- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Income from different lines of work was combined into single 1099-MISC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from different lines of work was combined into single 1099-MISC

I am engaged in 2 different types of self-employed business. I sometimes do business of both types at a location owned by someone else. They have provided me a 1099-MISC for the year and income from both types of business activities has been combined into a single line item (non-employee compensation.)

I had been planning on filing a separate Schedule C for each of my businesses. However, I am concerned that the 1099-MISC income will only be tied to one business or the other. Is there any good reason for this concern?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Income from different lines of work was combined into single 1099-MISC

If these are two unrelated businesses, report them separately. In TurboTax, I'd report the 1099-MISC on one of the Schedule C's, to make sure that the IRS sees that you reported it, rather than dividing it and reporting a portion on each Schedule C.

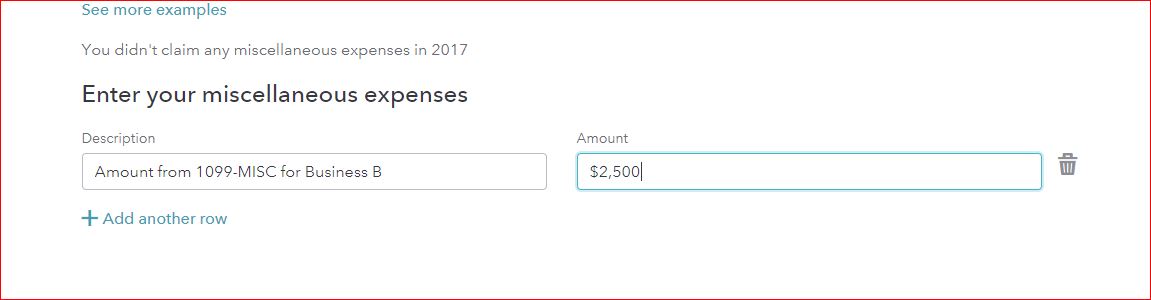

However, to accurately reflect the income from each activity, I'd deduct the portion of the 1099-MISC that relates to Business B from the amount reported in Business A as a miscellaneous expense on your Schedule C. Then report that amount as Other self-employed income on Business B.

However, if these two businesses are closely related, you can report all of your income and expenses together on one Schedule C.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kenn

Level 3

psutiger

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

user17538710126

New Member

jmgretired

New Member

gborn

Level 2