I was employed roughly about 3/4th of the year and contributed to a 401K through the employer (did not max out) and self-employed remainder of the year.

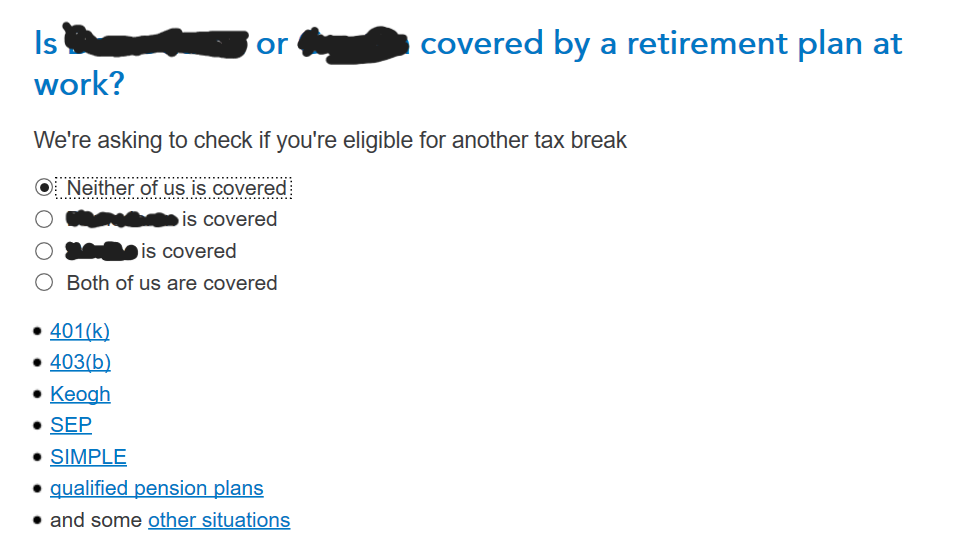

Spouse was employed and did not have a 401K through their employer. Can the spouse make a deductible contribution to their IRA? What do we answer for the below question as shown in TurboTax Desktop. Should we select "Neither of us is covered" which is true based on the employment scenario towards the end of the year or should we select that one of the spouses was covered?