- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

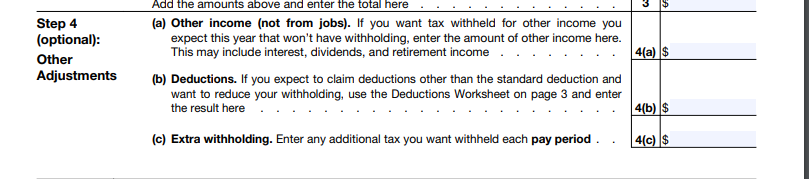

The W-4 only affects your withholdings from your employers, it does not account for your self-employment income. You have two options: 1) make estimated quarterly tax payments based on your additional self-employment income, or 2) adjust your withholdings from your W-2 income. You may have either or both employers withhold extra tax per pay period. You make this selection in step 4 Form W-4. Line (c)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 12, 2022

6:03 AM

913 Views