- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I adopted my special needs son in 2019, I only used 4100 of my credit. I have a carry over of 10,000. It isn't allowing me to use this roll over.

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I adopted my special needs son in 2019, I only used 4100 of my credit. I have a carry over of 10,000. It isn't allowing me to use this roll over.

Topics:

posted

March 16, 2021

10:28 PM

last updated

March 16, 2021

10:28 PM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I adopted my special needs son in 2019, I only used 4100 of my credit. I have a carry over of 10,000. It isn't allowing me to use this roll over.

It depends.

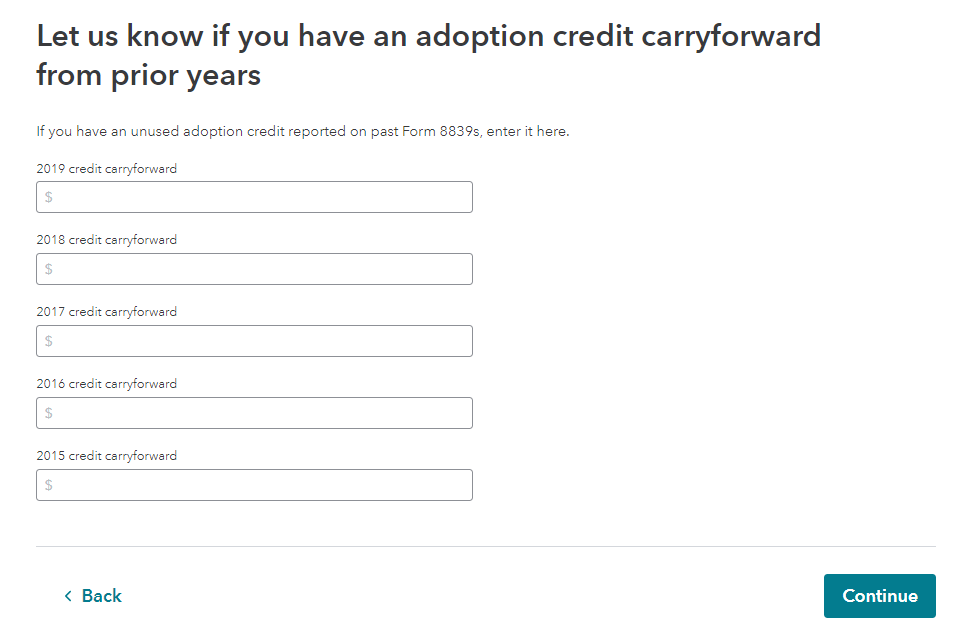

I would recommend confirming the amount of the Adoption Credit Carryforwards from prior years to ensure the amounts pulling in are correct going forward.

You would do this in the federal interview section.

- Select Deductions & Credits

- Scroll down to All Tax Breaks

- Select You and Your Family

- Click Show more and select start (or revisit) under Adoption Credit

- Select your child's name, and click edit.

- After going through all of the screens, you will see a page which says Here's your adoptive child info.

- Click done at the bottom of that page. This will get you to the carryforward screen.

- On this screen, please confirm the amounts you have from your prior year tax returns to ensure the carryforward amount for the 2019 tax year is correct. This will ensure all returns filed from this year forward are correct.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 21, 2021

3:26 PM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CherylinTexas

New Member

ria-kwon7877

New Member

mmlomshek

Level 1

aamhp1

New Member

amandajervisschiro

New Member