- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

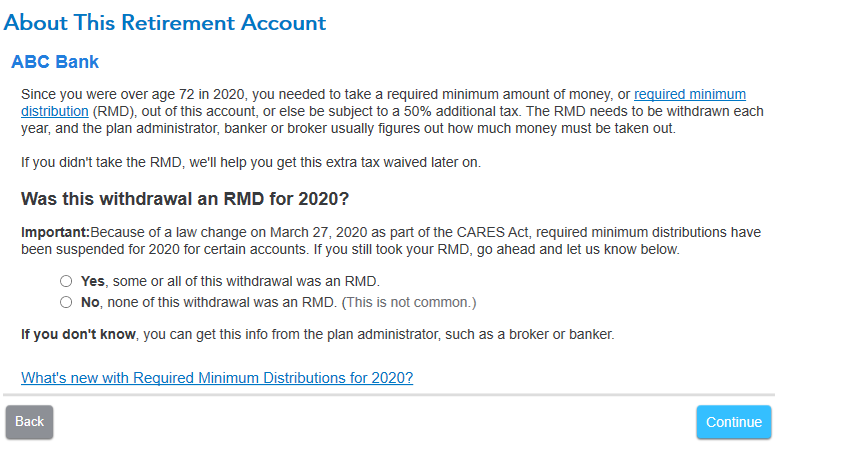

Indeed, starting from tax year 2020, Required minimum distributions (RMDs) must be taken each year beginning with the year you turn age 72 (instead of 70 1/2 up to tax year 2019).

I have tested the program, and the age reference has been changed to 72 (instead of 70 1/2). Your program may need updating. In the program, please click on Online, then Check for updates.

Please see this screenshot:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 28, 2021

2:22 PM