- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I lost my job this Jan 2023. I am only receiving unemployment. I can't pay my taxes due. Is there something I can do to not have to pay it all right away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I lost my job this Jan 2023. I am only receiving unemployment. I can't pay my taxes due. Is there something I can do to not have to pay it all right away.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I lost my job this Jan 2023. I am only receiving unemployment. I can't pay my taxes due. Is there something I can do to not have to pay it all right away.

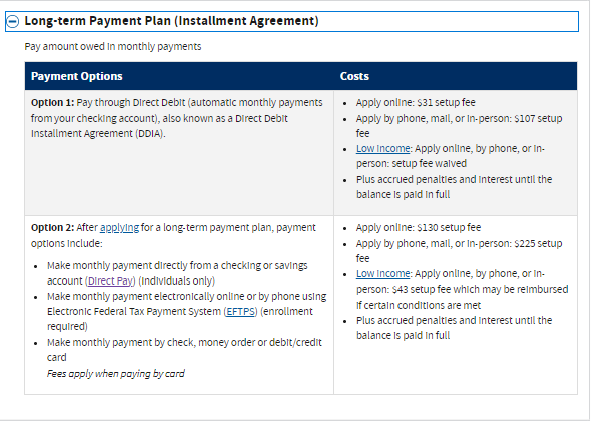

Yes, you can request a payment agreement with the IRS to pay your taxes. You can do this online. You will still be charged interest, but you won't be charged failure to pay penalties. Depending on the amount you owe and the time you take to pay, you may or may not have additional fees.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I lost my job this Jan 2023. I am only receiving unemployment. I can't pay my taxes due. Is there something I can do to not have to pay it all right away.

Thank you. What would be best to do monthly or 180 day pay?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I lost my job this Jan 2023. I am only receiving unemployment. I can't pay my taxes due. Is there something I can do to not have to pay it all right away.

The quicker the debt is paid the less you will have to pay. Interest is added to the balance until it is paid off completely. The 180 day pay would be the least expensive way if you are able to pay within the time frame.

From the IRS:

The setup fee may be waived if you qualify.

How do I determine if I qualify for Low Income Taxpayer Status?

If you believe that you meet the requirements for low income taxpayer status, but the IRS did not identify you as a low-income taxpayer, please review Form 13844: Application for Reduced User Fee for Installment AgreementsPDF for guidance. Applicants should submit the form to the IRS within 30 days from the date of their installment agreement acceptance letter to request the IRS to reconsider their status.

Internal Revenue Service

PO Box 219236, Stop 5050

Kansas City, MO 64121-9236

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

IslandMan1

New Member

troyponton

New Member

rodriguezjasmin9

New Member

amy_meckley

New Member

abuzooz-zee87

New Member