- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to retry an e-file for 2021 amended return that was rejected

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to retry an e-file for 2021 amended return that was rejected

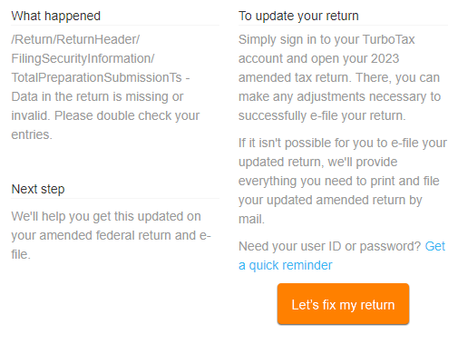

I've used TT online for several years and I recently prepared amendments using TT for 2021 and 2022. I tried to use the e-file for 2021 and it immediately provided a status of "Rejected". The email that I received several minutes later does not have a helpful error code, instead just the weird message under "What happened", as shown below. The email info is not helpful and it strangely references the "2023 amended tax return" on the right side, which is incorrect.

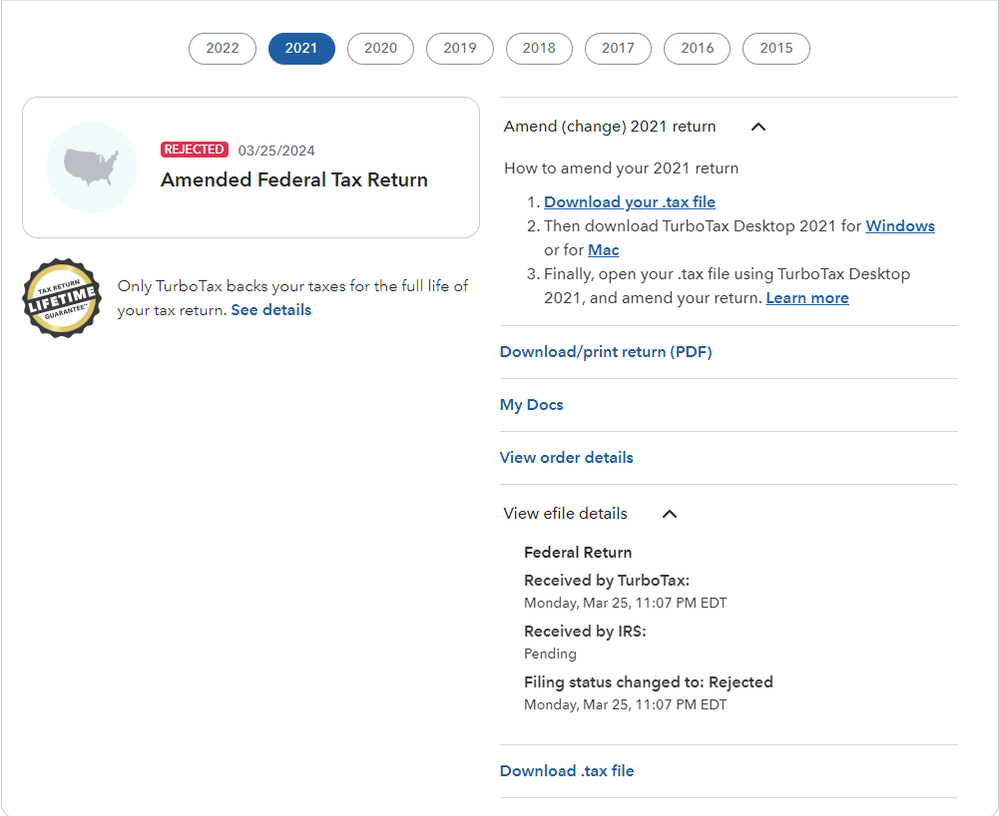

In addition to the worthless error code above, I'm now locked out of being able to edit my 2021 return so that I can attempt to e-file again. See the image below, where it is telling me now to download TT desktop, rather than providing a link to open my file. How to get TT to return to letting me edit/e-file 2021 again?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to retry an e-file for 2021 amended return that was rejected

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to retry an e-file for 2021 amended return that was rejected

I've tried clearing my Chrome browser cache and cookies and even using a different browser (Edge) that I rarely use, but it did not work. For 2021, it still looks exactly like the image I posted, which means there is no longer a button to click that opens my return for editing/amending. How do I get that back?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to retry an e-file for 2021 amended return that was rejected

And why does the "View efile details" say "Received by IRS: Pending" at the same time its saying "Filing status changed to: Rejected". Help me out here TT, is my amendment pending or rejected?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to retry an e-file for 2021 amended return that was rejected

You can check that your return was received by the taxing authority using these instructions: Check the Electronic Postmark of your Return. Pay close attention to the separate lines for Federal and State. They are separate statuses.

You can check the status of your amended return here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to retry an e-file for 2021 amended return that was rejected

My issue seems like a bug with the TT that has locked me out of editing my 2021 return. Is this forum the right place to report this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to retry an e-file for 2021 amended return that was rejected

You have to mail in a 2021 amended return. See Can I e-file 2022, 2021, or earlier tax returns? If you are not able to get into the program, contact support.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to retry an e-file for 2021 amended return that was rejected

I contacted support and they were unable to help. Recommended that I file my amendment by paper.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Opus 17

Level 15

cindi

Level 1

carissagloria91

New Member

kevin840415

New Member

taylorkubicki96

New Member