- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I withdrew all the money from my adult child's QEP and received a 1099Q. Where do I report that income? I know I have to pay tax and penalty?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I withdrew all the money from my adult child's QEP and received a 1099Q. Where do I report that income? I know I have to pay tax and penalty?

Topics:

posted

March 29, 2022

2:41 PM

last updated

March 29, 2022

2:41 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

3 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I withdrew all the money from my adult child's QEP and received a 1099Q. Where do I report that income? I know I have to pay tax and penalty?

Please follow the instructions in this TurboTax Help topic to enter your form 1099-Q.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 29, 2022

2:54 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I withdrew all the money from my adult child's QEP and received a 1099Q. Where do I report that income? I know I have to pay tax and penalty?

I withdrew all the money from 1099Q funds I was saving for my grandson. He does not live with me and he dropped out of high school. Where do I report using Turbo Tax

April 14, 2023

4:42 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I withdrew all the money from my adult child's QEP and received a 1099Q. Where do I report that income? I know I have to pay tax and penalty?

Yes, that will need to be recorded.

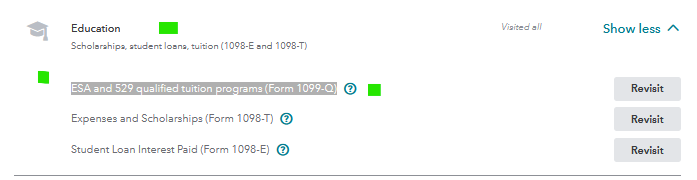

- To enter your Form 1099-Q, please click on Deductions and Credits, on the side menu bar

- Scroll down to Education and select See More

- Click on Start or Revisit next to ESA and 529 qualified tuition programs (Form 1099-Q)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 14, 2023

4:55 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

Aowens6972

New Member

rkplw

New Member

jjon12346

New Member

kac42

Level 1