- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

Income reported in box 3 of a 1099-MISC is self-employment income as far as the IRS is concerned. Follow the below guidance so that SCH C is not generated, and you should expect to be audited on the income about 24-36 months after the IRS accepts your e-filed return. So long as you can prove to the IRS it's not SE income, this won't be a problem for you. But it may be a problem for whatever person or entity that incorrectly issued you the 1099-MISC.

Reporting 1099-MISC (box 3 or box 7) that is not self-employment income

Under the Wages & Income tab (or Personal Income tab) scroll down to Other Common Income and elect to start/update Income from form 1099-MISC. Then click YES to indicate you have a 1099-MISC.

Enter the 1099-MISC exactly as printed, and then Continue.

Enter the reason you got this money – be it scholarship, bonus, streaking butt naked across the 50 yard line of the super bowl, whatever. Then continue.

Select None of these apply, then Continue.

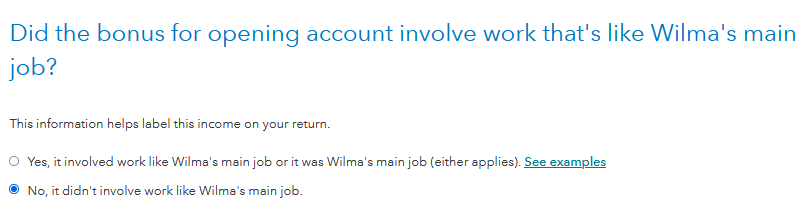

Select No, it didn’t involve work….. and Continue.

Select ONLY the tax year for which this specific 1099-MISC was issued. Do not select the year that you received the 1099. Select the year for which the 1099-MISC was issued. Select no other year. Then Continue.

Select No, it didn’t involve an intent to earn money, then Continue.

Select NO, then Continue.

Click the DONE button, and that does it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

Very interesting - thanks for the reply. The company issuing the 1099-MISC is Pershing LLC - investment brokerage firm. I've relayed your answer to them - maybe they'll fix their 1099...

As to the procedure on entering - all sounds good, except for the NO on the "intent to make money" This is an investment company - I would like to make money from investment, or at the very least not lose it :-). This answer will stand during the audit, as you suggest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

PS - I also have 1099-INT, DIV, B frmo same Pereshing LLC, but those are straight-forward. Have no idea why some investments generate 1099-MISC.

Thanks again

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

I have the same issue - 1099-MISC from Pershing LLC and have been struggling with entering this information into TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

I hope it is okay to follow up on a thread from 2020. I am in a very similar situation. I received a bonus payment for opening a brokerage account with Fidelity. They generated a 1099-MISC and reported the bonus in box 3 (other income)!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

Yes, this Form 1099-MISC Box 3 income can be entered in the Wages and Income section

- Scroll down to Other Common Income and click on Show More

- Select Start or Revisit for Form 1099-MISC

- Add your Form 1099-MISC and answer all of the questions

- Some of them will look like these examples.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I have a brokerage account and got a 1099-misc that shows income from trigger notes. TT wants to enter as self-employment/business. Doesn't apply at all. Any advice?

This was very good and clear to follow and corrected the issue with my cx. Thank you for sharing.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

catdelta

Level 2

jmgretired

New Member

RicN

Level 2

user17524231336

Level 1

user17522833981

Returning Member