- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

I'm not sure what you mean by multiple EIN's. A K-1 schedule would only have one EIN listed on the top of it.

However, it is acceptable to make several K-1 form entries to report the information from a single K-1 form. This typically happens when you have rental and ordinary income reported on a K-1 form. You make one K-1 form entry for the ordinary income and another one for the rental income.

You have to be careful not to duplicate an entry, however.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

Hi @ThomasM125! I wasn't clear. I have a 1065 form that was issued by Company A. This form has information in Box 20 which is Code Z: Section 199A information. There is no dollar amount in that box, because I am asked to refer to a statement section of my 1065 form that lists all of the line items that contribute to the 199A information. I have line items in this section from Company A, but I also have line items in this section from Companies B & C which are owned by Company A. When I get to the screen in the first screenshot I've attached here, I can only pick that the income is from the partnership that generated this K-1 (Company A) or the income comes from another business (Companies B or C). Even if I choose "another business", I can only enter information (including the EIN, see the second screenshot) for one company. I need to report information for all 3 companies, but after selecting either "from the partnership that generated this K-1" or "another business", I never get the chance to report the other companies - I only get to enter information for one company. What do I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

OK, no problem. You need to make three K-1 entries for the K-1 you received from company A, one for each of the companies referenced in box 20, code Z.

For the income reported in box 1, you will enter the amount reported in box 20. So, when you are done you will have three K-1 entries and the total will equal what is on the K-1 form you received from company A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

Okay, thanks. That makes sense, but I have some follow-up questions:

1. Do I enter these K-1s as the same form type (1065) as what the K-1 is for Company A?

2. I assume I will now have to get Part I information (company name, address, ID#) for Company B & C?

3. Do I enter the Type of Partner to be the same as the Type of Partner on the Company A 1065?

4. If I already have a K-1 for Company B (I individually have ownership in that company), do I start a new K-1 for this 199A information, or do I add it to the existing K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

Yes, you will report this as follows:

- Yes, if these are from partnerships, so these will be entered as 1065 entries.

- Since you already have a K1 for company B, you will not need to create a new K1. You can add the 199A information to this K1.

- You can assume that the type of partner is the same as company A if its not referenced anywhere.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

Does all the other information stay the same? Couldn't you just add the numbers together for this section?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

I have a similar situation and I think I'm following. One follow up. I'm comfortable splitting the box 1 numbers to align to the information provided in box 20 (code z) for the companies, but what about the information in all the other boxes? Do I enter it again on all k1s? Do I only enter the box 1 information for the 'duplicate k1s?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have more than one company that is the source of 199a information on a single Schedule K-1. How do I enter 199a information for more than one company (multiple EINs)?

You may not be provided a breakdown as displayed below. Only report interest and dividends on one K-1 entry or you will duplicate the income. Post if you have questions about other boxes.

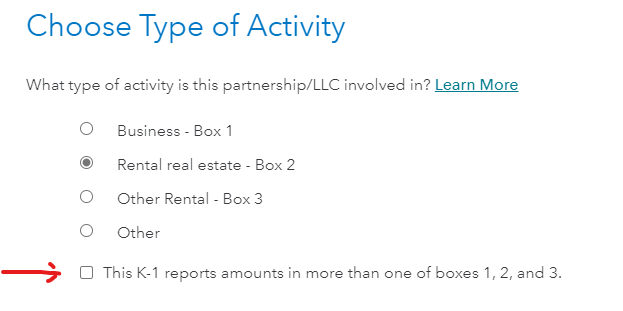

In both TurboTax Online Premium and TurboTax Desktop Premier, at the screen Choose Type of Activity, select This K-1 reports amounts in more than one of boxes 1, 2, and 3.

The instructions read:

Since your K-1 reports amounts in more than one of boxes 1, 2, or 3, the partnership/LLC is involved in more than one type of activity. You should treat each activity separately in TurboTax.

Enter the business activity amount, box 1, on one K-1

Enter real estate rental activity amount, box 2, on another K-1

Enter other rental activity amount, box 3, on a third K-1.

In addition, you would be able to enter two business activity amounts, box 1, that is reported on one K-1. Hopefully, your attachments will provide all of the additional information that you need including EIN numbers, if necessary.

You may find that individual section 199A information is reported for each business activity. The entries on the K-1 are reported on two K-1 entries into the TurboTax software.

Original K-1 EIN 1 EIN 2

Box 1 $1,000 = $500 $500

Box 4 $100 = $75 $25

Box 5a $200 = $150 $50

Box 5b $100 = $75 $25

W-2 wages $50,000 = $25,000 $25,000

UBIA $100,000 = $50,000 $50,000

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anth_edwards

New Member

orenl

New Member

maya-cooper-brill

New Member

j_pgoode

Level 1

Rockpowwer

Level 4