Yes, if you jointly own the account 50/50 then all numbers should be split in half when you do the entry. For the one whose social security number (SSN) is not listed on the document you can choose to nominee half to the other person (assumes this is not a spouse).

As explained by TurboTax:

"Nominee Interest: Some or all of the interest belongs to someone else but the entire amount was reported under your Social Security number. This includes interest belonging to your child but reported under your ID number."

It's not unusual for a broker or fiduciary to send a form like a 1099 (INT or DIV) under one SSN when the interest, in part or all, belongs to someone else. A nominee adjustment removes the amount from your taxable income.

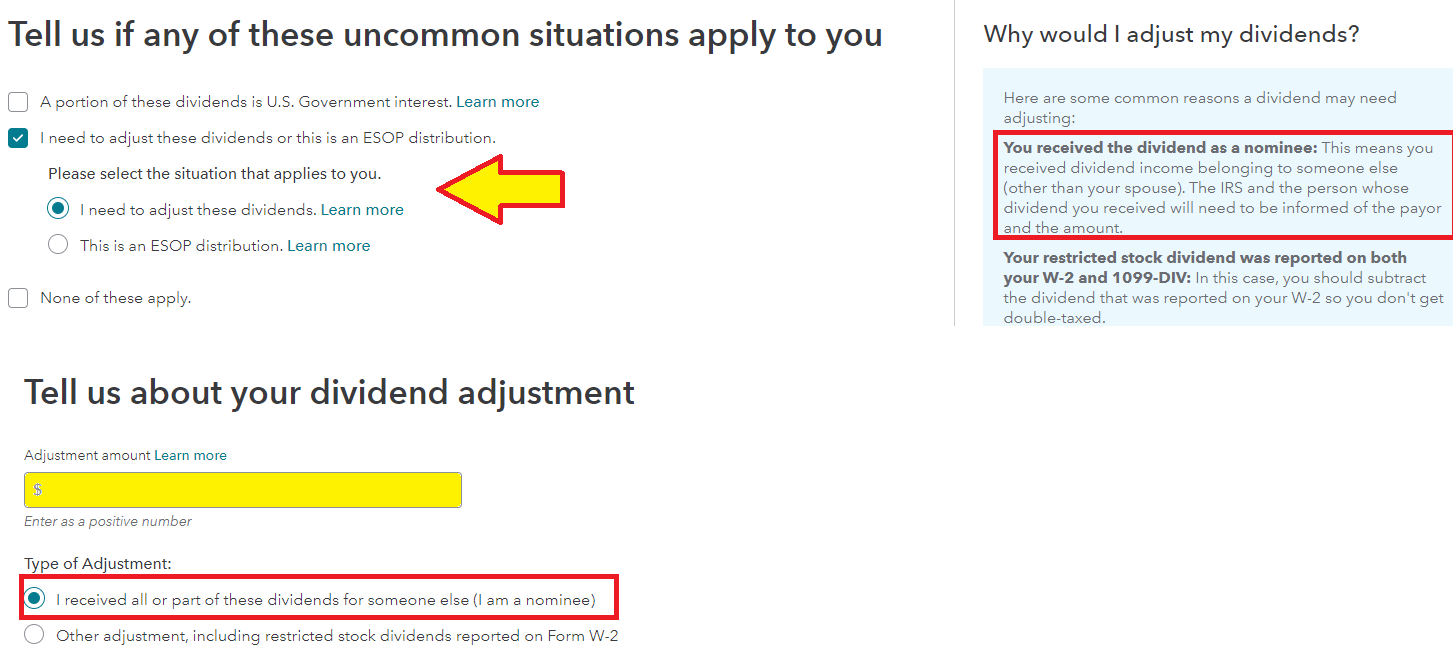

In TurboTax you do this by entering the 1099, then checking on the next screen that you need to adjust the amount. You'll then be able to enter the adjustment amount and check the reason for the adjustment. You can do this for both 1099-INT and 1099-DIV). Keep your documents with your tax return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"