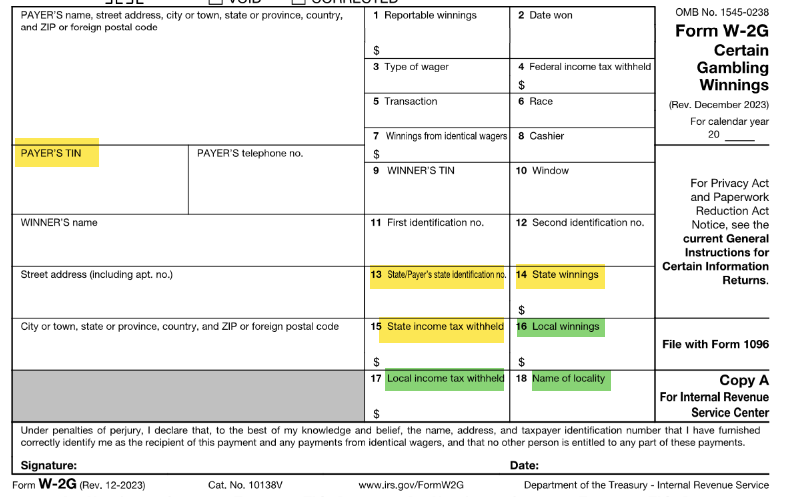

You do not need to enter your SSN when you enter any tax forms. TurboTax will pull that information (and your address) from your personal information worksheet and automatically put your SSN in the required fields. You have to enter an EIN for the casino or gaming establishment, is the EIN (Payer's TIN) on your W-2G?

Usually, the filing issues with W-2Gs have to do with the state id number in box 13. What is in Boxes 13 - 18? Did you have state or local tax withheld? If you have amounts in boxes 14 or 16, you have to complete the other boxes as well.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"