- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I need to re-enter my 1099-int form

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to re-enter my 1099-int form

I uploaded a picture of my 1099-INT form and somehow the computer put the wrong state on my address. I need to edit it or take a new picture.

Topics:

posted

April 10, 2023

8:45 AM

last updated

April 10, 2023

8:45 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

3 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to re-enter my 1099-int form

Delete your Form 1099-INT and type it in yourself.

- Sign in to your TurboTax account and open or continue your return

- Select Federal from the menu, then Wages & Income

- On the screen Your investments & savings or Here's your 1099-INT info, select the trashcan icon to delete the 1099-int form

- Select Add Investments or Add another 1099-INT, then Continue

- On the next screen, select how you want to enter your Form 1099-INT:

- If you want to upload a copy of your form or manually enter the info, select Enter a different way, and follow the instructions to enter your 1099-INT

- On the screen Do any of these uncommon situations apply? check the boxes according to your situation and Continue

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 10, 2023

9:37 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to re-enter my 1099-int form

I have followed these instructions but there is no trash can icon to delete the 1099-INT.

April 17, 2023

10:40 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to re-enter my 1099-int form

To delete a duplicate form in TurboTax Online, you can use Delete Forms

- In the left menu, select Tax Tools

- Select Tools

- Select Delete a form

- Scroll to the Form 1099-INT and click Delete on the right

- Then scroll to the bottom and select Continue with my return

To re-enter the Form 1099-INT manually:

- Yes, enter the interest under Wages and Income, on the left menu

- Scroll down to Investments and Savings and click on Show More

- Click Start or Revisit under Interest on 1099-INT

- Click on Add Investments

- Click the Enter a Different Way button

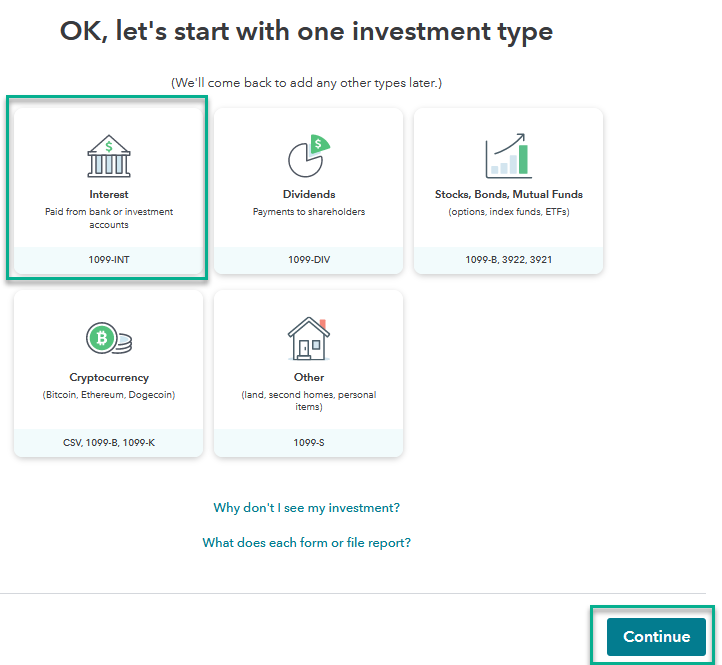

- On the OK, let's start with one investment type screen select Interest 1099-INT and click Continue

- Select Type it in myself

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 17, 2023

11:06 AM

432

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bagel

New Member

awootten

New Member

SquillyP

New Member

aodum

New Member

vibhavyawalkar

New Member