- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to split income, I entered my full W2, split the income using Form 8958, but 1040 still shows my entire income as mine instead of splitting it. TT is not splitting it automatically and I cannot mo...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to split income, I entered my full W2, split the income using Form 8958, but 1040 still shows my entire income as mine instead of splitting it. TT is not splitting it automatically and I cannot modify 1040 nor want to modify W2.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to split income, I entered my full W2, split the income using Form 8958, but 1040 still shows my entire income as mine instead of splitting it. TT is not splitting it automatically and I cannot modify 1040 nor want to modify W2.

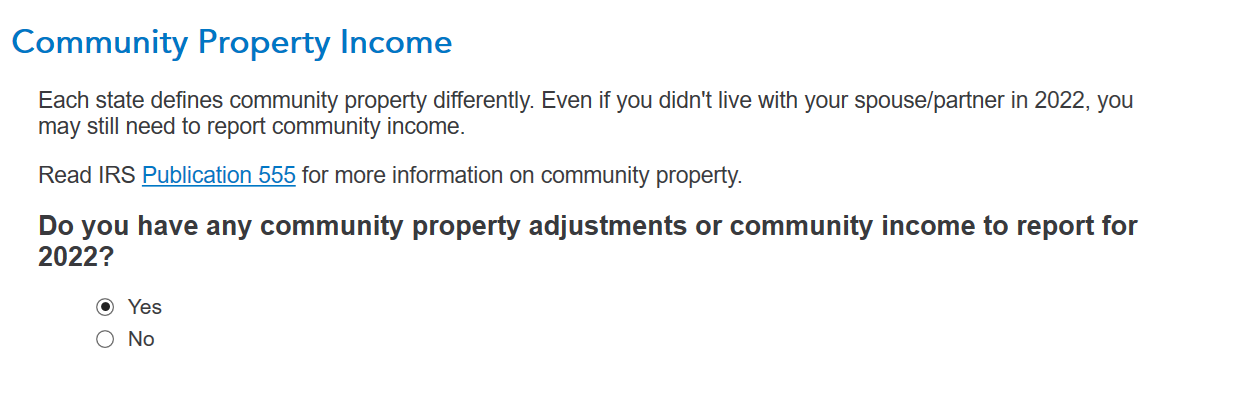

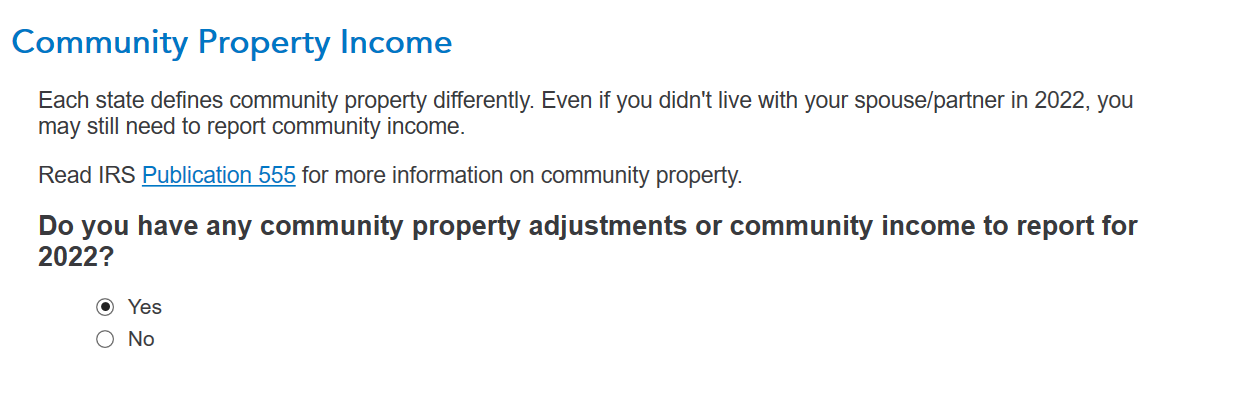

You have to show the adjustment to wages on line 12 of form 8958. The wages in line 1 on your form 1040 should be the wages reported on your W-2 form. The adjustment to your income for community property rules shows on line 8(z) of schedule 1 as Other Income. From there, it will show on line 8 of form 1040. I think you may have made your entry directly on form 8958, as opposed to working through the question and answer routine in TurboTax. It would be best to answer the questions rather than work on the forms, you will see this screen after you have entered your income and deductions in TurboTax:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to split income, I entered my full W2, split the income using Form 8958, but 1040 still shows my entire income as mine instead of splitting it. TT is not splitting it automatically and I cannot modify 1040 nor want to modify W2.

You have to show the adjustment to wages on line 12 of form 8958. The wages in line 1 on your form 1040 should be the wages reported on your W-2 form. The adjustment to your income for community property rules shows on line 8(z) of schedule 1 as Other Income. From there, it will show on line 8 of form 1040. I think you may have made your entry directly on form 8958, as opposed to working through the question and answer routine in TurboTax. It would be best to answer the questions rather than work on the forms, you will see this screen after you have entered your income and deductions in TurboTax:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to split income, I entered my full W2, split the income using Form 8958, but 1040 still shows my entire income as mine instead of splitting it. TT is not splitting it automatically and I cannot modify 1040 nor want to modify W2.

Thanks. Will look for that summary adjustment TT question format and on schedule 1.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17525220452

Level 2

user17525220452

Level 2

user17525107081

New Member

angelle721

New Member

chriswongdo

New Member