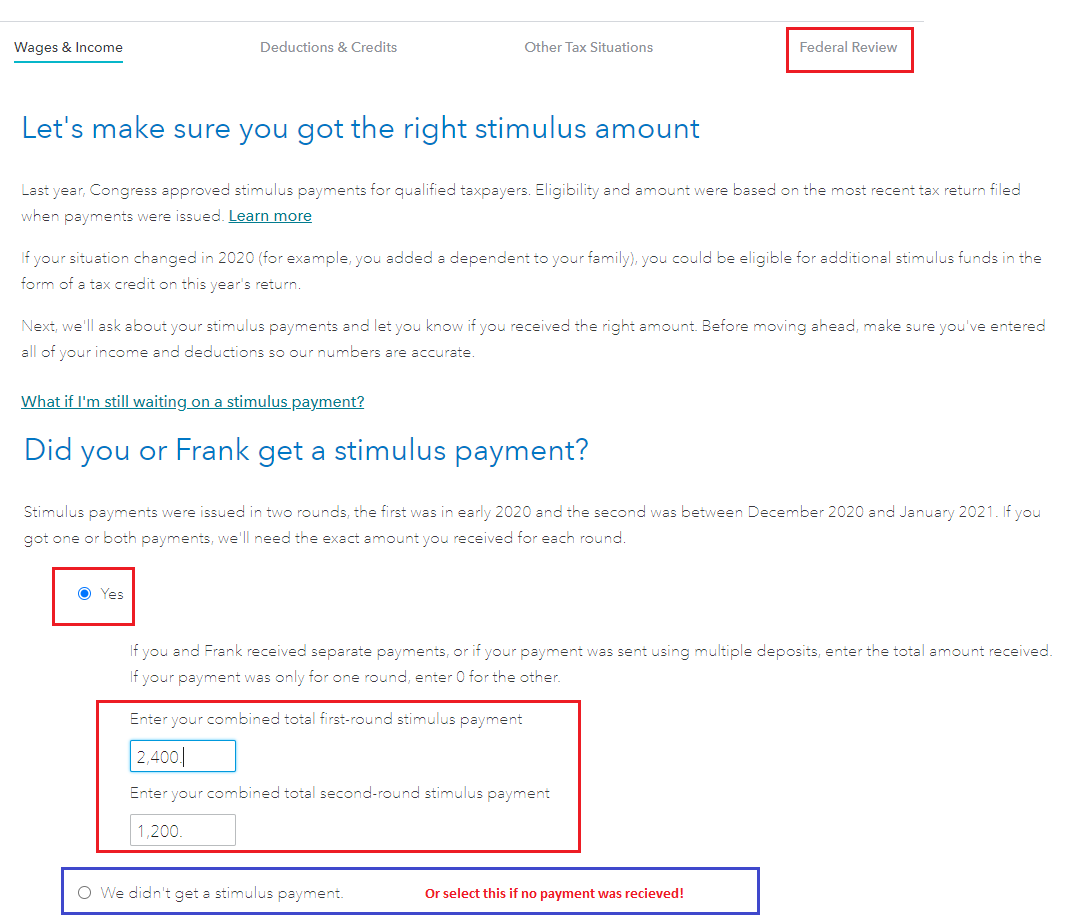

To do this in TurboTax, please follow these steps:

- Enter the information in your return.

- Click Federal Review at the top of your screen.

- On the screen, Let's make sure you got the right stimulus amount, click Continue.

- You will be asked about the amounts of first round and second round stimulus payments you received.

- TurboTax will then calculate the amount of stimulus payment remaining that you are still entitled to. This will show as a credit on line 30 of the 1040.

For additional information, please see the following articles on the IRS website:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

I'm trying to find out why I have not received my taxed check yet. They said was suppose to be here the 19-22. And I still have not received it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

If your tax return has been accepted, TurboTax gives you an estimate - which is 14-21 days from the day you filed. For filed and accepted tax returns, the IRS's Where's My Refund site gives the most current and accurate information regarding your tax refund. What does the WMR tell you about your tax refund? @Teri1967 You will need:

- Social security number or ITIN

- Your filing status

- Your exact refund amount

If you are unsure about any of those 3 numbers, look on your Form 1040 to confirm. Your refund amount is on Line #34 - If you elected to apply some of your refund to next year, your requested refund amount is on Line #35a.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

I need help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

There is help for determining the amount of your stimulus and what you should receive at each link below. Be sure you filed your 2020 tax return and included the Recovery Rebate Credit (RRC).

Using the Get My Payment link will show you what they have on file for you - Select the button Get My Payment to see your information.

They should use your 2020 tax return for the most current address and bank information. They prefer direct deposit so it would seem it will be deposited since you added that information to your 2020 tax return.

The third stimulus payment will be sent to you based on your 2020 tax return. As long as you are not being claimed as a dependent on another tax return and you income is below the limit you should be entitled to your allowable stimulus payments.

These links are the FAQs for each round of stimulus:

In TurboTax Online, to claim the Recovery Rebate credit please do the following:

- Sign into your account and continue from where you left off

- Click on Federal in the left-hand column, then on Federal Review on the top of the screen

- On the next page titled Let's make sure you got the right stimulus amount, click on Continue

- Follow the interview to correct the amounts (zero for nothing received before filing your return)

- TurboTax will determine whether you are entitled to any additional stimulus

- Any stimulus amount remaining due to you will show as a credit on line 30 of your form 1040

- See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

I don’t know what year I am missing I have w2 for last five years I don’t know or know how to find that out please help me

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there any information available for Turbo Tax customers who haven't yet received the second stimulus check?

What are you trying to do exactly? Can you please clarify your question so we can assist you?

If you are trying to prepare a prior year tax return, please see the link below to access the software. You will need to report each W-2 in each tax year as reported on your tax form.

Prior-year tax return information

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cadottethomas83

New Member

Meldenillo

New Member

bmtransue

New Member

ronscott2003

New Member

kacib230

New Member