- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I’m self employed and if I claim all my Venmo sales with cash and checks in 1 lump sum do I have to still do a 1099k? I had 40 transactions and 6,331 in sales Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m self employed and if I claim all my Venmo sales with cash and checks in 1 lump sum do I have to still do a 1099k? I had 40 transactions and 6,331 in sales Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I’m self employed and if I claim all my Venmo sales with cash and checks in 1 lump sum do I have to still do a 1099k? I had 40 transactions and 6,331 in sales Thanks

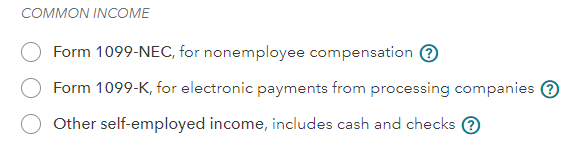

You are reporting self-employment income on Schedule C. The Schedule C reports gross sales revenue with a one line entry Other self-employed income, includes cash and checks such as here.

The one line entry is sufficient provided that the entry reports at least $6,331. The Schedule C may report the cost of sales and positive Schedule C income will be subject to income tax as well as self-employment tax.

You may also report two lines of income, one line in the amount of $6,331 and the second line in the amount of the remaining income reported on your Schedule C.

For instance, if you Schedule C reports gross income of $12,331, you may report two lines, one for $6,000 and one for $6,331.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17548719818

New Member

6616jm

New Member

SCswede

Level 3

Alex012

Level 1

davidcjonesvt

Level 3