- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

@Anon95 wrote:

Same here! Just got a 1099-K from PayPal for over $100k but I didn't actually win $100k on the gambling site. It was a lot of withdrawls that made the total go so high. Theoretically, I could use PayPal to deposit $500 into the online casino and then immediately use PayPal to withdrawl the same $500, do that 200 times over and reach $100k in withdrawl transactions without ever actually gambling a penny of it. How does the IRS reconcile this? Do we enter the PayPal withdrawls reported on 1099-K as income from online gambling but deduct the PayPal deposits to reach a "net" income?

That's the real problem. If your gambling site says you "won" $10,000 and lost "15,000", that's what you should be reporting on your tax return. But if PayPal issues you a 1099-K for more, because of the churn in the account, how do you report it?

One option that is still consistent with IRS guidelines is to leave the 1099-K off your return, report the winnings under "gambling winnings", report the losses on the deduction page, and file by mail. You would attach a copy of the 1099-K and a letter of explanation as to why you reported a different amount. This would also work if your PayPal account contains different types of income (you mixed your eBay sales and your gambling activities, for example). However, filing by mail is not preferred.

Another option would be to zero out the entire 1099-K. Report the whole 1099-K as other income, then create another item of other income with a minus sign (negative number) to cancel out the 1099-K, and use a reason like "gambling winnings reported elsewhere". Then report the actual winnings and losses as usual. The IRS may or may not send a letter asking for a more detailed explanation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

In most cases, the casino will take 25 percent off your winnings for IRS gambling taxes before paying you. Not all gambling winnings in the amounts above are subject to IRS Form W2-G. W2-G forms are not required for winnings from table games such as blackjack, craps, baccarat, and roulette, regardless of the amount.

For gambling winnings, there's no 1099-K entry form screen like there is for a W-2, in TurboTax. You don’t have to worry about the 1099K from PayPal for withdrawing part of your winnings, you have to worry about the W-2 G from the sports betting company that will report your winnings for the year.

In addition to what Opus 17 said, you may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040) and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

Click on the link below to see how to enter W-2G:

Here's where you enter Form W-2G (Certain Gambling Winnings) in TurboTax:

- Open or continue your return in TurboTax, if you aren't already in it

- Search for W2G (don't include any hyphens) and select the Jump to link in the search results

- Answer Yes on the Did you win money or other prizes in

- 2022? screen and follow the instructions to enter your W-2G

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

I am in same boat, I talked to tax specialist at tax act, I think they are leading me down the wrong road. They tried to make me put as income then . Then put it in loss .like I was a professional gambler. Which I feel like im due to get audit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

So if someone has a high churn right on sports books/casino via PayPal. If I received this 1099k for a large large amount. However I deposited over 10k more than what they sent me. Aka a 10k net loss on the year. My losses outweighed my wins by 10k. Didn't win anything at any book overall. I can simply write off by itemizing my taxes and write off that entire 1099k amount because it was a loss. I can't write off all the losses however I can write off the quote on quote wins as reported on my 1099k. Is that correct? I think I understand but I believe since I didn't win $ on any sites overall and was down I shouldn't owe any income taxes on that. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

You had gambling receipts that will be recorded on W2-G's. The receipts were only deposited and withdrawn from the the Paypal account. So the Paypal account performs the same function as a dedicated checking account. Is that correct?

A 1099-K that reports income that is not accurate should still be entered into your tax return but then backed out. It is important that you retain records of what you did should a taxing authority ask questions about this income down the road.

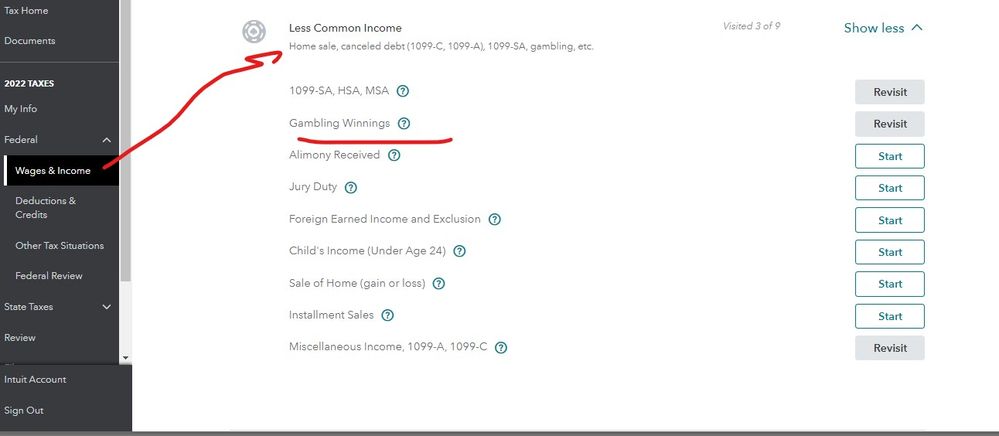

To report Other income, follow these directions.

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click Show more to the right of Other Common Income.

- Under Your income and expenses, click the Edit/Add button to the right of Form 1099-K.

- At the screen Did you get a 1099-K? click Yes.

- At the screen How would you like to enter your 1099-K? click Type it in myself. Click Continue.

- At the screen Choose which type of income your 1099-K is for, select the button for Other income. Click Continue.

- At the screen Let’s get the info from your 1099-K, enter the information. Click Continue.

- At the screen Your Other 1099-K income, you enter further information for the Other income. Click Continue.

- At the screen Your 1099-K summary, notice that the income relates to Other income. Click Done.

Other income may need to be reversed if some or all the income reported on the 1099-K is not accurate. Post the negative entry as follows:

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click Show more to the right of Less Common Income.

- To the right of Miscellaneous Income, 1099-A, 1099-C, click the Start / Revisit button.

- To the right of Other reportable income, click the Start / Revisit button.

- At the screen Other Taxable Income, enter a description such as “Other income reversed” and a negative amount.

The entries will be reported:

- on line 8z of Schedule 1 of the Federal 1040 tax return, and

- on line 8 of the Federal 1040 tax return.

Make sure that you keep records of all transactions. Later, you may need to demonstrate to the IRS that this is not taxable income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

That is correct PayPal acted like a checking account in this instance.

I never received a W2G for any website at all. Simply just the 1099k. But thanks for the Info. Based of that info it sounds like yes I can report the income on the 1099k as other income than just simply back it out since I lost more than I received by a larage amount and wouldn't have to pay taxes on that income since it was all gambling and at a loss

thanks for the info

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

NO .... All your gambling income/winnings MUST be reported on the form 1040 and the losses can go on the Sch A ... you will enter the amount from the 1099-K as gambling winnings in the proper section for gambling winnings and then you will be asked for the losses. Do NOT just put it on and negate it off completely on the Sch 1 line 8 ... this will get you an IRS audit letter for sure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

I don't fully understand the ins and outs of sports gambling but if you only won $10,000, your gambling income is not $200,000, with 190,000 on Schedule A, although that's one way to do it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

No I'm saying report the full amount on the 1099k as gambling winnings.

than also on the itemized portion where you can report losses I will report the full amount of my winnings as gambling losses. I can show those records if requested. My goal here is to report my gambling winnings and losses properly. However since I lost over 10k net after all my wins and losses are calculated I don't believe I will be taxed on that gambling wins as income because I have the losses to more than out weigh the amount that showed up in this 1099k. Essentially it looks like I earned way more in 2022 than I did. However in reality I lost money overall by a large amount in gambling net

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

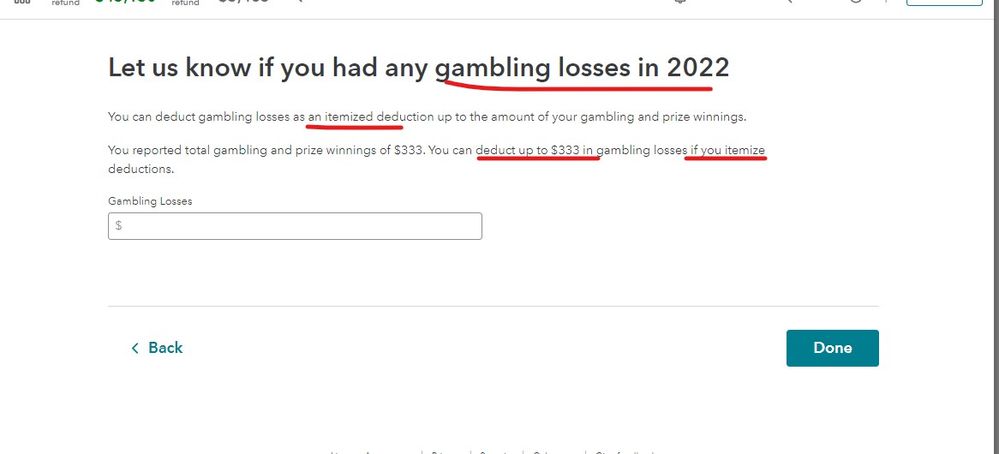

Not quite right ... the gambling winnings must be reported as income and only the losses (up to the amount of winnings) can be used on the Sch A which is not a $ for $ reduction and is not done on the form 1040 "above the line". You are not allowed to net the losses against the winnings and only report the difference on the form 1040 and you can never deduct more loss than you reported in gains.

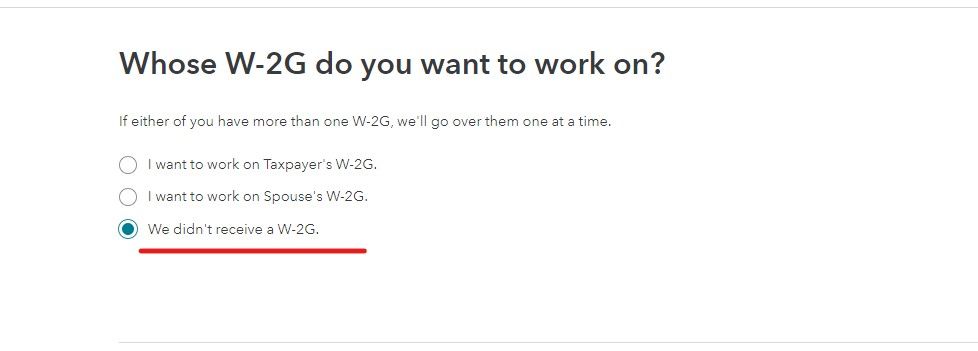

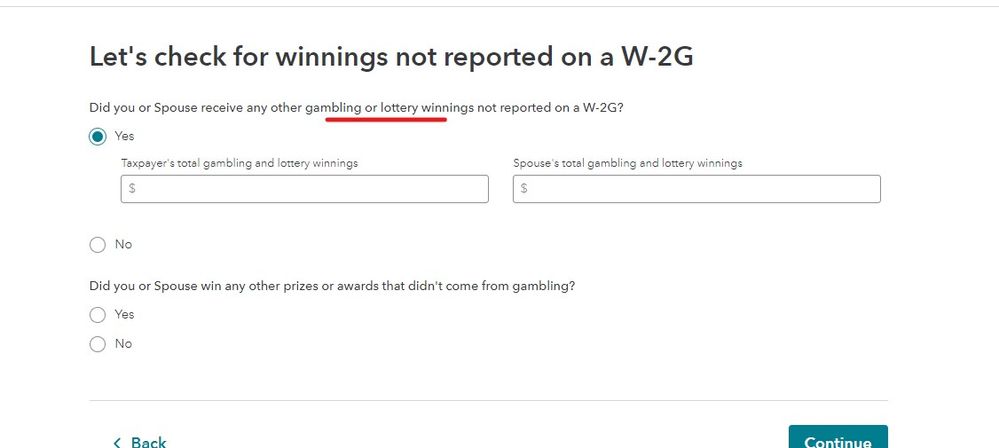

In the TT program, when you enter the gambling winnings in the W-2G section (even if you have no W-2G to enter) you are asked for the total of the winnings and on the next screen the total of the losses ... the program will put them in the correct places on your return.

Do not also enter the 1099-K if you got one for the gambling if you already entered the gambling winnings somewhere else in the return. Do not enter that amount twice unless you like paying more in taxes than required.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

So, if my 1099-k says 250k and my betting sites say 500k in winnings and 600k in losses and the net of negative 100k, I must enter 500k in winnings and write it off in SCH A by entering the same amount and not to report 1099-k at all ? Is that a right understanding ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

Correct ... no matter what the 1099-K says you must report all the winnings ... so enter 500K for winnings and the same for the losses. This has always been the rule on the form 1040 for the last few decades.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

Enter it this way ... ignore the 1099-K ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

Thank you for the detailed explanation. My only worry is if I combine all my winnings from gaming sites it will be in the excess of $4M where my actual family income is $250k. All that $4M is simply the churn amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

If I have been using PayPal to withdraw gambling winnings, I know I will receive a 1099K. I have made about $4,000 in withdrawals from PayPal. What will the tax rate be?

I guess my question is does gambling winnings account towards AGI at all if the same amount is written off in losses ?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hayleyreagin

New Member

user17552101674

New Member

keriswan58

New Member

keriswan58

New Member

trelawneyscroggins

New Member