- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How to complete W4 with second job?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to complete W4 with second job?

I recently received a promotion and raise at my current full-time and will be starting a second part-time job. What is the best way to fill out both W4 forms? I will be filing as Single.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to complete W4 with second job?

Hi Adriana!

First, I just want to say congratulations on the promotion and raise at your full-time job!!

You will notice on the 2021 W-4 for withholdings, there is a Step 2 for Multiple Jobs or Spouse Works. You will need to complete this section on the W-4 for both of your jobs. For your convenience, I am including a link to the 2021 W-4. The W-4 is located at https://www.irs.gov/pub/irs-pdf/fw4.pdf

In addition, you may choose the optional step 4 of the W-4 for extra withholding. The IRS tax withholding estimator is an extremely useful tool to calculate your potential tax liability for the year. Once you use the estimator tool, you can make a determination if you should have extra withholding on your W-4.

The IRS tax withholding estimator can be found on the IRS website at: https://apps.irs.gov/app/tax-withholding-estimator/income-and-withholding/

You will click on the blue button, Use the Tax Withholding Estimator, which will guide you through a series of question about your specific tax situation. Please note that in the income & withholding step (step 2 of the estimator) you will use the + sign to add your second job. Then you will be prompted to provide income information about each job. Please be sure to answer all questions related to your specific tax situation when using the estimator in order to receive the most complete results.

In summary, you will use the IRS tax withholding estimator to determine your tax liability for your entire tax picture (both jobs and raise). Next you will complete the W-4 indicating that you have multiple jobs in step. Based on the results of the estimator, you may need to complete step 4 of the W-4 for extra withholding.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to complete W4 with second job?

i really dd not understand how to complete the new w4 form. am so lost i just want my employer to take taxes out however there are not .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to complete W4 with second job?

Hi @Sp873 ,

You are not alone, the latest version of the W-4 can be quite intimidating. Let’s break it down step by step so you can follow complete it accurately.

For your convenience, I am providing a link to the 2021 W-4: https://www.irs.gov/pub/irs-pdf/fw4.pdf

Please note that you only have to complete page 1 for your payroll department. The subsequent pages are instructions and worksheets for your reference but not required to be completed for your employer.

STEP 1: Enter personal information, name, social security number, address and filing status. This section must be completed by everyone.

STEP 2: ONLY IF IT APPLIES TO YOU . You would check the box if you have two jobs. If you have multiple jobs or a spouse that also works, you would go to page 3 Step 2(b) Multiple Jobs worksheet and work through the section to determine if you need additional taxes withheld from your paycheck. If this section does not apply to you, please leave blank.

STEP 3: ONLY IF IT APPLIES TO YOU. If your income is below the amounts provided, you would enter how many children you have under 17 on the top line and multiply by $2,000 as well as the number of OTHER dependents and multiply by $500. You would add these together and enter that total in box 3. . If this section does not apply to you, please leave blank.

STEP 4: OPTIONAL , only complete this section if you would like other types of income or deductions considered into your paycheck withholdings OR if you have a specific amount you would like to designate as EXTRA WITHHOLDING to be withheld with each pay period.

STEP 5: This section must be completed by everyone. Sign on the employee’s signature line and date it. The employer will complete the very bottom line.

I hope you find this information is helpful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to complete W4 with second job?

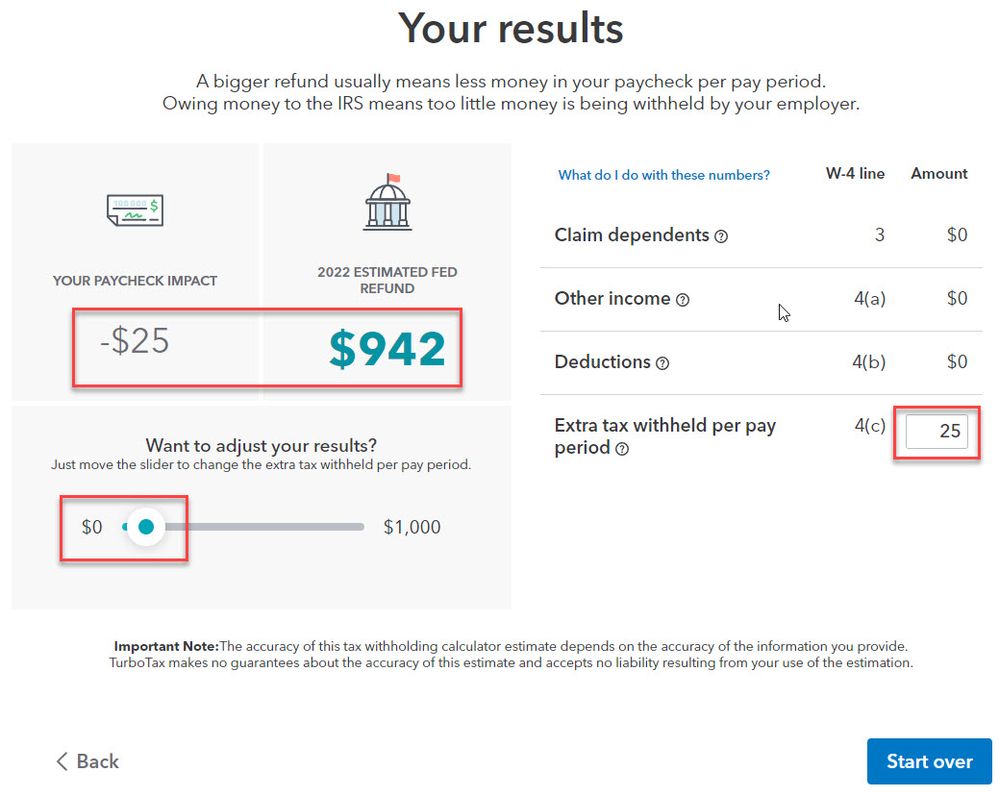

TurboTax’s free W-4 Withholding Calculator will figure your estimated refund or amount due and allow you to make adjustments.

Best of all, the calculator will show you exactly what numbers to fill in on Form W-4.

The slider allows you to adjust your results. In this example, the taxpayer decided to withhold an additional $25 per weekly paycheck to get a bigger refund.

TurboTax shows the paycheck impact, the projected refund, and — on the right side — the numbers to put on your W-4. If you’ve already filed a W-4, you can file a new one at anytime to change your withholding.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to complete W4 with second job?

Thank you so much for these recommendations, it's very helpful for me. I am currently looking for a job and I need to write a good CV, which will allow me to attract employers. On https://resumeedge.com/cv-writing I received professional help with this. For a fairly low price, I received a quality document.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to complete W4 with second job?

I'm starting a second job, I went to the website with the W4 worksheet and got confused. It asks for info from my most recent pay stub for my first job, no problem. But then is asks for info from my most recent pay stub at my 2nd job, the one that I haven't started yet and havent gotten a pay check from yet. What am I supposed to enter in this section when that information literally does not exist yet?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to complete W4 with second job?

You may need to back into some amounts based upon your work contract. TurboTax does provide a W-4 Calculator for 2024 that is user friendly. You can enter the information for each job and can also enter zero for the amount withheld so far. Once you complete all of the fields, you can print out your W-4 and give that to your new employer.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nickjwang

New Member

CassandraDA

Returning Member

ionedes

New Member

Arv726

New Member

S_Henderson

New Member