- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I entered 1099 Int inform Box 3 (Interest US bonds & savings in software) but it is not showing up I am worried if software is getting those included in the calculation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered 1099 Int inform Box 3 (Interest US bonds & savings in software) but it is not showing up I am worried if software is getting those included in the calculation

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I entered 1099 Int inform Box 3 (Interest US bonds & savings in software) but it is not showing up I am worried if software is getting those included in the calculation

Try previewing your actual return to see if your interest has been included in your income. This interest will be reported on line 2 of your Form 1040.

You can also go back to your input screens for interest income to make sure your 1099-INT is there. You can do this by clicking on "Search" at the top right of your screen. Type "1099-INT" in the search box. Click on "Jump to 1099-INT".

You can get to your tax return in TurboTax desktop as follows:

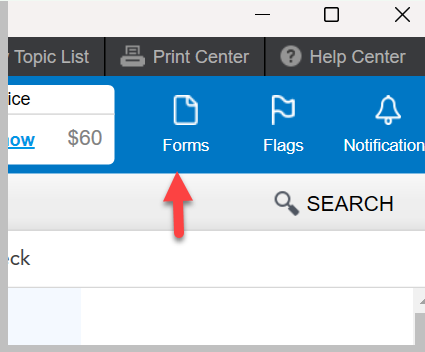

- Switch to Forms Mode, and then (see screenshots below for additional guidance)

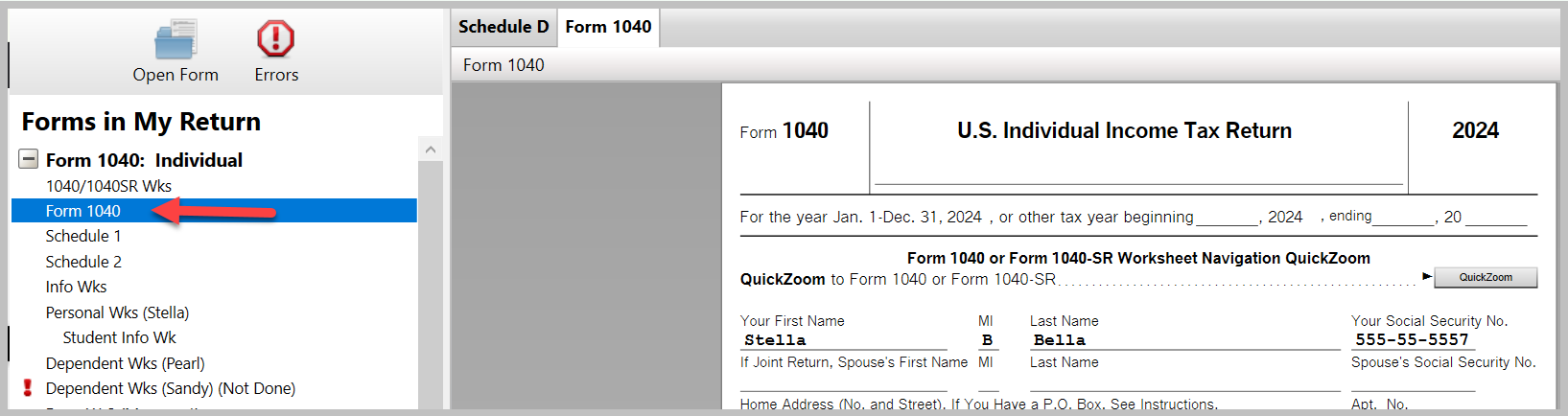

- Scroll through your forms in the left panel and

- Click on the form you want to preview (Example Form 1040)

You can get to your Tax Return in TurboTax Online as follows:

- Go to "Tax Tools" in your left panel,

- Select "Tools" and then

- Select "View Tax Summary" and

- Select "Preview Form 1040"

To search for your Form 1099-INT input screens:

You will see your Form 1099-INT here:

In TurboTax Desktop, it will look like this to switch to "Forms Mode":

Your left panel (list of forms) will look something like this:

In TurboTax Online Online it will look like this:

Click here for additional information on previewing your tax return in TurboTax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ggj02

New Member

Rmoore8844

Returning Member

ckharod

New Member

denise6

New Member

nandu-m

New Member