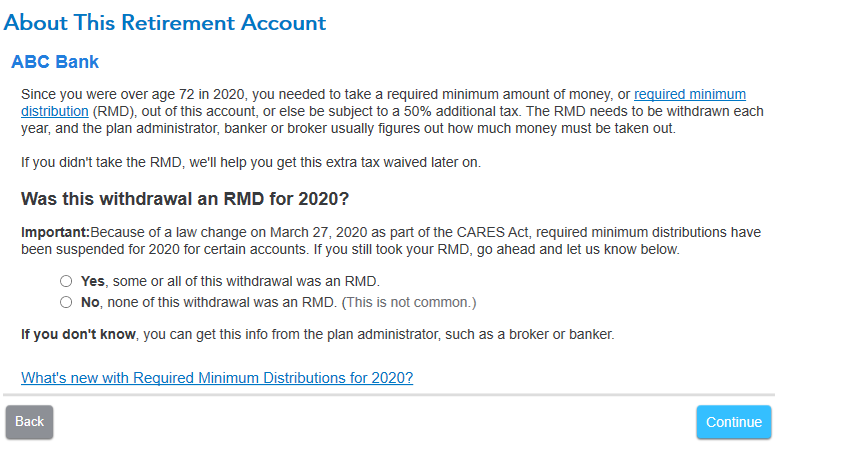

Indeed, starting from tax year 2020, Required minimum distributions (RMDs) must be taken each year beginning with the year you turn age 72 (instead of 70 1/2 up to tax year 2019).

I have tested the program, and the age reference has been changed to 72 (instead of 70 1/2). Your program may need updating. In the program, please click on Online, then Check for updates.

Please see this screenshot:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"