- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to report a jointly titled 1099-DIV with my ex husband now that I am divorced

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report a jointly titled 1099-DIV with my ex husband now that I am divorced

We had a joint Vanguard account and divorced in June 2020. The account is closed in June after assets are split into individual accounts. We received a 1099-DIV in both names with my name listed first. There are dividend and capital gain in this 1099-DIV. Obviously, each of us owe tax on half of the dividend and half of the capital gain. My questions are:

1. Can TurboTax Deluxe version handle this?

2. Since the 1099 is in my name, I have to report it and then select "I need to adjust these dividends." on the next page. However, TurboTax only ask about adjustment to dividend. Does the capital gain get adjusted accordingly too by the same percentage as the dividend?

3. How does my ex husband report this 1099-DIV on his return? Exactly the same way I do it or differently?

4. This question is for another 1099-DIV. Only my name is on this form; it shows dividend and no capital gain. My ex owes a quarter of the dividend. I report what is on the form and then select "I need to adjust these dividends". The adjustment amount is the amount he owes or the amount I owe?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report a jointly titled 1099-DIV with my ex husband now that I am divorced

The steps to enter the Form 1099-DIV have been placed in your other post and I will answer your questions here as well since they were not visible on the other post.

- Yes, TurboTax Deluxe can handle this entry.

- Unlikely, however you can enter the amount to remove from your dividends and your ex husband can enter the appropriate portions on his tax return. There is a nominee procedure that can be used which will require physical document changes with the IRS, but will be effective. These instructions will be placed below.

- It depends. The one whose social security number (SSN) is on the document (assumed yours since your name is listed first) will follow the procedures in the other post. The one whose SSN is not present on the form will enter the information in each box show on the form but only half of each amount.

- The adjustment is for the portion that should not be taxed on your return.

Nominee Procedures - Documented and filed with the IRS (each owner files the correct amount on their respective returns without adjustment):

Nominee returns.

Generally, if you receive a Form 1099 for amounts that actually belong to another person or entity, you are considered a nominee recipient. You must file a Form 1099 with the IRS (the same type of Form 1099 you received). You must also furnish a Form 1099 to each of the other owners.

File the new Form 1099 with Form 1096 (this is a transmittal for the 1099) by mailing to the Internal Revenue Service Center for your area. (Provided on the Form 1096)

- On each new Form 1099, list yourself as the payer and the other owner, as the recipient. On Form 1096, list yourself as the nominee filer, not the original payer. The nominee is responsible for filing the subsequent Forms 1099 to show the amount allocable to each owner.

The forms filed with the IRS should be the red copy so if you don't have a color printer, go to the IRS website and order the forms here:

Steps that can be used without completing the physical nominee changes are included here for convenience from your other post.

After entering the full amount on your return, follow these steps:

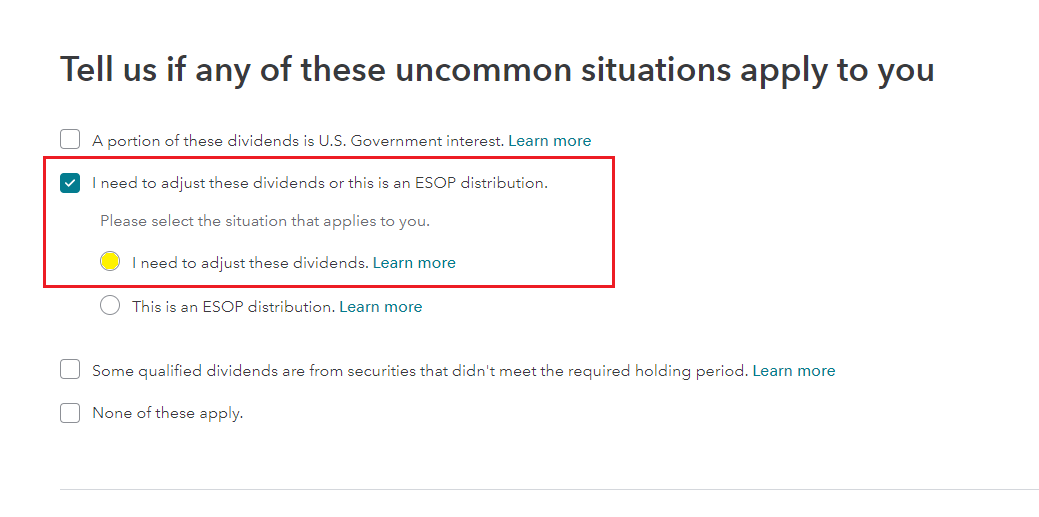

- After you click Continue when you have finished entering the information from your Form 1099-DIV, the next screen is titled “Tell us if any of these uncommon situation apply to you”

- Select “I need to adjust these dividends” > select again I need to adjust these dividends by checking the box

- Continue

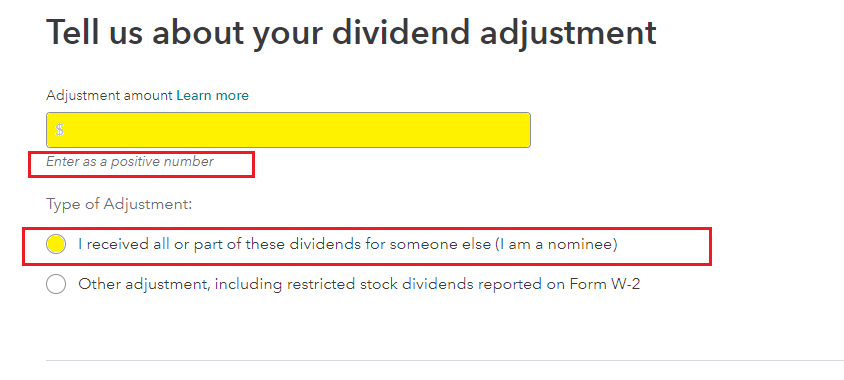

- Then you will see a screen titled “Tell us about your dividend adjustment”

- Enter the amount as a positive number and the reason for the adjustment. This will make the proper entry on your Schedule B.

- Review the images below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

CarolynGG

New Member

NikiB

Level 1

splitting927

Returning Member

Daniel123456

Returning Member

SingleNoProceedsFromHouse1099S

New Member