- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

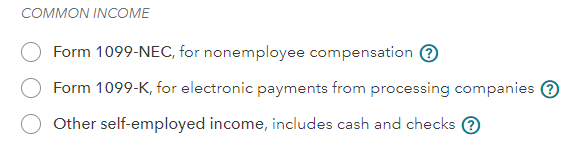

You are reporting self-employment income on Schedule C. The Schedule C reports gross sales revenue with a one line entry Other self-employed income, includes cash and checks such as here.

The one line entry is sufficient provided that the entry reports at least $6,331. The Schedule C may report the cost of sales and positive Schedule C income will be subject to income tax as well as self-employment tax.

You may also report two lines of income, one line in the amount of $6,331 and the second line in the amount of the remaining income reported on your Schedule C.

For instance, if you Schedule C reports gross income of $12,331, you may report two lines, one for $6,000 and one for $6,331.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 27, 2023

5:10 AM