- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I live in Alaska I received the PFD dividend for 2022 the amount $3,284 how ever $662. was non taxable I paid taxes on the full amount and would like to correct the matte

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Alaska I received the PFD dividend for 2022 the amount $3,284 how ever $662. was non taxable I paid taxes on the full amount and would like to correct the matte

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Alaska I received the PFD dividend for 2022 the amount $3,284 how ever $662. was non taxable I paid taxes on the full amount and would like to correct the matte

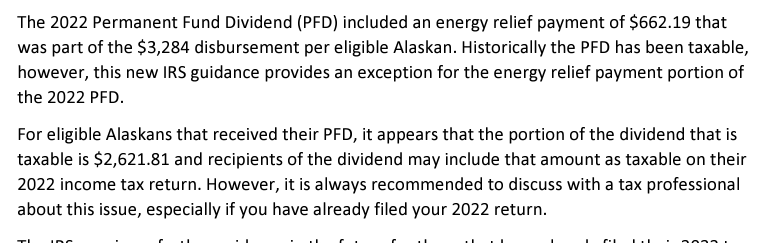

Yes, you are correct that a portion of the Alaska Permanent Fund Dividend (PFD) is not taxable for 2022. Click here for more information.

If you already filed your return and it was accepted, you will need to amend to correct this.

- Sign in to TurboTax.

- On the home screen, scroll down to Your tax returns & documents and select 2022.

- Select Amend (change) return, then Amend using TurboTax Online.

- On the screen OK, let's get a kickstart on your amended return, select the reason(s) you're amending and Continue.

- When you reach Here's the info for your amended federal return, select Start next to the 1099-MISC.

- Correct the amount to the taxable portion only ($2,622).

- Continue through the screens and carefully answer the remaining questions to finish amending your return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Alaska I received the PFD dividend for 2022 the amount $3,284 how ever $662. was non taxable I paid taxes on the full amount and would like to correct the matte

@JulieS I found myself in the same predicament and followed your advice. Now I'm preparing my children's returns and I'm seeing conflicting advice about how to enter the correct amount, with some experts including the full amount from the 1099, and then doing a reversal by including a negative amount (the nontaxable portion of the pmt) under "other income". I'd much prefer the simpler method of reducing the taxable amount entered from the 1099. Are both of these methods acceptable?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Alaska I received the PFD dividend for 2022 the amount $3,284 how ever $662. was non taxable I paid taxes on the full amount and would like to correct the matte

The state of Alaska has issued a statement about this that says recipients of the dividend may include the portion of the dividend that is taxable on their 2022 income tax return. Both methods are acceptable and the easiest way is to enter just the part of the PFD that is taxed without entering a negative amount to offset the total.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PGW1

Returning Member

bmc4

Returning Member

JQ6

Level 3

natroundtree

New Member

frostily0495

Level 3