- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

There is help for determining the amount of your stimulus and what you should receive at each link below. Be sure you filed your 2020 tax return and included the Recovery Rebate Credit (RRC).

Using the Get My Payment link will show you what they have on file for you - Select the button Get My Payment to see your information.

They should use your 2020 tax return for the most current address and bank information. They prefer direct deposit so it would seem it will be deposited since you added that information to your 2020 tax return.

The third stimulus payment will be sent to you based on your 2020 tax return. As long as you are not being claimed as a dependent on another tax return and you income is below the limit you should be entitled to your allowable stimulus payments.

These links are the FAQs for each round of stimulus:

In TurboTax Online, to claim the Recovery Rebate credit please do the following:

- Sign into your account and continue from where you left off

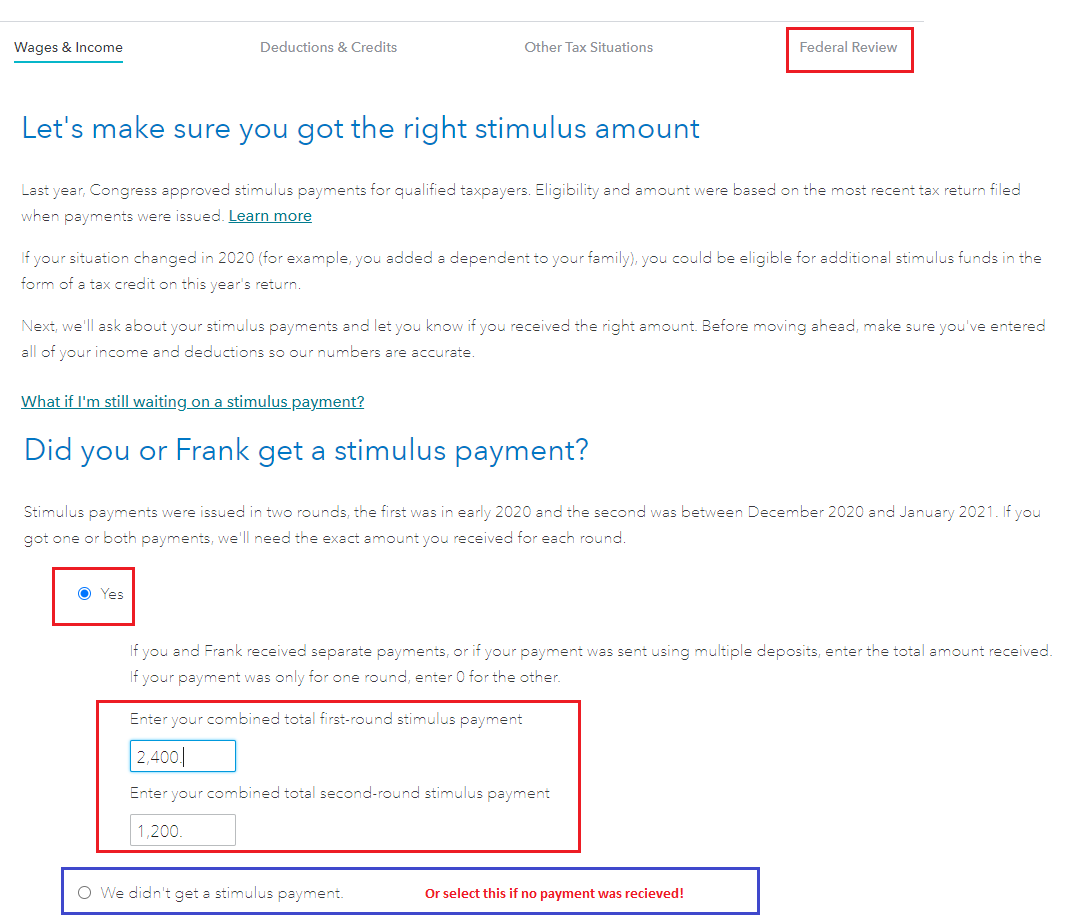

- Click on Federal in the left-hand column, then on Federal Review on the top of the screen

- On the next page titled Let's make sure you got the right stimulus amount, click on Continue

- Follow the interview to correct the amounts (zero for nothing received before filing your return)

- TurboTax will determine whether you are entitled to any additional stimulus

- Any stimulus amount remaining due to you will show as a credit on line 30 of your form 1040

- See the image below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"