- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

Yes, the dependent's income is a factor is determining the household income on which the premium tax credit amount is calculated. You have to enter the child's modified adjusted gross income, which is the amount on line 2(a) to line 8 on your dependent's form 1040.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

Hello - I can't seem to find where to enter the dependent's income for this. I saw it my first time thru, but now cannot find it. HELP!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

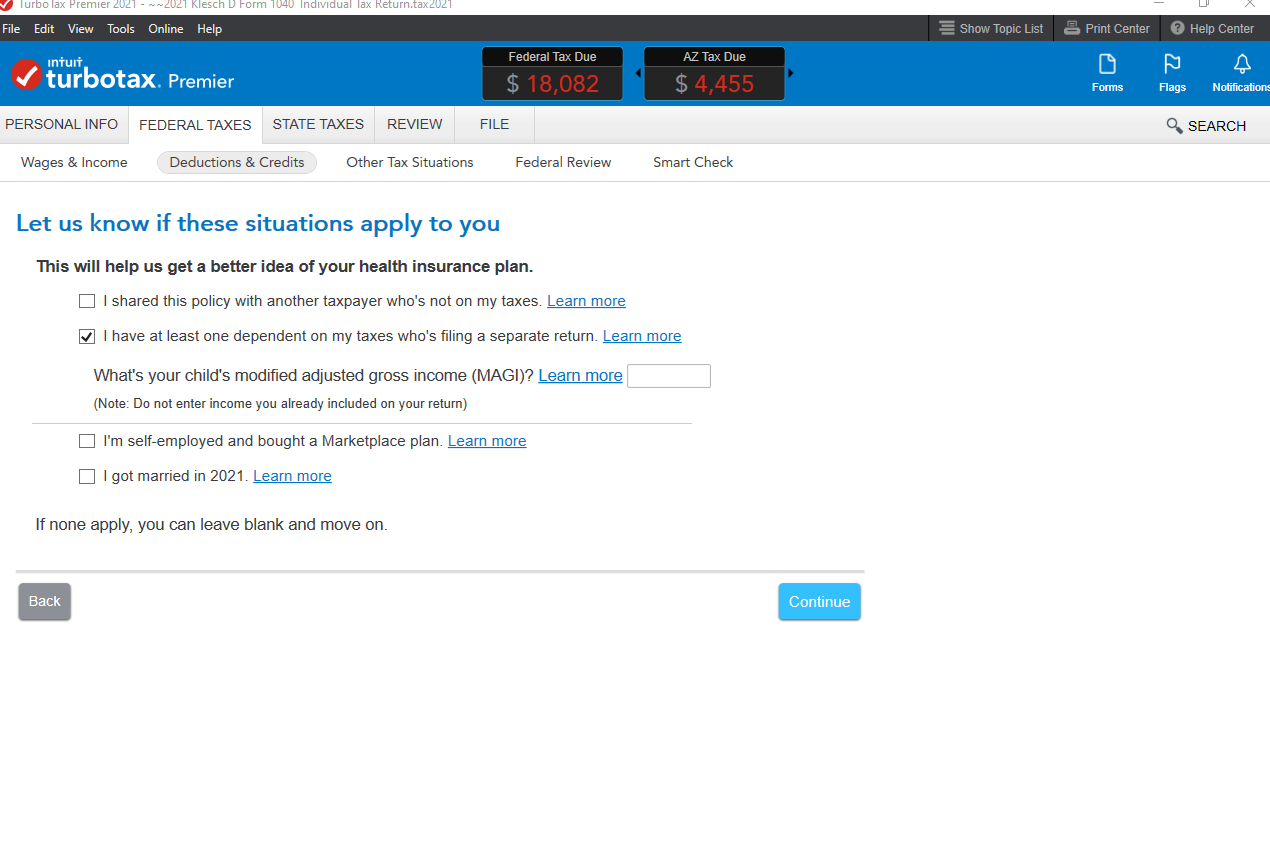

Type '1095-a' in the Search area, then click on 'Jump to 1095-a'.

If you indicated that 'you have a dependent on your taxes who's filing a separate return' there is an entry field for their MAGI (screenshot).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

Can someone please provide clarifications based on what is stated below:

The way this question was answered on February 10, 2021 12:43 PM , I would have taken it to mean the dependent's income should always be entered. I think the answer to the turbotax question "What's your child's modified adjusted gross income (MAGI)? should be zero if the dependent is not required to file a tax return. Please Clarify.

According to Instructions for Form 8962 Premium Tax Credit Line 2B

Line 2b

Enter on line 2b the combined modified AGI for your dependents who are required to file an income tax return because their income meets the income tax return filing threshold. Use Worksheet 1-2 to figure these dependents’ combined modified AGI. Do not include the modified AGI of dependents who are filing a tax return only to claim a refund of tax withheld or estimated tax.

If you click on the Turbotax link "learn more"

I have at least one dependent on my taxes who's filing a separate return. Learn more |

The Turbotax Help window agrees with this and says:

"If you have a dependent who’s required to file a separate tax return, you’ll need to include their income in your modified adjusted gross income (MAGI). Your MAGI is the household income amount that’s used to calculate the premium tax credit you qualify for."

Anybody who did not click on the LEARN MORE link would miss this!

My understanding is that if your dependent is only filing a tax return to claim a refund, then Form 8962 Line 2B should be zero.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

Please also reference this similar post https://ttlc.intuit.com/community/tax-credits-deductions/discussion/re-should-i-say-my-dependent-s-m...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

Yes, it should be zero if the dependent is not required to file a tax return. If your dependent is not required to file a tax return and does so simply to get a full refund of any federal tax withheld, you do not count that income for that specific dependent. The Form 8962 instructions are clear as you printed them here above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

My dependent has a negative agi due to business loss. Do I leave it blank or put 0? Can you put a negative number?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How does having a dependent who’s required to file a separate tax return affect my 1095-A?I have to add their earned income to my wages on my taxes too ?

No, Adjusted Gross Income cannot be less that zero.

Please look at their 1040 line 11

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

alej2020

New Member

ltkeener

Returning Member

rmbibber

New Member

HollyP

Employee Tax Expert

JoeTaxDad

Level 2