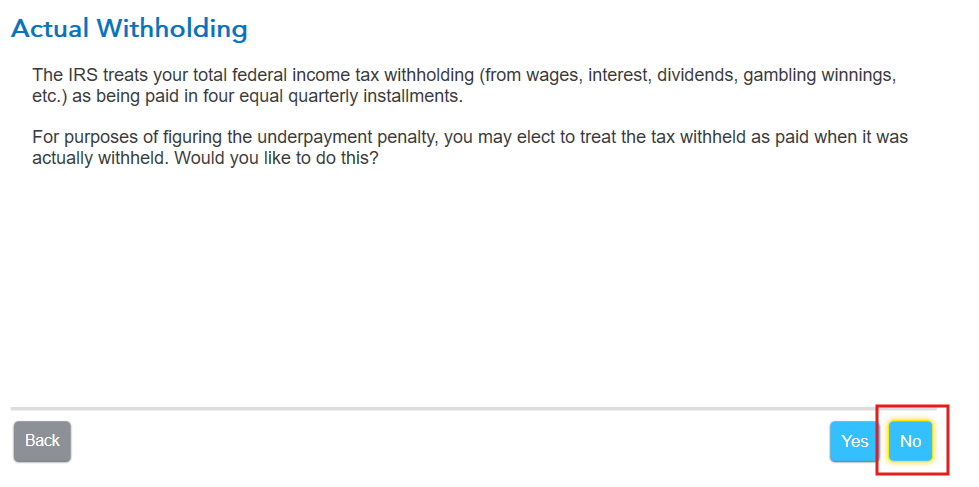

To update your form 2210 to have your withholding treated as paid equally throughout the year instead of when it was actually paid, you will need to go back through the Step-by-Step section to Other Tax Situations. In the Additional Tax Payments section, click Start or Update next to Underpayment penalties. When you see the Actual Withholding screen, click No.

However, to fix the error that you're getting you'll need to account for all of the withholding paid on your income. Depending on your income level, you may have additional withholding reported in your Medicare tax. The amount on line D worksheet needs to equal the amount on line 6 of the Form 2210.