- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- IRS reduced our W4 withholding 2 years in a row and now we owe and owe more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS reduced our W4 withholding 2 years in a row and now we owe and owe more.

We have a somewhat "interesting situation".

My wife and I both have regular jobs.

We also have two residential income properties.

...and we each have a sole proprietor side business (mine is an LLC commercial rental property).

I also have a self managed investment account that pays dividends and interest.

Up until 2019, we simply had extra withholding taken out of our pay checks, and that covered the additional income. We were usually under $200 either owed or refunded.

In 2020, IRS unexpectedly reduced the withholding from my wife's check.

We ended up owing $1200 for that tax year.

She and I both filled out new W4 forms and asked for additional withholding.

But again, not only did IRS not honor the request, they again reduced my wife's withholding.

For the 2021 tax year we are looking at owing $2300.

Why?

Why won't IRS allow us to withhold enough to cover what we owe during the year.

It's MUCH easier to simply have it taken out every month than to remember to write checks and mail estimated quarterly payments.

The "new" W4 instructions basically say to take ALL withholding from the highest paycheck.

Why? Why do they care?

I only make about 10K more than my wife, but we each manage our own side businesses.

Why wouldn't IRS want their money every month?

If this sounds like a rant, I'm sorry. I just can't figure this out.

I WANT to pay my taxes, and I don't want to owe thousands every April 15th.

I'm hoping an experienced professional here can shed some light.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS reduced our W4 withholding 2 years in a row and now we owe and owe more.

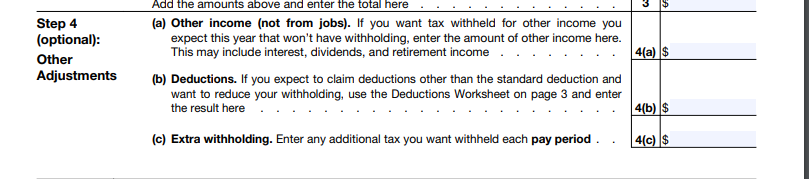

The W-4 only affects your withholdings from your employers, it does not account for your self-employment income. You have two options: 1) make estimated quarterly tax payments based on your additional self-employment income, or 2) adjust your withholdings from your W-2 income. You may have either or both employers withhold extra tax per pay period. You make this selection in step 4 Form W-4. Line (c)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS reduced our W4 withholding 2 years in a row and now we owe and owe more.

Your employer records and acts according to your W-4.

IRS has nothing to do with it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS reduced our W4 withholding 2 years in a row and now we owe and owe more.

I was under the impression that's the way it worked.

However, my wife's employer (a county school district) told her they had submitted the request, but had no control over what the IRS does, and that she needed to contact IRS directly.

Are they lying?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS reduced our W4 withholding 2 years in a row and now we owe and owe more.

Why would my wife's employer then arbitrarily reduce her withholding two years in a row?

To me that sounds like a federal crime.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS reduced our W4 withholding 2 years in a row and now we owe and owe more.

Without having direct contact with the employer, it is hard to tell why they did that, however, the IRS does not control the W4 or how much extra you have withheld.

When you file your W4, if you want you could have an extra $1,000/ pay withheld (assuming your check is high enough).

You can try submitting the W4 again and watch her checks each week to be sure the correct amount is being withheld. The School district should be using the 2022 Tax Withholdings to calculate the amount she has withheld as a starting point. Any changes you want to be made would be done through the W4.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

IRS reduced our W4 withholding 2 years in a row and now we owe and owe more.

If school HR dept. is not cooperative (why not?) then you can make estimated tax payments.

the end result is the same you paid withholding as you go.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

StPaulResident

Returning Member

patamelia

Level 2

Lilsexynini

Returning Member

VJR-M

Level 1

Porus

Level 2