- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I'm ready to file, but on the dividend income worksheet, it says the Payer has too many characters-- but it won't let me edit the entry.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm ready to file, but on the dividend income worksheet, it says the Payer has too many characters-- but it won't let me edit the entry.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm ready to file, but on the dividend income worksheet, it says the Payer has too many characters-- but it won't let me edit the entry.

You may need to delete the Form 1099-DIV that reports the dividend income and re-enter it.

- Click on Tax Tools in the left menu bar

- Click on Tools

- Look under Other Helpful Links and choose Delete a form

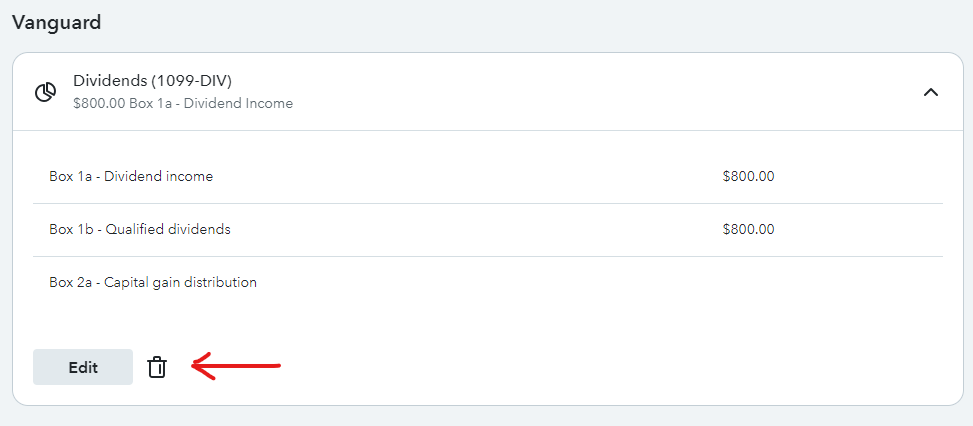

Find the form 1099-DIV you want to remove in the list and click on the delete icon to remove it.

Follow these steps to enter a form 1099-Div:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Look for Interest and Dividends

- Choose Dividends on Form 1099-DIV

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm ready to file, but on the dividend income worksheet, it says the Payer has too many characters-- but it won't let me edit the entry.

mine was a vanguard issue, go into your dividend section and shorten the vanguard name.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I'm ready to file, but on the dividend income worksheet, it says the Payer has too many characters-- but it won't let me edit the entry.

If you are unable to edit the name of the issuer, delete the entry and re-enter the entry by hand.

The entry may be deleted at the screen Let's finish pulling in your investment income. Click the down arrow to the right. Click on the trashcan to delete.

Pay special attention to qualified dividends (box 1b) and capital gain distributions (box 2a). Shorten the the Vanguard name.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

abcxyz13

New Member

Blue Storm

Returning Member

cpdlc

New Member

DFH

Level 3

vjs20

Returning Member