in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Indiane state Tax intest I had EE savings bonds cashed and it was claimed as interst income $ 3254

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiane state Tax intest I had EE savings bonds cashed and it was claimed as interst income $ 3254

and refiled

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Indiane state Tax intest I had EE savings bonds cashed and it was claimed as interst income $ 3254

If your return has been transmitted and rejected by the Indiana Department of Revenue, you can correct your tax return and re-transmit.

If your return has been transmitted and accepted by the Indiana Department of Revenue, you will have to amend your Indiana state tax return. However, before amending your tax return, do not enter the return and do not enter the return and make any changes.

Amended tax returns will not be available before February 15. See forms availability here.

If you used TurboTax Online, log in to your account and select Amend a return that was filed and accepted.

If you used the CD/download product, sign back into your return and select Amend a filed return.

See also this TurboTax Help.

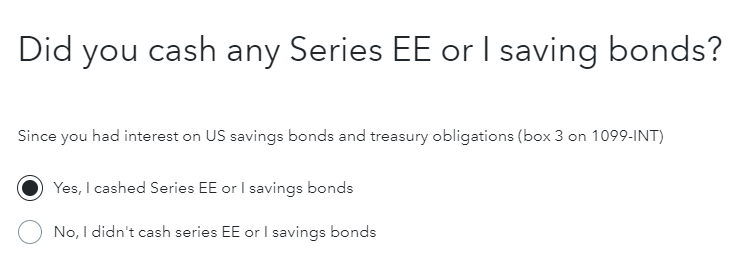

When preparing your tax return, did you identify the EE savings bond interest at this screen?

The screen is found in the entry of the IRS form 1099-INT.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hillite

Level 3

dvalenti659

New Member

louise1997

New Member

dantom2006

New Member

billyg2700

New Member